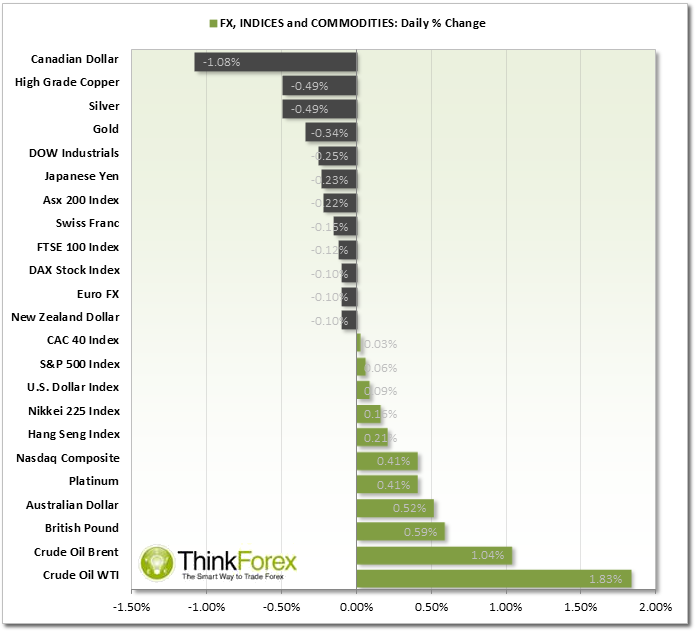

MARKET SNAPSHOT:

AUD: Yesterday's bullish gains were nearly eradicated today after Chinese manufacturing PMI not only came in less than expected, but also below 50 to suggest industry contraction. This is the first negative reading in 7 months.

CAD: The Loonie continues to unravel across the board and trade at record lows against USD, CHF, GBP and NZD. Bank of Canada Monetary policy report and rate statement are up later today.

EUR: Trading at 12-month lows against GBP and broke through 0.8240 support this week, EURGBP is looking increasingly weak from a technical perspective.

GBP: Continues to look strong and broke to new highs against the Aussie, the Loonie and the Swissy. No change in the Asset Purchasing facility, with the jobs market painting a mixed picture by reducing unemployment whilst job claims are up.

INDICES: S&P 500 and Dow Jones suffered bearish closes and both suggest deeper retracements whilst NASDAQ held ground at record highs. Nikkei 225 struggles to maintain recent gains and suggests they have merely been corrective (and hints at another bearish leg). This may provide clues for USDJPY which tends to have a strong positive correlation.

COMMODITIES: Continue to diverge as Metals retreat from their recent highs whilst Oil rallies. WTI hit our 96.20 target and continued with a high of 96.86 yesterday with Brent also following suit to break past resistance and hold 107.85 as support. Technically the near-term looks bullish for these two and interesting to see they have also diverted from CADJPY which has had a strong positive correlation recently.

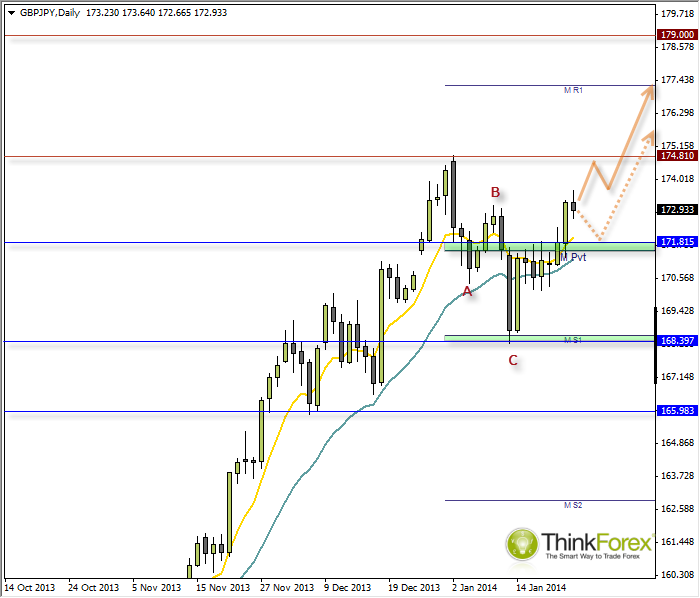

Charts Of The Day: GBP/JPY

I am not more confident we are back in line with the dominant trend and the correction is over. Ultimately my next primary trend target is around 179 although we do also have the Monthly R1 pivot around 177.4 which is likely to provide a pullback at the very least. Therefore this is my interim target.

Yesterday price briefly traded above the prior swing high (B) which is our first clue to a change in trend.

We have support around 172 which may entice further buying in the event of any bullish setups are seen on intraday timeframes around these levels. This too may provide extra pips and an increase in reward to risk ratio.

Keep an eye on 174.80 which could also be treated as an interim target on route to 177.

Only a break below 171.50 would warn of a deeper bearish correction with a possible target back at 168.39.

Even then the overall bias remains bullish where only a break below 165.0 would threaten the primary bullish trend.  GBP/JPY Daily Chart" title="GBP/JPY Daily Chart" height="598" width="700">

GBP/JPY Daily Chart" title="GBP/JPY Daily Chart" height="598" width="700">