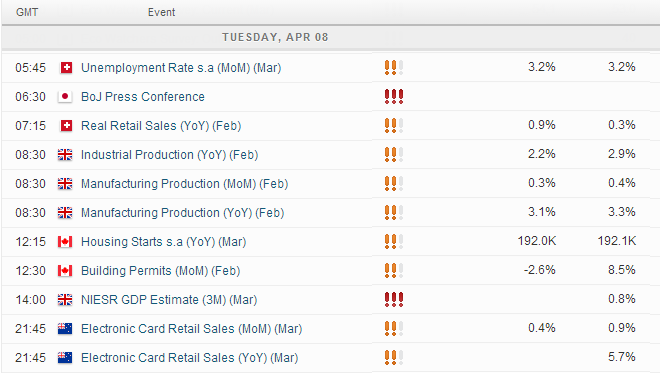

MARKET SNAPSHOT:

Asia Roundup:

A subdued session that awaited the BoJ monetary decision which, as expected, remained unchanged. We may have to wait until FOMC minutes are released on Wednesday night (Thursday AM for Australasia to see more sustained market moves.

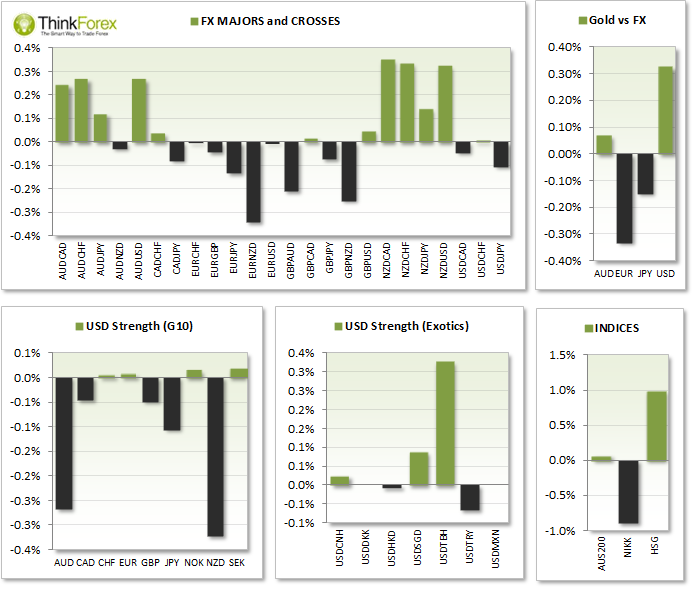

- AUD NAB business confidence has reduced for a 2nd consecutive month to sit at the lowest since Aug '13; Westpac Jobs Index suggests unemployment will rise to 6.5% by the end of the year; AUDUSD quickly shook off the reaction and currently +0.15% and continues to retrace against yesterday's losses against CAD and CHF.

- JPY Japan saw its first trade surplus in 5 months; BoJ maintain their policy to increase monetary base by 60-70T per year.

- NZD NZDUSD broke to a 4-day high in Asia trading as business confidence remained at a multi-decade high; The Kiwi Dollar continued to retrace against yesterday's losses against CAD, CHF and JPY.

- USD extended losses against all G10 currencies.

- Greece is planning a return to the money markets, as early as next week, for the first time in 4 years.

- WTI rebounds ahead of US inventory data

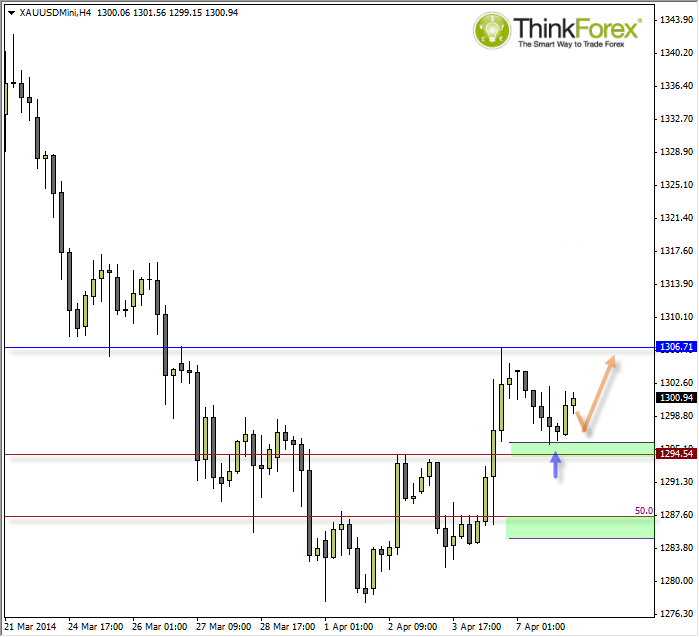

Gold: H4 Morning Star Reversal; Targeting $1307

The blue arrow highlights the swing low and what I consider to be a Morning Star Reversal candle formation. I tend to find these are quite reliable 3-bar candle patterns, especially when they respect a level of support.

As the next target is back up at the 1306 highs and mid-way to reaching that target I do not see a 1:1 reward to risk ratio worth trading. However, in the event we retrace back within the body of the previous H4 candle then we could potentially double the reward to risk ratio. I find it a common occurrence to retrace back within the body of a Morning Star Reversal, so a buy-limit order would suffice in this situation.

The risks with this kind of trade are either getting stopped out, or missing the trade all together if price continues to trade north without triggering the order. However due to reward risk ratio I accept this may happen and quite happy not to enter the trade with a lower reward/risk ratio.

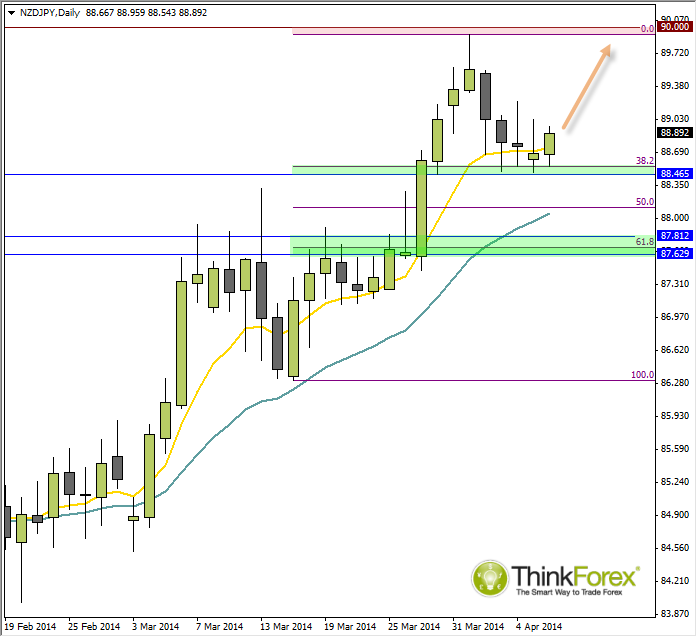

NZD/JPY: Bullish above 88.50

A very simple trend trade idea: Higher-highs and lows are forming and bouncing along the 8eMA. The previous 3 sessions have produced a Bullish Hammer followed by 2x inverted Hammers, with today’s Asia trading continuing to respect 80.50 support zone.

As long as we remain above here the next target remains the previous swing high and round number of 90.

A break below 80.50 opens up the potential for a deeper retracement towards 87.60-80 but the bullish trend does not come under threat until we break below the 87.00 swing low.