U.S. stocks are likely to move sideways and gradually rise over the coming months. Because of an excess of caution, the U.S. Federal Reserve is waiting too long to raise interest rates.

An increase in the inflation rate will eventually lead to a strong rise in commodity prices, led by gold and precious metals.

Areas we like:

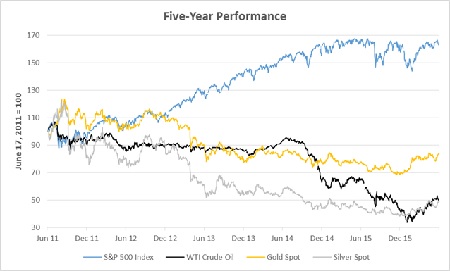

We are modestly bullish on U.S. stocks, and think that fears about Brexit will create buying opportunities. In the U.S., we favor buying oil, gold, and technology stocks on market corrections. We are bullish on the long-term price appreciation of oil, gold, and silver.

Outside the U.S., we remain bullish on Brazilian bonds, stocks, and currency. We remain bullish on Indian stocks, and for the bold speculator, the Russian currency and bonds look good.

Although some European stocks are getting cheap, as we’ve written, we are not bullish on Europe. We remain concerned about the frail condition of European banks, which unlike U.S. banks, have not been forced to raise capital to strengthen their balance sheets.

A lower euro and pound are resulting from fear over Brexit, but we would not buy Europe, Japan, or most emerging markets.The Fed has opted for a very dovish view; slow U.S. economic growth is part of that view, and fear of world events is another part.

We believe that high global debt levels and high taxes are causing stagnating world growth. We expect continued slow growth for some years to come. This puts the onus on investors to own companies or commodities that can grow or rise in spite of high government debt and high tax rates. This leaves us invested in the areas mentioned above.