Equity markets are essentially at all time highs in advance of the September (Taper??) meeting.

Generally speaking, sentiment is friendly to stocks and heavy on fixed income. Shortly we'll see if it's a buy (stocks) on the rumor and sell (stocks) the news situation. The VIX/option volume has remained relatively well bid into the FOMC (which is not unusual).

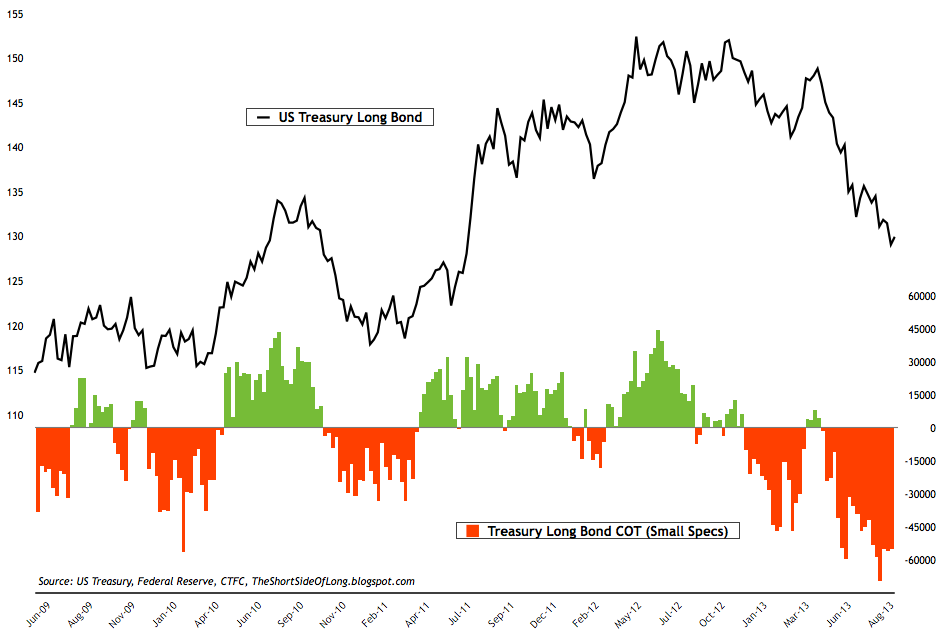

Here's a look at Treasury bond fund prices/flow in advance of Taper. Money has also been fleeing the Corporate bond space as well.

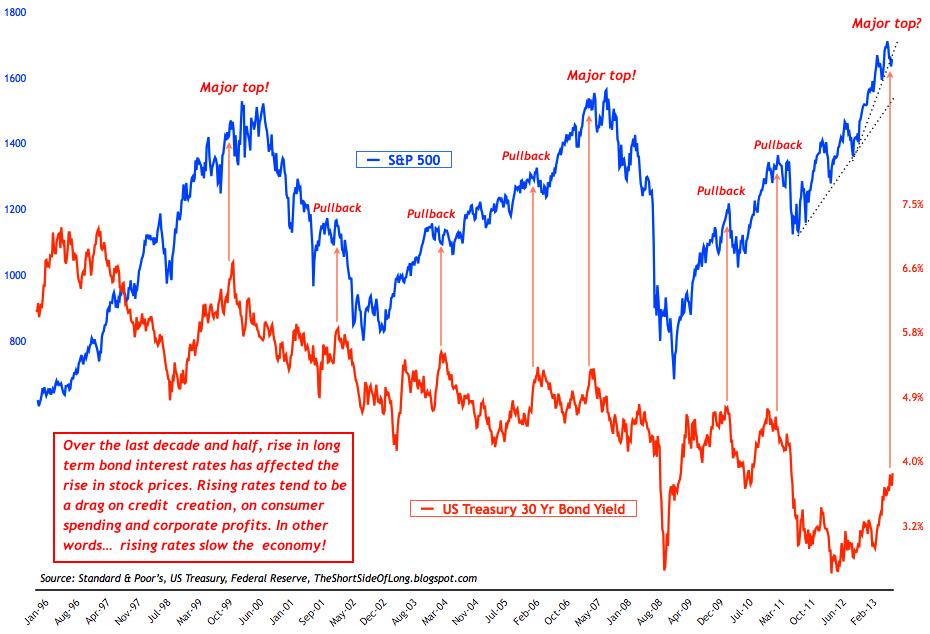

Historically, Equities have had difficulty during rising rates environments.

