We now have, understandably, a market that simply doesn’t know what to do with itself. With a mere three trading days left between now and the election results, people are frozen into inaction. In an odd way, it has created a bizarre equilibrium.

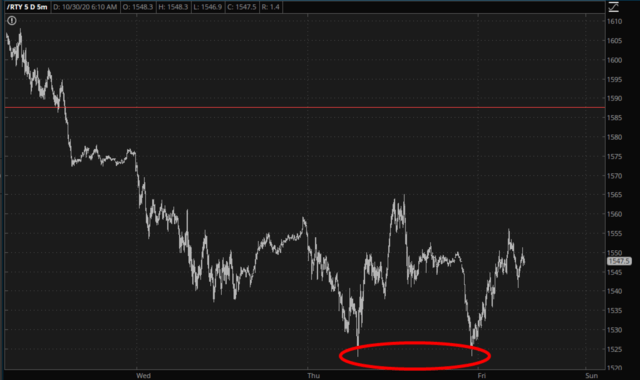

Last night, the Russell 2000 futures went into a freefall, magically hitting precisely their low from the prior night before violently reversing. How about that?

Gold, which has been a real piece o’crap for the past couple of months, finally found some buyers (probably in preparation for next week’s mayhem) and is in the midst of the rare but powerful Evil Smile Pattern.

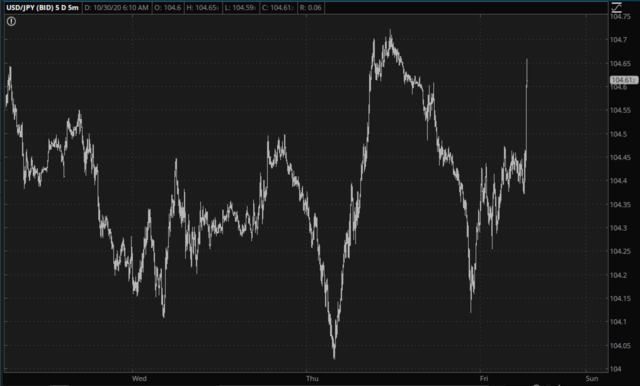

Not that FOREX provides us any clarity. The USD/JPY chart looks like we’re tracking the blue sphere at a racquetball game.

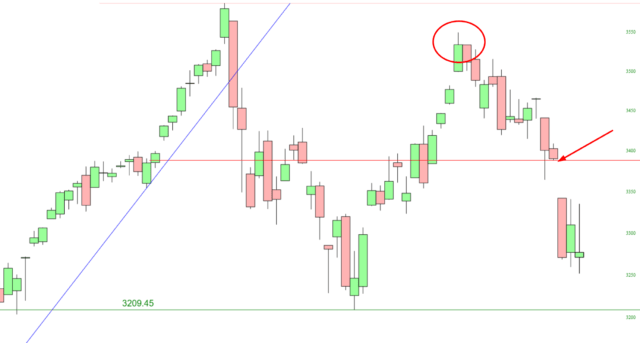

For me, I am focusing on the simple. I offer, as an example, the S&P 500 cash index. This chart sports three important features:

- The fact that the price peak a couple of weeks ago was nothing more than a “lower high,” which shows that the trillions from the Fed are losing their steam;

- The price gap that took place between Tuesday and Wednesday, which I consider a vital barrier at this point;

- The support at 3209.45, which is broken, opens the way to more powerful selling.

For myself, I am at precisely 113% commitment (and likely will stay close to that until Wednesday) with 45 short positions (no ETFs). My options account is pure cash, although I definitely have my eye on a re-entry. Good luck out there as we finish up this last pre-election week for the next four years!