Market movers today

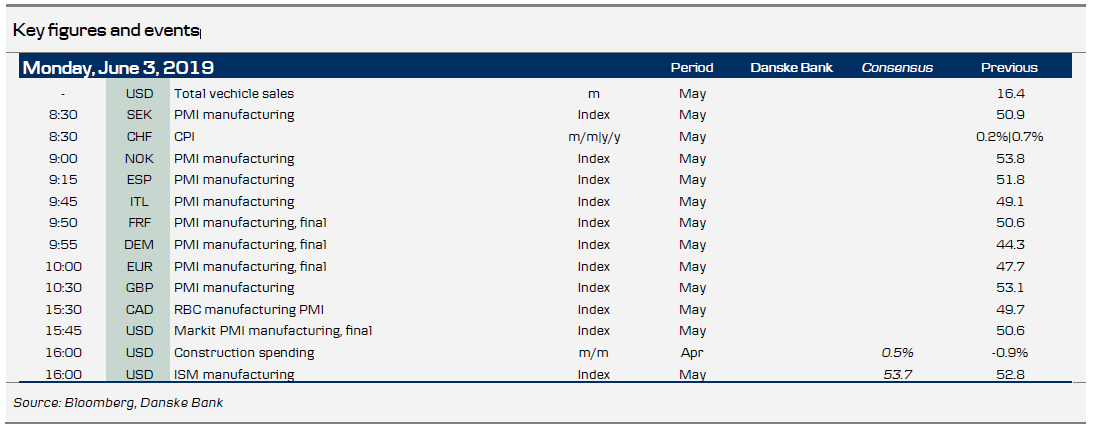

A busy week already kicked off this morning with the important Chinese Caixin PMI manufacturing. It was surprisingly unchanged in May at 50.2, and with two decimals it even increased from 50.16 to 50.24 (see more below). Today we also get PMI manufacturing from the US, UK, Sweden and Norway as well as US ISM manufacturing.

Later this week, we have the Euro area inflation, GDP breakdown and the important ECB meeting (on Thursday). In the US, attention will be drawn to Powell's speech on Wednesday at the 'Fed listens' events and the labour market report on Friday

On top of the important data and central bank events this week, the markets have to digest the recent escalation from US president Trump against Mexico/China and the general risk-off sentiment

Selected market news

Financial markets continued in risk-off mode overnight, where Asian equity markets and the US S&P futures declined further. US bond yields also continued lower and markets are now pricing about 50bp of rate cuts from the Fed by the end of the year. We have also changed our forecast and now look for a rate cut in July or September, see FOMC Comment - Dovish policy signal to pave the way for an insurance cut , 31 May 2019

The US-China trade war continues to escalate as China took the first steps on Friday to retaliate against the US export ban on Huawei. China announced it would create an 'unreliable entities list ' of foreign companies, organisations and individuals that it deems 'unreliable' in terms of harming Chinese companies. During the weekend, FedEx (NYSE:FDX) was put under investigation but it was not stated that the move was related to the new list. On Sunday, China issued a White Paper on the trade war blaming the US for the escalation and repeating that China did not want a trade war but was also not afraid of fighting one. The next key event to look out for in the trade war is the meeting between US President Donald Trump and Chinese President Xi Jinping at the G20 meeting in late June

As if the US-China trade war wasn't enough, Trump is also launching tariffs on Mexico and he also withdrew India's preferential trade status , leading to tariff increases. Trump's tariff actions have raised fears that he may also lift tariffs on European autos later this year

The small rise in Caixin PMI manufacturing overnight was surprising, as the official PMI manufacturing on Friday dropped sharply from 50.1 to 49.4. The truth may be somewhere in the middle, but metal markets also point to a set-back in activity in May after the sudden escalation of the trade war on 5 May. We expect Chinese activity to be under continued pressure until the trade war is resolved or at least is not escalating further. Our baseline scenario is still that we get a trade deal in H2 when the pain on both sides gets too high. But uncertainty around the timing of a trade deal is clearly elevated

Scandi markets

Sweden manufacturing PMI dropped to 50.9 in April. Given worrying signs abroad and not least among European peers, it shouldn’t be surprising if the PMI sank below 50 in May. The PMI data is due out at 08:30 CEST. One hour later we get retail sales for April, a first indication of how consumers fared in Q2 - note they were among the weak spots in last week's GDP data for the first quarter and we expect this will continue.

Fixed income markets The global fixed income rally continued on Friday as the market digested the new tariffs on Mexico. Markets are now pricing about 50bp of rate cuts from the Fed by year-end, as US 2Y yields dropped below 2% for the first time since early 2018. We have changed our Fed view and now expect the Fed to open up the possibility for rate cuts at the June meeting. The trade war escalation continued over the weekend after China released a White Paper saying that ‘unreasonable US demands’ led to the collapse of the trade talks and as China was accused of targeting FedEx as a retaliation manoeuvre. That combined with the news that the leader of Merkel’s collation partner, Andrea Nahles, has stepped down as SPD leader points to more support for Bunds today.

But this week all attention will be on the ECB on Thursday. The pressure is growing on the ECB to deliver a forceful message in light of the rapid deceleration of global growth. However, the market might be disappointed – at least temporarily. For more, see our preview here.

We also published our Government Bonds Weekly. We argue that despite the growing global growth concerns and risk-off sentiment, EGB investors will continue to focus on the ‘hunt for carry’ theme instead of the ‘credit weakening’ theme in a situation where core but also semi-core yields trade deeper and deeper into negative territory. Hence, we keep our long periphery/semi-core (ex. Italy) view. We are still long 10Y Spain vs France.

FX markets Risk currencies such as the commodity currencies and the Scandies remain fragile entering a week where the ECB risks disappointing if Draghi and co do not forcefully acknowledge a deteriorating outlook, see ECB Research: Walking a tightrope. The continued escalation in trade woes late last week is adding to recent disinflationary factors – and a too strong USD and too tight US monetary policy is a key driver of this globally. As we have argued recently, we need to see Fed blink and acknowledge the dovish market pricing for this trend to reverse. Today, the market may sell USD on a weak ISM manufacturing print in expectation that it will trigger a dovish shift from the Fed – and in fact it may eventually, as we now expect an insurance cut in H2 and some comfort in soft rhetoric at the mid-June meeting, see FOMC comment - Dovish policy signal to pave the way for an upcoming insurance cut. This week, the Fed conference on monetary policy strategy, tools and communication may provide some hints; Powell is speaking here on Tuesday.

Meanwhile, the GBP sold off markedly against the euro intraday on Friday but reversed in the late hours. We think this suggests that, on the margin, markets are weighing the possibility of the BoE easing (in light of emerging global tail risks) against repricing the euro area credit risk and are finding both equally offsetting. We continue to expect a relatively stable EUR/GBP, and notice volatility has started to drift down in the pound, albeit only marginally. Further, USD/JPY appreciated strongly in the past week, with three factors supporting: (1) the sharp fall in US interest rates, (2) positive terms-of-trade shock from falling oil and (3) ‘safe haven’ flows. We have been targeting 108 short term but expect to see continued downward pressure on the cross if central banks remain on the sidelines of the risk sell-off.

Finally for the SEK, last week was characterised by (1) mostly weak Swedish data, (2) rising global growth concerns, (3) risk-off trading and (4) thin markets due to holidays. Under normal circumstances this would be a perfect cocktail for selling the SEK, but this time was different as the Swedish krona had one of its best weeks this year. It remains to be seen how much steam is left in this tentative turn in sentiment; the PMI and retail sales data (see Scandi section) will be a first test.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.