- During the late 90s, equities did incredibly well as rates fell following the Bailout of Long Term Capital Management. (The original nail in the coffin for Moral Hazard). When Greenspan tugged on the monetary reigns at the end of the decade - well I probably don't have to remind many of you how stocks did in the early part of the 2000s.

- Following 9/11, Greenspan had cover to (re)inject stimulus by lowering the Fed Funds which gave equities a respite, but they resumed their fall until (roughly) the beginning of the Iraq/Afghanistan Wars.

- Incredibly loose monetary policy worked it's magic until late 2007 (Sub Prime is problem?) when Greenspan started hiking rates and handed the levered hot potato to Ben Bernanke.

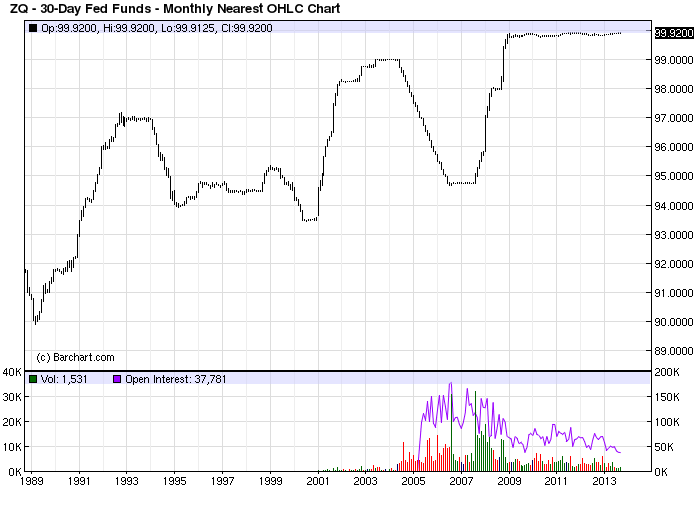

Here's a 25 year look at Fed Funds: (or how the Fed has painted themselves into a cheap money corner)

The following are worth noting/at/near interesting levels (in my opinion):

- The Dollar Index around 81. How do the Currencies react to Taper Talk? The British and Aussie and to a lesser extent the Euro and Swiss have done very well lately. Reversal?

- The Nikkei has not "confirmed" the US equity strength and may have rolled over last night.

- Natural Gas may be a short opportunity around the 100 day moving average @ 3.78. Recommend - Short future with stop @ 3.86 (risk 8 cents) and a target @ 3.60 (try to make 18 cents).

- Heating Oil may find support at it's 100 day moving average (it did last time). Recommended approach: Selling either October 295 puts (theta focus) or November 280 puts. Willing to be long futures on assignment and trade around risk.

- Coffee (KCZ13) traded to multi year lows today. Consider "bottom picking" for short term pop, but DO NOT get married to longs.

- Cocoa (CCZ13) has been on a tear (and correlates well to the British Pound). Both close to "extended" on the top side. Looking for pullback. Consider short futures with stops around Sept 2012 and Nov 2011 highs - near 2700.

Platinum looks intriguing (long) somewhere between 1410 and 1390 depending on your risk appetite and time frame.

We may see considerable knee jerk moves in the Metals/Currencies today after the announcement. If Gold/Silver/Platinum go into free fall and implied vols spike higher from current levels, I would consider selling short dated puts at a level you would be comfortable being long the underlying.

Risk Disclaimer: This information is not to be construed as an offer to sell or a solicitation or an offer to buy the commodities and/ or financial products herein named. The factual information of this report has been obtained from sources believed to be reliable, but is not necessarily all-inclusive and is not guaranteed to be accurate. You should fully understand the risks associated with trading futures, options and retail off-exchange foreign currency transactions (“Forex”) before making any trades. Trading futures, options, and Forex involves substantial risk of loss and is not suitable for all investors.

You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more than your initial investment. Opinions, market data, and recommendations are subject to change without notice. Past performance is not necessarily indicative of future results. This report contains research as defined in applicable CFTC regulations. Both RCM Asset Management and the research analyst may have positions in the financial products discussed.