Signs of progress in budget negotiations between US Congressional leaders and President Obama led to moderate risk taking yesterday, which gave a boost to the euro. That being said, a lack of significant international news resulted in little movement elsewhere in the marketplace.

Today, traders can anticipate significantly more volatility when the German Ifo Business Climate and US Building Permits figures are released. The indicators, scheduled to be announced at 09:00 and 13:30 GMT, could boost higher-yielding assets, like the euro, if they come in above their expected levels.

Economic News

USD - Building Permits Data Set to Impact Dollar

The safe-haven US dollar took moderate losses against some of its higher-yielding currency rivals yesterday, following an increase in risk taking due to signs of progress in US budget negotiations. The USD/CHF fell some 25 pips during the European session to trade as low as 0.9155, while the GBP/USD gained 21 pips during the mid-day session to trade as high as 1.6225. Against the Japanese yen, the greenback remained within reach of a recent 20-month high, as speculations that the Bank of Japan will soon begin an aggressive policy of monetary easing weighed down on the yen.

Today, trades will want to continue monitoring any developments in the ongoing US budget negotiations, which need to be resolved to prevent the implementation of a set of automatic tax increases and budget cuts, known as the “fiscal cliff,” at the beginning of the year. Additionally, the US Building Permits figure, set to be released at 13:30 GMT, could generate volatility for dollar pairs. If the indicator comes in above the forecasted 0.87M, risk taking in the marketplace could result in losses for the safe-haven greenback.

EUR - Euro May Extend Gains Following German News Today

Signs of progress in US budget negotiations encouraged risk taking among investors yesterday, which led to moderate bullish movement for the EUR/USD during the mid-day session. The pair, which earlier in the week hit its highest point in almost eight-months at 1.3192, advanced close to 30 pips to trade as high as 1.3185. Against the Japanese yen, the common currency spent the day range trading between 110.70 and 110.45.

Today, euro traders will want to pay attention to the German IFO Business Climate, set to be released at 09:00 GMT. Analysts are predicting that the indicator will come in at 101.9, which would represent a slight improvement over last month for the euro-zone's biggest economy. A better than expected business climate result today is likely to generate risk taking, which could give the euro an additional boost during the morning session.

Gold - Gold Fails to Stay Above $1700 Level

After briefly advancing past the psychologically significant $1700 an ounce level during early morning trading, largely due to optimism that a US budget deal will soon be reached, gold prices once again began falling. The precious metal dropped close to $7 an ounce, eventually trading as low as $1695 by the evening session.

Today, gold traders will want to pay attention to the German Ifo Business Climate figure. Should the figure come in above the forecasted 101.9, investor risk taking could help gold prices reverse yesterday's bearish trend.

Crude Oil - US Inventories Figure May Help Crude Reverse Downward Trend

After advancing close to $0.50 a barrel during Asian trading yesterday, largely due to signs that the US budget crisis was closer to being resolved, crude oil began falling during afternoon trading. The commodity traded as low as $87.65 by the end of the European session, down some $0.70.

Today, oil traders will want to pay close attention to the US Crude Oil Inventories figure, set to be released at 15:30 GMT. Analysts are forecasting that US inventories fell by some 0.9 million barrels last week, which if true, would be a sign of increased demand and could turn the price of crude bullish.

Technical News

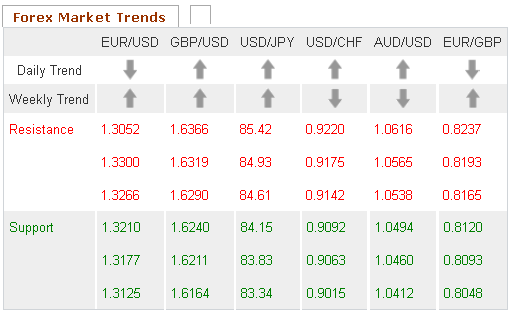

EUR/USD

The Bollinger Bands on the weekly chart are beginning to narrow, indicating that this pair could see a price shift in the coming days. Furthermore, the Williams Percent Range on the same chart has crossed over into overbought territory, signaling that the price shift could be bearish. Traders may want to open short positions for this pair.

GBP/USD

A bearish cross on the weekly chart's MACD/OsMA indicates that a downward correction could take place in the near future. Furthermore, the Relative Strength Index on the same chart appears close to crossing into the overbought zone. Opening short positions may be the best long-term choice for this pair.

USD/JPY

The Slow Stochastic on the weekly chart has formed a bearish cross, indicating that a downward correction could occur in the near future. Additionally, the Williams Percent Range on the same chart has crossed into overbought territory. Opening short positions may be the wise choice for this pair.

USD/CHF

The weekly chart's Williams Percent Range has crossed into oversold territory, indicating that an upward correction could occur in the near future. Furthermore, the Slow Stochastic on the same chart appears close to forming a bullish cross. Traders may want to open long positions for this pair.

The Wild Card

CAD/CHF

The Slow Stochastic on the daily chart appears close to forming a bullish cross, indicating a possible upward correction in the near future. Furthermore, the Williams Percent Range on the same chart has crossed into oversold territory. Opening long positions may be the best choice for forex traders for this pair.

