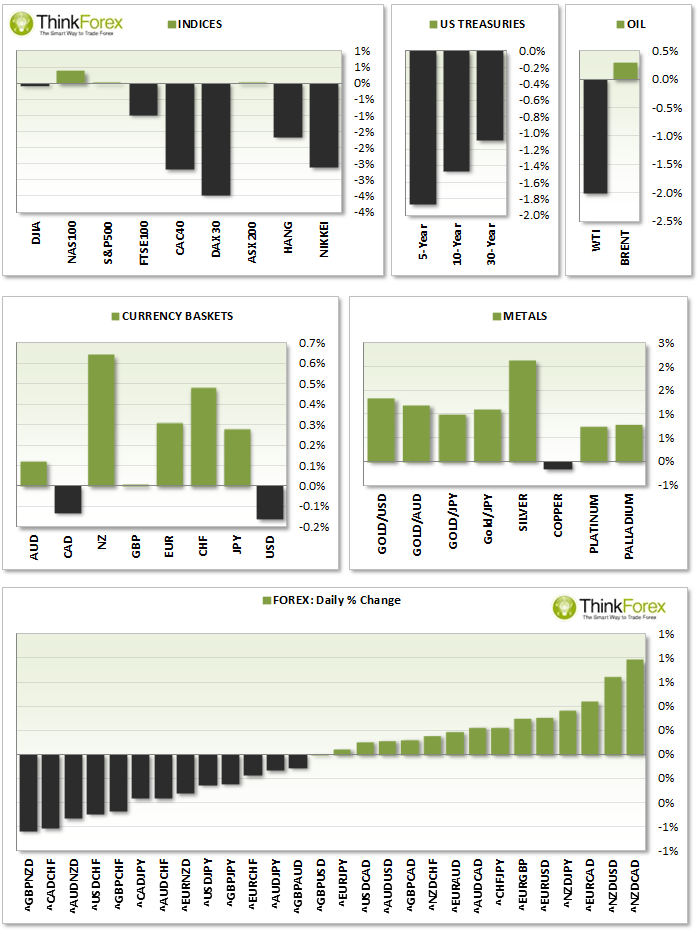

Market Snapshot:

ASIA ROUNDUP:

- AUD: 47.5k jobs created, beating estimates by 32k and at the highest level in 10 months.

- CNY: Chinese Premier Li Keqiang said today the Chinese Government will not overlook debt risk, they will enhance shadow banking monitoring and that their debt ratio is below international danger levels.

- JPY: Core machinery orders at 13.4% and the highest in 10 months

- NZD: As expected RBNZ becomes the first G10 ban to raise interest rates by 25bps to 2.75%. AUDNZD fell to 6-week lows with NZDCAD printing record highs.

- INDICES: 1st bullish day all week for AUDS200 which is now trading back above 5420 and up 0.8%. Quiet sideways trading on Nikkei 225 whilst Hang Seng continues to unwind and trade at 4-week lows

COMING UP:

- CNY: Industrial production y/y; Retail sales

- EUR: French CPI;

- USD: Core retail sales 0.2%; Retail sales 0.3%; Unemployment 334k; Import prices m/m; Business inventories m/m;

CHARTS OF THE DAY:

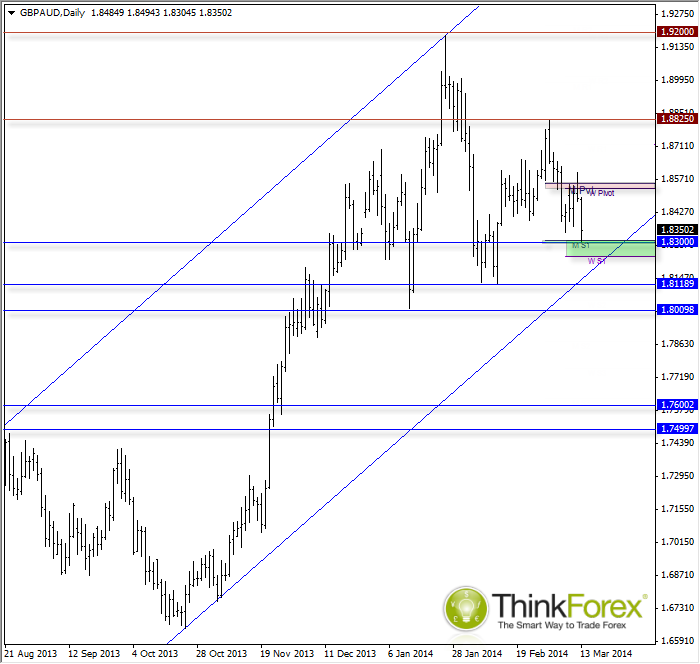

GBP/AUD: Approaches Bullish Support Zone And Lower Channel GBP/AUD Daily Chart" title="GBP/AUD Daily Chart" width="474" height="242">

GBP/AUD Daily Chart" title="GBP/AUD Daily Chart" width="474" height="242">

At time of writing this is not a pair I would be seeking to buy so this is one for your watchlist.

