The relatively high return correlations across markets in recent years are giving way as volatility surges in 2022. As a result, assumptions about relationships between markets, and the degree of diversification benefits, may be in need of updating.

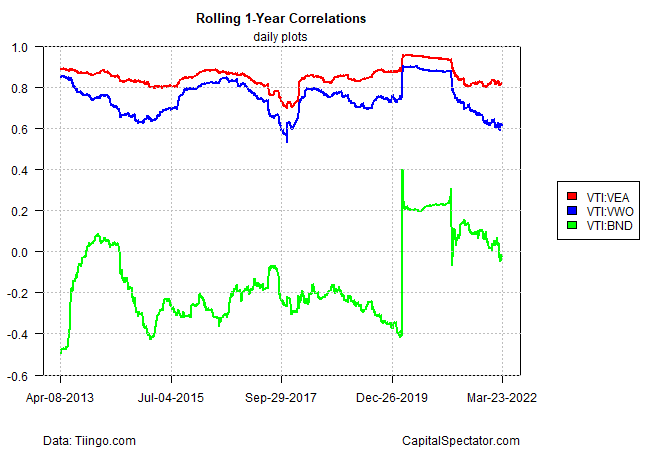

As a sign of the times, consider how rolling one-year correlations have shifted recently for three widely followed pairings via a set of ETFs: US stocks via Vanguard Total Stock Market Index Fund ETF Shares (NYSE:VTI) vs. US bonds via Vanguard Total Bond Market Index Fund ETF Shares (NASDAQ:BND), foreign equities in developed markets (VTI:VEA) and shares in emerging markets (VTI:VWO).

As shown in the chart below, all three correlation sets have fallen more than trivially in recent months on a rolling one-year basis.

Note: correlation readings range from -1.0 (perfect negative correlation) to zero (no correlation) to +1.0 (perfect positive correlation).

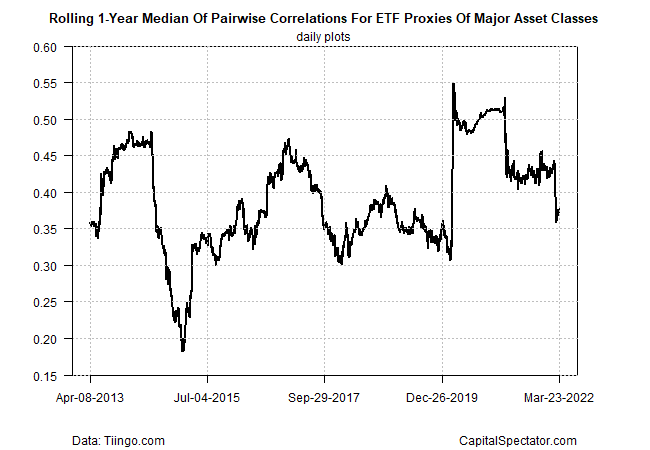

For a broader perspective, note that the median correlation for the major asset classes has also declined. The current 0.37 reading (as of Mar. 23) is the lowest in more than two years.

