It was always going to get ugly yesterday, once the market realised that the era of cheap money from the Fed is nearing the end. What was interesting about yesterday’s move lower was the sheer inclusivity of it all. Stocks regardless of sector, bonds regardless of credit rating and commodities regardless of scientific formula were all taken lower.

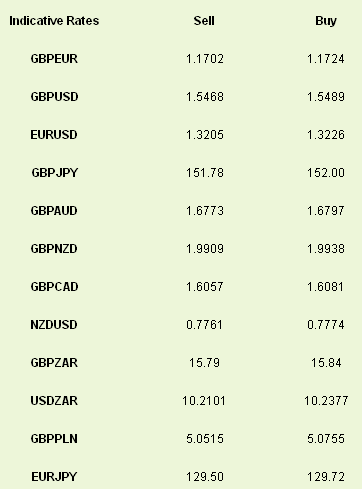

The winners on the day were few, with USD the major beneficiary. Going forward, as we said yesterday, the relationships between asset classes and data have only shifted slightly – but very importantly.

We are great fans of acronyms in financial markets. Readers will have heard me talk about RORO in the past - the dynamic that the market finds itself either Risk-On (happy to invest in riskier assets on the back of increasing global economic confidence) or Risk-Off (safer assets are desirable as confidence slips). This used to govern the markets and now doesn’t. The new acronym is POPO – Path On/Path Off.

The “path” is not to enlightenment but is instead the path that the Fed currently envisages the US economy coming down in order to meet its timeline for the reduction of asset purchases. This was clearly laid out by Fed Chair Ben Bernanke on Wednesday evening. Data that supports the jobs market, indicates solid growth or points to an improving inflation outlook will be viewed as “Path On” and markets will behave like they did yesterday – although without the magnitude of the losses.

Likewise, “Path-Off” should see these losses retraced as investors bet that the world is not ready for a Fed to step away from the printing presses.

That being said the mixture of noise and signal from the Fed statement and recent pressures out of China have meant that some data has been lost. Sterling was one of the better performers against the dollar yesterday following a surprise increase in retail sales in May. Sales rose by 2.1% compared to a 1.0% expectation, which helpfully erased the past 2 months of declines. One caveat to the increase in sentiment is that it’ll be interesting to see if retail sales in a climate of falling real wages is driven by an uptick in consumer credit demand i.e. are people loading up the credit cards to afford life now?

The European open is looking like we could be in for a classic ‘dead-cat bounce’ kind of session. Investors will be happy to swoop in on assets at these levels and run them a little higher, plus those of us who were backing the USD are more than likely going to reduce positions and bank some profit.

Pressure could be seen on the single currency following the news overnight that the IMF has warned Eurozone creditors of gaps in the financing of Greece’s bailout. Greece is due another round of funding from the troika in July – we could be heading down this track again unfortunately.

In the meantime, have a great day and a cracking weekend.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Market Takes The Path To Pain

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.