Not only is the Aussie dollar is gaining strength across the board but due to the bearish candle on the current daily range and the potential for a head and shoulder reversal to be forming.

However, for the H&S to be confirmed we would need to break below the bullish channel line, the neckline and the support zone around 1.830. Until that happens I have to remain bullish because overall, we are in a bullish trend.

Should we remain above the bullish support zone then I will be seeking bullish set-up to initially target 1.8825 and 1.92. As we approach the final milestone I will reassess to project further targets.

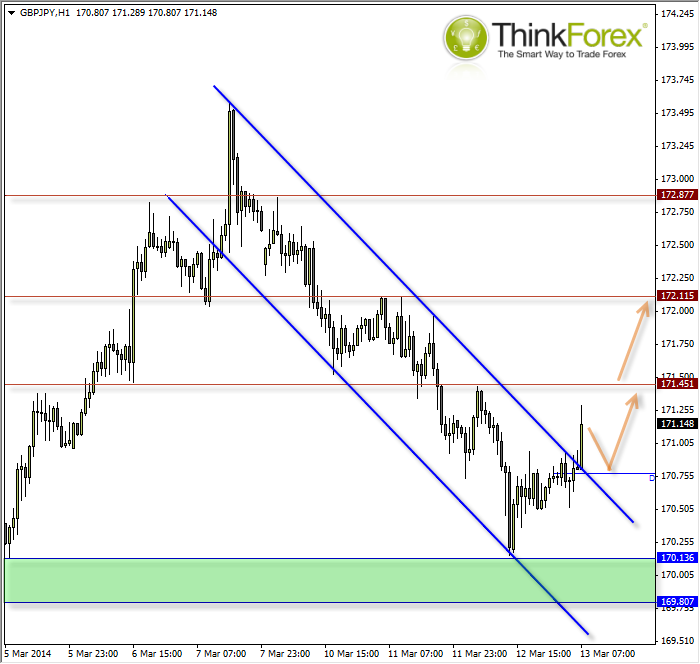

GBP/JPY: Bullish Channel Breakout GBP/JPY Hour Chart" title="GBP/JPY Hour Chart" width="474" height="242">

GBP/JPY Hour Chart" title="GBP/JPY Hour Chart" width="474" height="242">

This pattern broke out as I was writing the report and there are a couple of ways we could approach this.

Firstly we could refer to smaller timeframes and trade long to target the 171.45 resistance.

Alternatively, we could wait for a retracement towards either the Daily Pivot (170.8) or the broken trendline to seek bullish set-ups for a longer trade and target 172 and 172.80.

Disclaimer: Trading in the Foreign Exchange market involves a significant and substantial risk of loss and may not be suitable for everyone. You should carefully consider whether trading is suitable for you in light of your age, income, personal circumstances, trading knowledge, and financial resources. Only true discretionary income should be used for trading in the Foreign Exchange market. Any opinion, market analysis or other information of any kind contained in this email is subject to change at any time. Nothing in this email should be construed as a solicitation to trade in the Foreign Exchange market. If you are considering trading in the Foreign Exchange market before you trade make sure you understand how the spot market operates, how Think Forex is compensated, understand the Think Forex trading contract, rules and be thoroughly familiar with the operation of and the limitations of the platform on which you are going to trade.

A Financial Services Guide ( FSG) and Product Disclosure Statements (PDS) for these products is available from TF GLOBAL MARKETS (AUST) PTY LTD by emailing compliance@thinkforex.com.au. The FSG and PDS should be considered before deciding to enter into any Derivative transactions with TF GLOBAL MARKETS (AUST) PTY LTD. Please ensure that you fully understand the risks involved, and seek independent advice if necessary. Also, see the section titled “Significant Risks” in our Product Disclosure Statement, which also includes risks associated with the use of third parties and software plugins. The information on the site is not directed at residents in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. 2013 TF GLOBAL MARKETS (AUST) PTY LTD. All rights reserved. AFSL 424700. ABN 69 158 361 561. Please note: We do not service US entities or residents.