Currencies

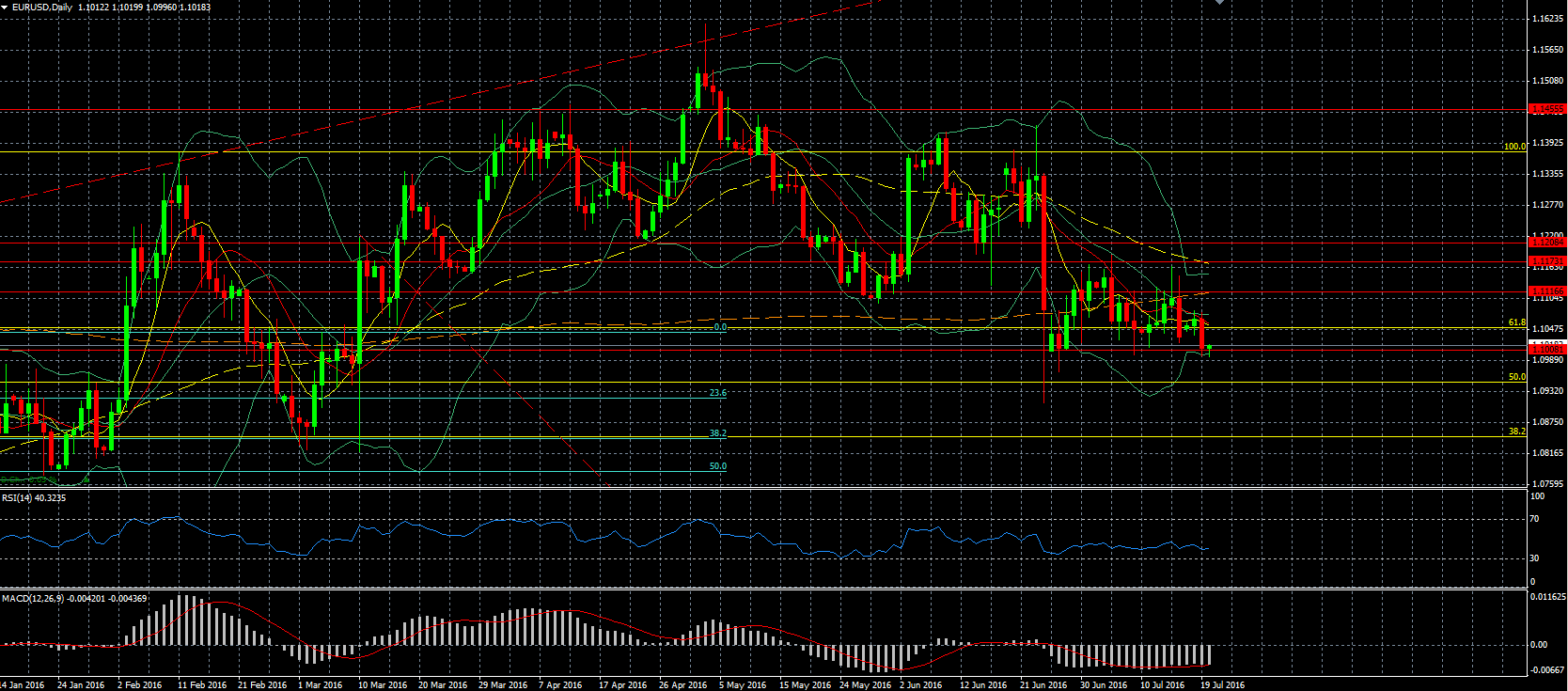

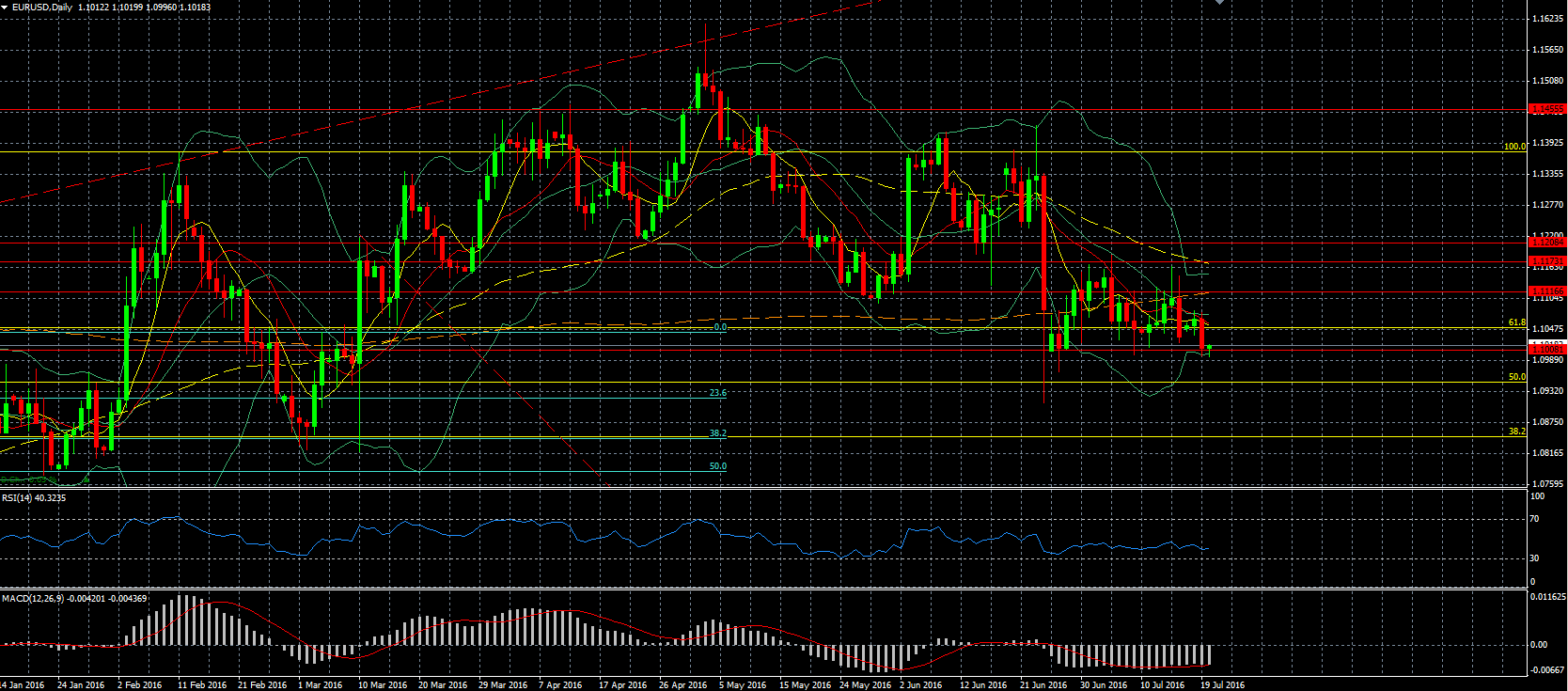

EUR/USD – started to drop after the weak data out of the Eurozone and extended the drop after the better data out of the US. We are trading at the moment around the support which can be found around the 1.10 level.