Today, traders can anticipate significantly more volatility when the German Ifo Business Climate and US Building Permits figures are released. The indicators, scheduled to be announced at 09:00 and 13:30 GMT, could boost higher-yielding assets, like the euro, if they come in above their expected levels.

Economic News

USD - Building Permits Data Set to Impact Dollar

The safe-haven US dollar took moderate losses against some of its higher-yielding currency rivals yesterday, following an increase in risk taking due to signs of progress in US budget negotiations. The USD/CHF fell some 25 pips during the European session to trade as low as 0.9155, while the GBP/USD gained 21 pips during the mid-day session to trade as high as 1.6225. Against the Japanese yen, the greenback remained within reach of a recent 20-month high, as speculations that the Bank of Japan will soon begin an aggressive policy of monetary easing weighed down on the yen.

Today, trades will want to continue monitoring any developments in the ongoing US budget negotiations, which need to be resolved to prevent the implementation of a set of automatic tax increases and budget cuts, known as the “fiscal cliff,” at the beginning of the year. Additionally, the US Building Permits figure, set to be released at 13:30 GMT, could generate volatility for dollar pairs. If the indicator comes in above the forecasted 0.87M, risk taking in the marketplace could result in losses for the safe-haven greenback.

EUR - Euro May Extend Gains Following German News Today

Signs of progress in US budget negotiations encouraged risk taking among investors yesterday, which led to moderate bullish movement for the EUR/USD during the mid-day session. The pair, which earlier in the week hit its highest point in almost eight-months at 1.3192, advanced close to 30 pips to trade as high as 1.3185. Against the Japanese yen, the common currency spent the day range trading between 110.70 and 110.45.

Today, euro traders will want to pay attention to the German IFO Business Climate, set to be released at 09:00 GMT. Analysts are predicting that the indicator will come in at 101.9, which would represent a slight improvement over last month for the euro-zone's biggest economy. A better than expected business climate result today is likely to generate risk taking, which could give the euro an additional boost during the morning session.

Gold - Gold Fails to Stay Above $1700 Level

After briefly advancing past the psychologically significant $1700 an ounce level during early morning trading, largely due to optimism that a US budget deal will soon be reached, gold prices once again began falling. The precious metal dropped close to $7 an ounce, eventually trading as low as $1695 by the evening session.

Today, gold traders will want to pay attention to the German Ifo Business Climate figure. Should the figure come in above the forecasted 101.9, investor risk taking could help gold prices reverse yesterday's bearish trend.

Crude Oil - US Inventories Figure May Help Crude Reverse Downward Trend

After advancing close to $0.50 a barrel during Asian trading yesterday, largely due to signs that the US budget crisis was closer to being resolved, crude oil began falling during afternoon trading. The commodity traded as low as $87.65 by the end of the European session, down some $0.70.

Today, oil traders will want to pay close attention to the US Crude Oil Inventories figure, set to be released at 15:30 GMT. Analysts are forecasting that US inventories fell by some 0.9 million barrels last week, which if true, would be a sign of increased demand and could turn the price of crude bullish.

Technical News

EUR/USD

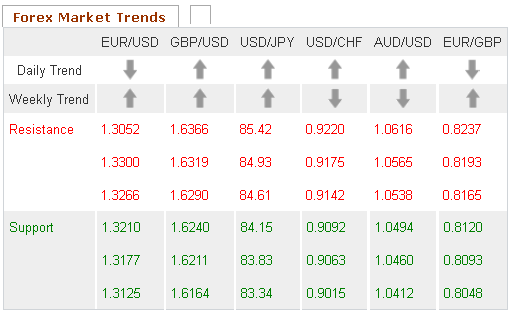

The Bollinger Bands on the weekly chart are beginning to narrow, indicating that this pair could see a price shift in the coming days. Furthermore, the Williams Percent Range on the same chart has crossed over into overbought territory, signaling that the price shift could be bearish. Traders may want to open short positions for this pair.

GBP/USD

A bearish cross on the weekly chart's MACD/OsMA indicates that a downward correction could take place in the near future. Furthermore, the Relative Strength Index on the same chart appears close to crossing into the overbought zone. Opening short positions may be the best long-term choice for this pair.

USD/JPY

The Slow Stochastic on the weekly chart has formed a bearish cross, indicating that a downward correction could occur in the near future. Additionally, the Williams Percent Range on the same chart has crossed into overbought territory. Opening short positions may be the wise choice for this pair.

USD/CHF

The weekly chart's Williams Percent Range has crossed into oversold territory, indicating that an upward correction could occur in the near future. Furthermore, the Slow Stochastic on the same chart appears close to forming a bullish cross. Traders may want to open long positions for this pair.

The Wild Card

CAD/CHF

The Slow Stochastic on the daily chart appears close to forming a bullish cross, indicating a possible upward correction in the near future. Furthermore, the Williams Percent Range on the same chart has crossed into oversold territory. Opening long positions may be the best choice for forex traders for this pair.