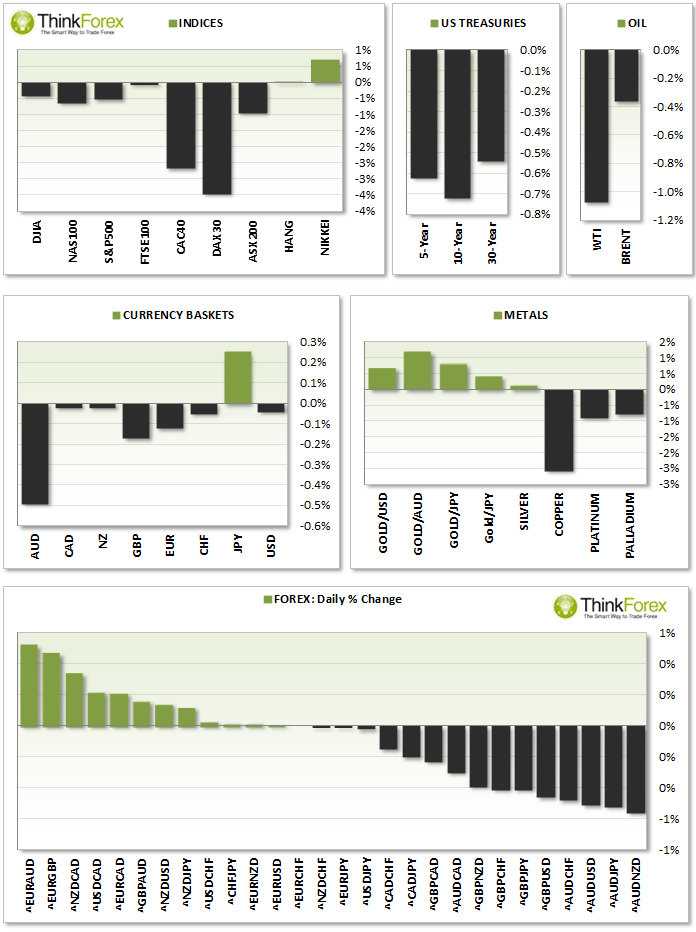

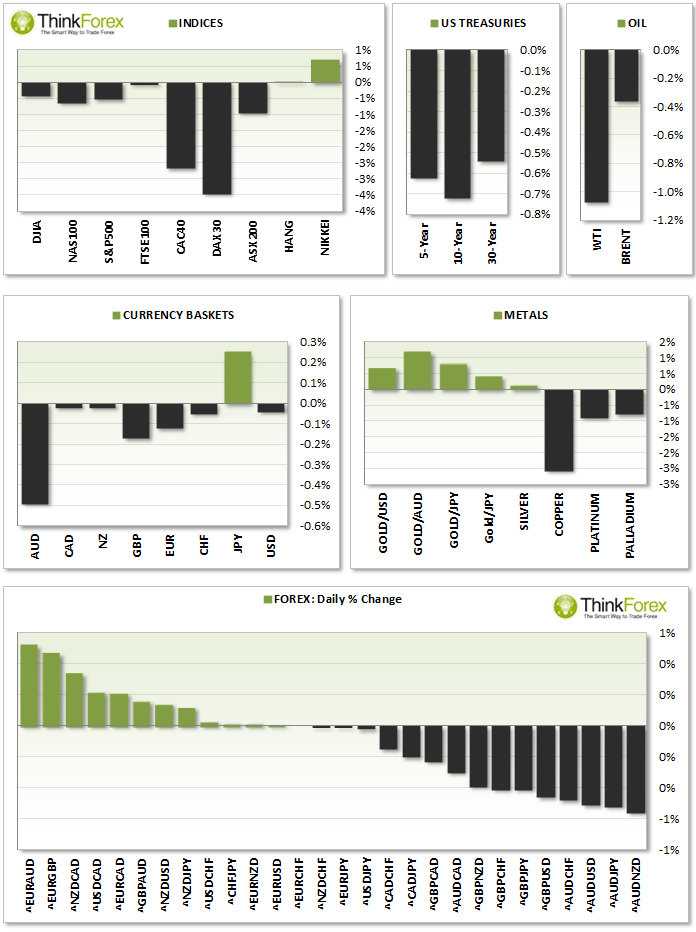

Market Snapshot:

Following the record low in China exports recently along with news of China’s first company to default, Copper and Iron ore prices fell heavily resulting in AUDUSD trading back below 0.90.