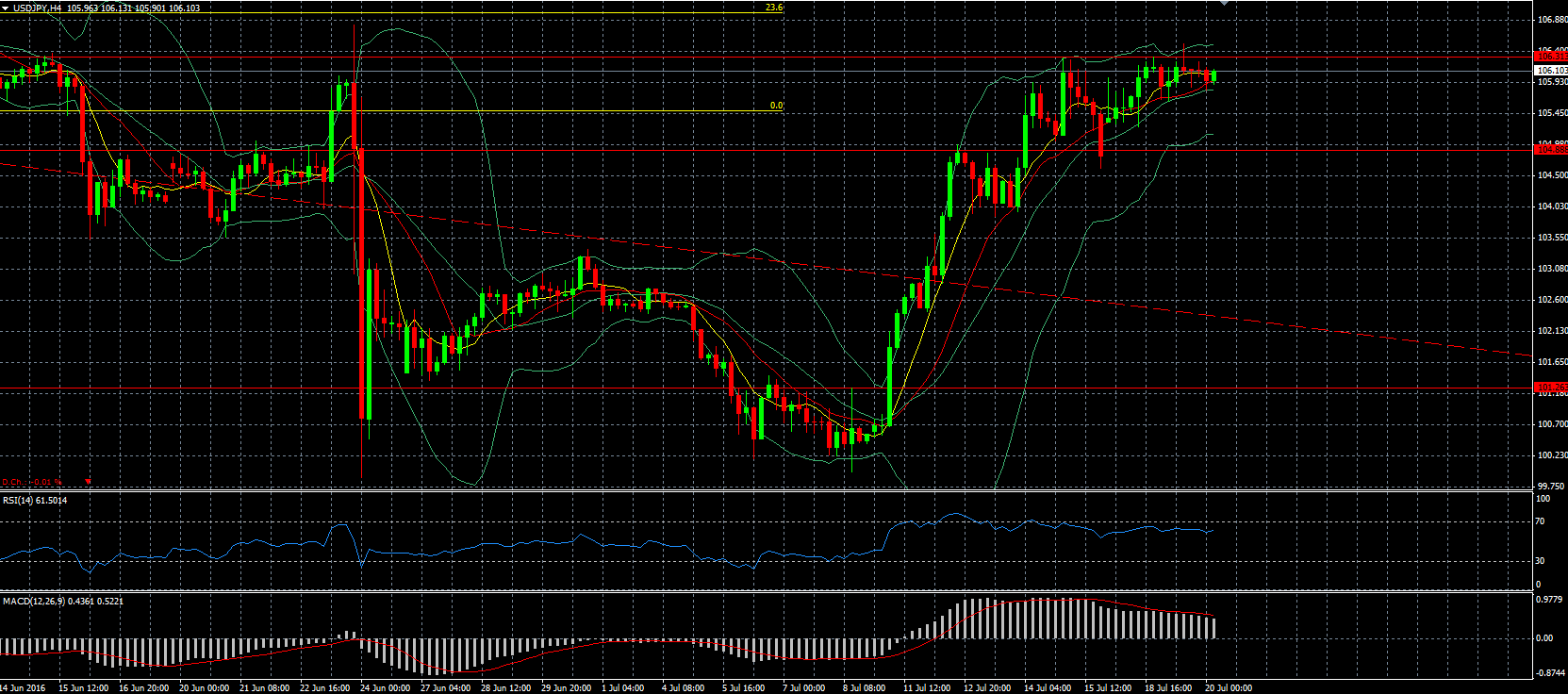

USD/JPY – tried once more to breach the resistance around the 106.3 level which for a short while appears to be succeeding, but turned out to be false. This is actually surprising as we have better data out of the US which should be strengthening the USD and also the expectation of further stimulus measures in Japan.

GBP/USD – the better than expected inflation data was not able to help the GBP move up. Since yesterday it has dropped nearly 200 pips and we have employment data coming up this morning.

USD/TRY – continued to move higher as Turkey continues to purge the different institutions after the attempted coup. We saw a further upwards move after reports of a large explosion in Ankara, which in the end turned out to be a fire, but it shows that the situation remains fluid.

