Yesterday, the ADP report for March showed jobs rose 200k - a touch higher than expectations (195k), confirming that the labor market remains robust. Revisions to February were minor at -9k, taking this measure of jobs growth in the month to 205k. However, Yellen said yesterday that the real fed funds rate is low and consistent with further improvement in the labor market, so these data are not going to change sentiment much, if at all. Therefore, June may not be as remote a possibility for an interest rate hike as the market is pricing at the moment (22% odds of a Fed hike).

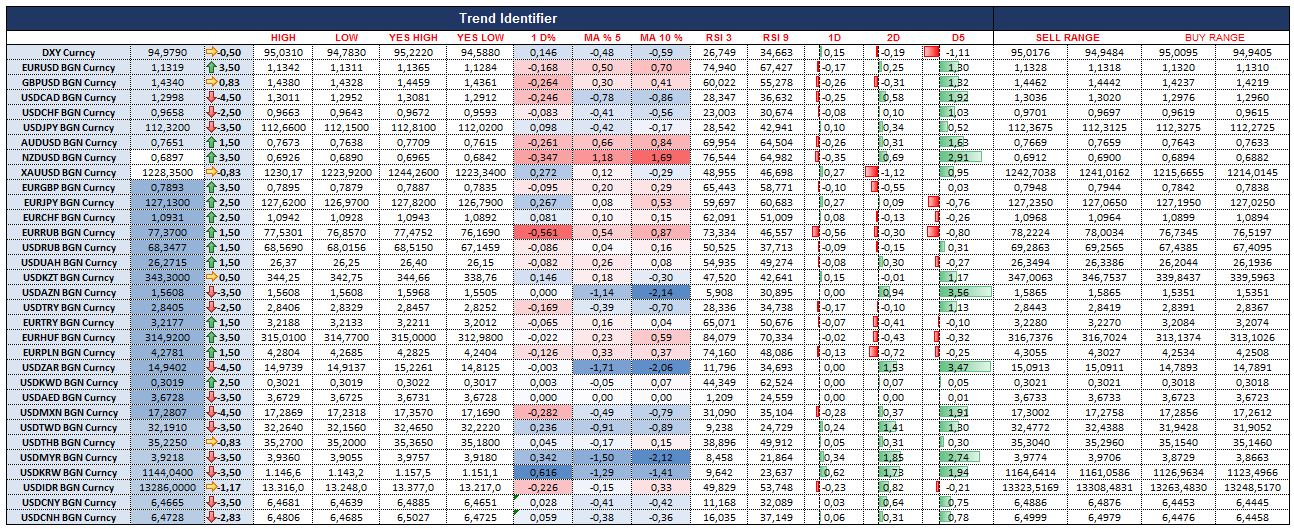

Price action wise, USD Index seems to have leveled around 95,00 for now. The momentum of the move was harsh, obviously taking out long-term stops along the way. The yield differentials have been working against the USD and still do not provide any support, with the USD curve shifting lower.

Looking at currencies, commodity currencies are still well-supported. Even with some oil weakness, CAD remains relatively well bid (I think it shouldn't), while AUD and NZD are still in an uptrend.

Latam and Asian emerging market currencies are still performing well. CNY has gained some ground and Asian emerging FX has followed. In Latam, BRL and MXN gained ground, with MXN leading the way.

European emerging markets lag the rally, as most central banks in the area have turned dovish, starting to cut rates. TRY, HUF and PLN lag the rally but ZAR still keeps pushing through.

It seems going into payrolls we might see some corrective action, however the main trend of USD weakness and positive risk environment will stay intact.