NYLON ROUNDUP (New York - London)

- COMMODITIES: WTI down -1.5% for a 2nd consecutive session finding support at 99.40; Gold broke above 1350; Copper currently trading at 30-week lows following China default;

- USD: Job openings down for 2nd consecutive month; USD Index tests our 79.90 resistance but remains technically bearish

- GBP: Manufacturing production m/m steady at 0.45 but industrial production fell short at 0.1% vs 0.3% expected. Cable approached 2 week lows but holds above 1.658 support

- INDICES: Equities close the session at their weekly lows following the news from China. FTSE100 back to 3-week lows; Dax at 3-week lows; CAC40 at 6-week lows

ASIA ROUNDUP

- AUD: Consmer sentiment down; Home loans at 5-month low coming in a 0% vs 0.8% expected; AUDUSD back below 0.90;

- CNY: Iron ore prices have fallen following dissapointing trade numbers

- JPY: Tertiary Industry activity is up at 0.9% vs 0.7% expected;

- INDICES: AUS200 recouped early losses to produce a bullish hammer on the close; Nikkei 225 closes lower for 3rd consecutive session; Hang Seng at 4 week lows

COMING UP:

- EUR: Industrial production m/m; French final NFP

- USD: Crude oil inventories; 10yr bond auction;

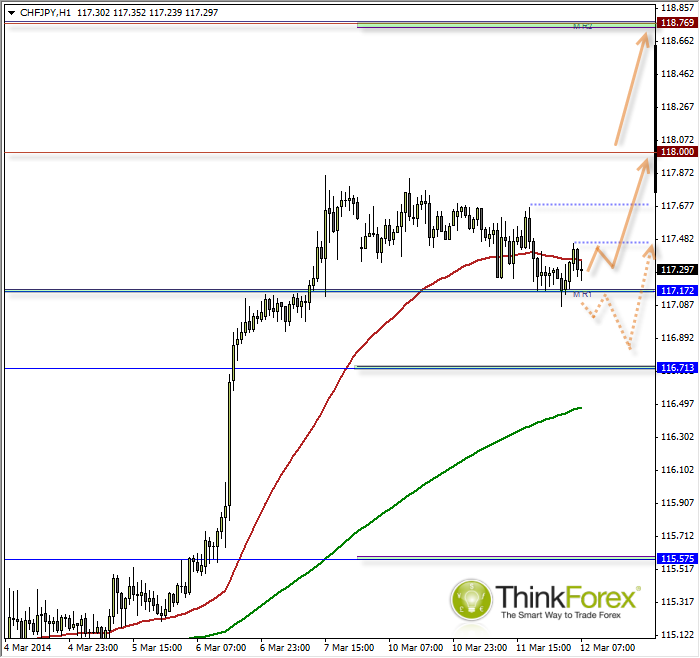

CHARTS OF THE DAY:

CHF/JPY: Holds above 117 with potential base forming CHF/JPY Hour Chart" title="CHF/JPY Hour Chart" width="700" height="658">

CHF/JPY Hour Chart" title="CHF/JPY Hour Chart" width="700" height="658">

This follows on from yesterday's analysis which has now seen the initial pullback and may provide a more precise entry. When you consider that the JPY was the only currency basket to finish in the green yesterday (see above) it bodes well for the CHF that it managed to hold ground against yen.

At time of writing we are hovering above 117 support with the potential for a 'higher low’ to form. If this continues and we then break above the 117.48 swing high then there is potential for a trend to develop and target the 118 / 118.7 targets highlighted yesterday.

We still may see a deeper pullback towards 116.7, but until we break below 117 then I favour a continuation of the bullish trend sooner than later.

Disclaimer: Trading in the Foreign Exchange market involves a significant and substantial risk of loss and may not be suitable for everyone. You should carefully consider whether trading is suitable for you in light of your age, income, personal circumstances, trading knowledge, and financial resources. Only true discretionary income should be used for trading in the Foreign Exchange market. Any opinion, market analysis or other information of any kind contained in this email is subject to change at any time. Nothing in this email should be construed as a solicitation to trade in the Foreign Exchange market. If you are considering trading in the Foreign Exchange market before you trade make sure you understand how the spot market operates, how Think Forex is compensated, understand the Think Forex trading contract, rules and be thoroughly familiar with the operation of and the limitations of the platform on which you are going to trade.

A Financial Services Guide ( FSG) and Product Disclosure Statements (PDS) for these products is available from TF GLOBAL MARKETS (AUST) PTY LTD by emailing compliance@thinkforex.com.au. The FSG and PDS should be considered before deciding to enter into any Derivative transactions with TF GLOBAL MARKETS (AUST) PTY LTD. Please ensure that you fully understand the risks involved, and seek independent advice if necessary. Also, see the section titled “Significant Risks” in our Product Disclosure Statement, which also includes risks associated with the use of third parties and software plugins. The information on the site is not directed at residents in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. 2013 TF GLOBAL MARKETS (AUST) PTY LTD. All rights reserved. AFSL 424700. ABN 69 158 361 561. Please note: We do not service US entities or residents.