Indices

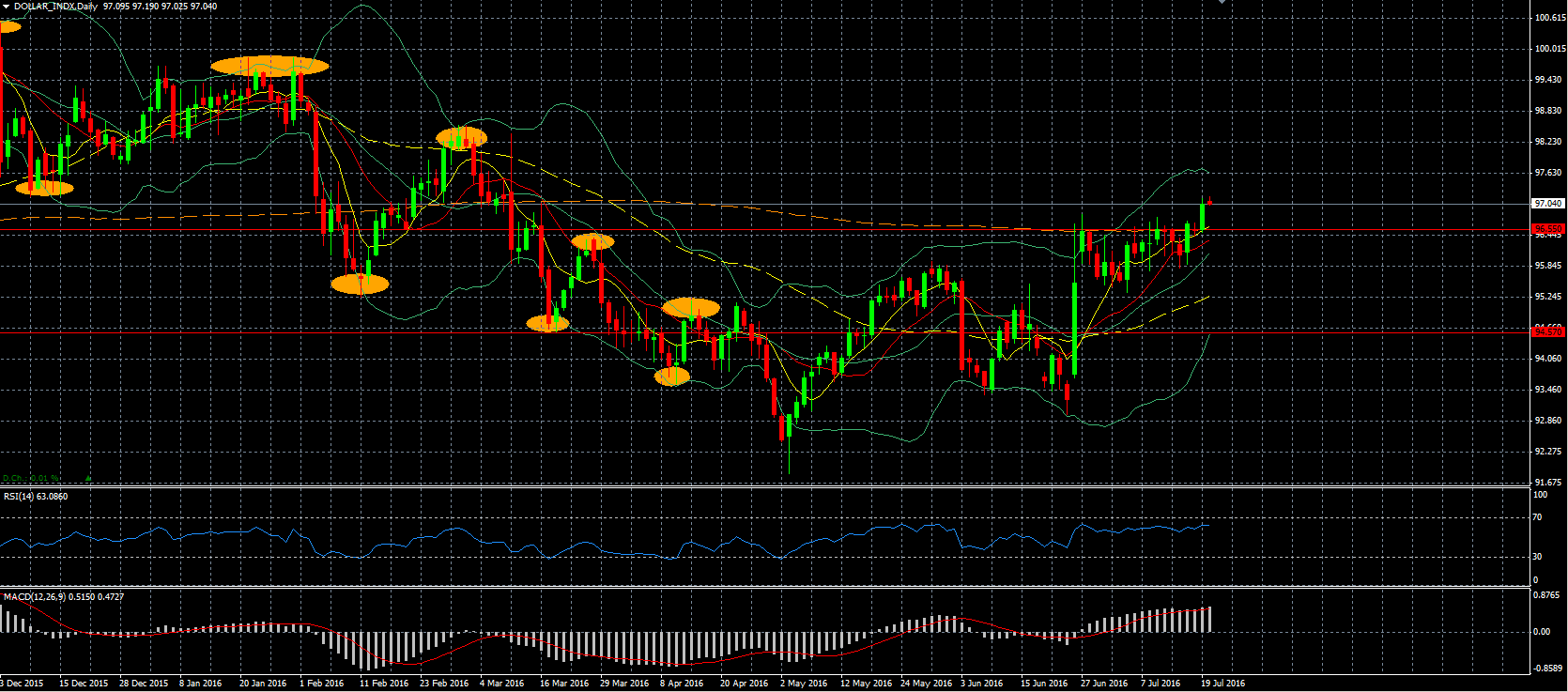

Dollar Index – managed to break through the resistance around the 96.55 level and is currently trading at the highest level since early March. The solid data out of the US is causing some to believe the FED might raise the interest rate after all this year.

Commodities

Gold – is trading in a bit of a holding pattern as we are awaiting what measures the ECB will take in light of the Brexit.

Oil – dropped once more as concerns on the oversupply in the markets and also the strengthening USD. The crude stock showed a drawdown of 2.3 million barrels which is close to the expected -2.1 million for the inventories. However we have seen over the last few weeks that there has been quite a difference between the two sets of data, so we will see if that is the case again this time. We will also be looking to see if we see production increase for the second week in a row.

Stocks

Bayer (DE:BAYGN) – after the $54.7 billion offer to take over Monsanto (NYSE:MON) was deemed not enough by the company, Bayer is making another offer which will be reviewed. This is at least the third time that Bayer is increasing its bid.

Intel (NASDAQ:INTC) – will be reporting its earnings today.

Microsoft (NASDAQ:MSFT) – reported better than expected earnings after market close. It beat revenue estimates which came in at $22.6 billion and a profit of $3.11 billion. In general most aspects of the company showed growth, except for phone sales which plummeted 71%. As a result Microsoft rose around 4% in afterhours trading.