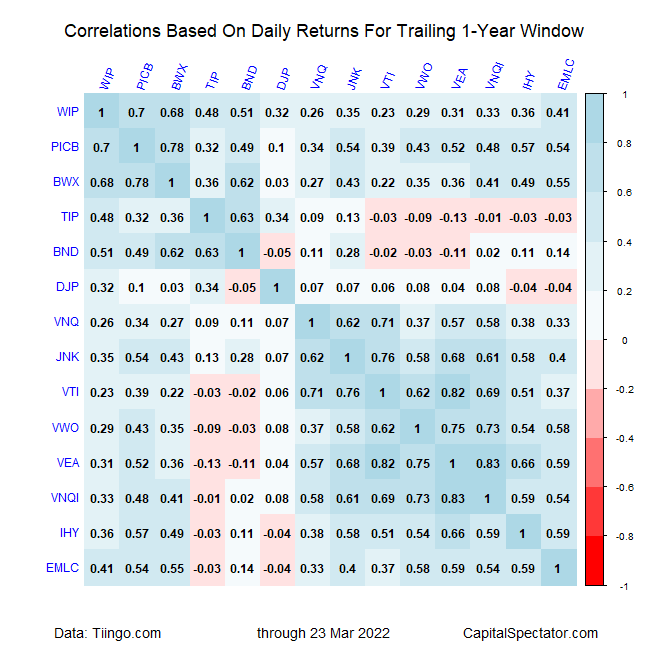

The downside bias in correlations of late is also conspicuous on a more granular level. Running numbers on 14 ETF proxies for major asset classes shows that low and slightly negative correlations now dominate the pairings for the trailing one-year window via daily returns.

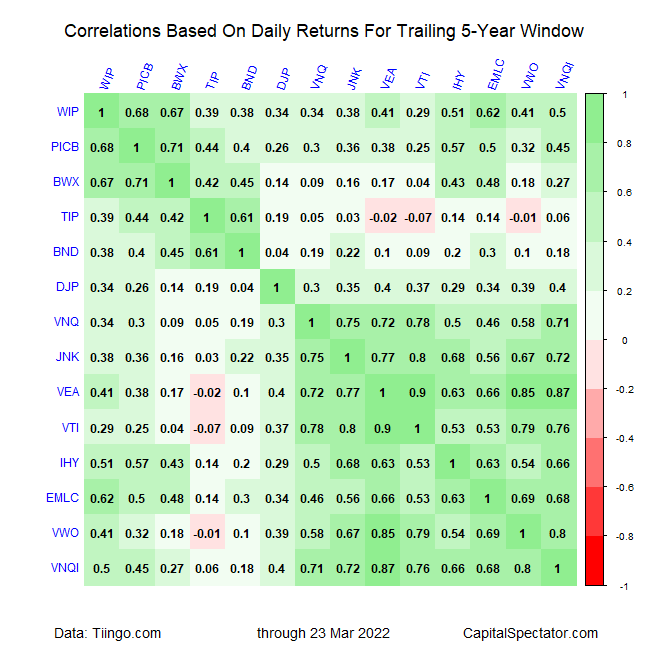

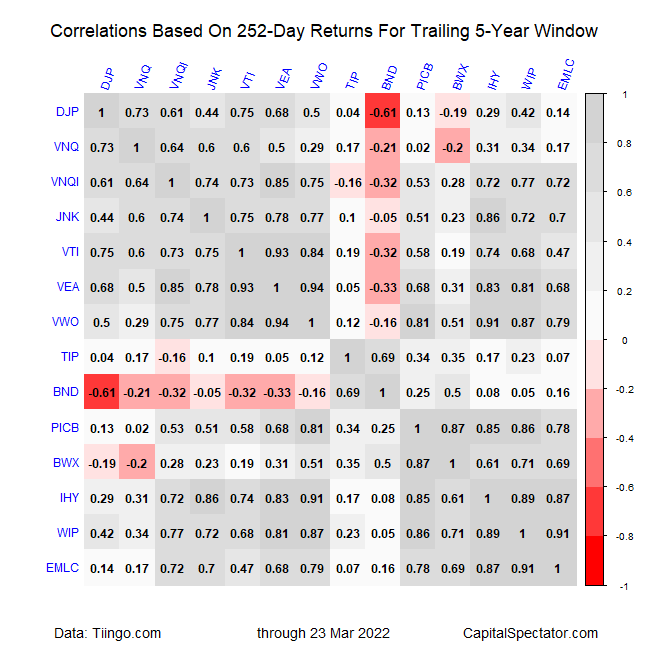

Even when the time window is extended to a five-year period it’s clear that low and slightly negative correlations are common.

The change is also visible when shifting to rolling one-year returns for a five-year window.

It was tempting in recent years to assume that correlations are relatively stable and elevated, which implied that modeling that uses this risk metric can be approached with a set-and-forget-it mentality. But markets are constantly repricing risk and that dynamic aspect applies no less to correlations.

The key question on this front is how much of a reset will correlations endure? Unclear, but this much is obvious: Whatever you assumed for correlations in the recent past is quickly becoming outdated.