European equities and risk-linked currencies gained on Monday, as the German Ifo survey showed improvement in business climate. With the UK and the US markets closed for holidays, the improved risk appetite rolled over to the Asian session today, as China’s central bank said it would strengthen economic policy and that it would continue to drive interest rates on loans lower.

EQUITIES AND RISK-LINKED CURRENCIES GAIN, SAFE HAVENS SLIDE

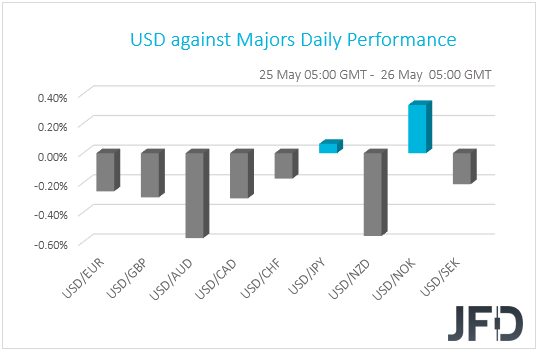

The dollar traded lower against all but two of the other G10 currencies on Monday and during the Asian morning Tuesday. It underperformed the most against AUD, NZD and CAD, while it gained the least ground versus CHF. The greenback eked out gains only against NOK and JPY.

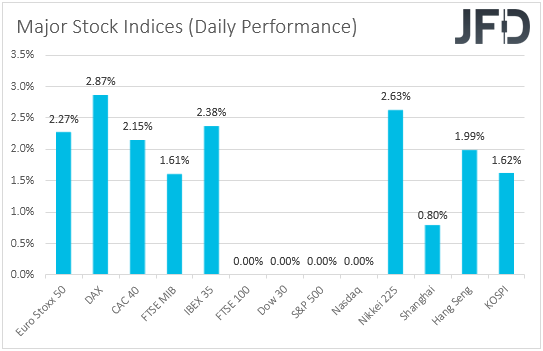

The strengthening of the commodity-linked currencies combined with the relative weakness in the safe havens suggests that market sentiment was upbeat. Indeed, turning our gaze to the equity world, we see that major EU indices were a sea of green, perhaps due to the better-than-expected German Ifo survey for May. Although the current assessment index slid to 78.9 from 79.4, instead of rising to 80.0 as the forecast suggested, the expectations index rebounded to 80.1 from 69.4. The forecast was for a rebound to 75.0. This has driven the business climate index up to 79.5 from 74.2. The increased optimism among businesses may have been the result of activity in the Eurozone’s growth engine gradually returning to normal levels after weeks of coronavirus-related restrictions. The fact that the German government approved a EUR 9mn bailout package for Lufthansa may have also boosted sentiment.

With the UK and the US markets closed for holidays, the improved risk appetite rolled over to the Asian session today as well, as China’s central bank said it would strengthen economic policy and that it would continue to drive interest rates on loans lower. An announcement from a US firm that it is ready to conduct human trials of its virus vaccine may have also added to the broader optimism, despite the increased tensions between the US and China. Over the weekend, White House National Security Adviser Robert O’Brien warned over potential sanctions to China if Hong Kong’s autonomy was undermined, while China’s top diplomat Wang Yi characterized the US attacks as a “smear”.

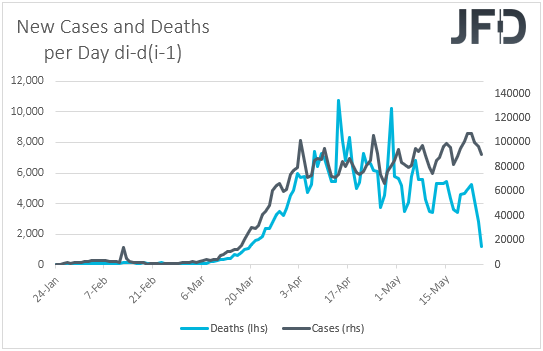

With both infected cases and deaths from the coronavirus slowing notably over the weekend, investors may have preferred to focus more on the potential recovery on economic activity as restrictive measures around the globe continue to ease. Remember that last week, we noted that the prospect of more fiscal and monetary stimulus around the globe, and the fact that headlines suggest we are closer to a virus drug, may allow risk assets to rebound again, and this appears to have been the case yesterday. Barring any fresh tensions between China and the US, which could jeopardize any potential trade accord and thereby result in another round of risk aversion, we would expect investors to continue increasing their risk exposures as the worst in the coronavirus saga appears to be behind us. That said, we will maintain a degree of caution as on Wednesday, the European Commission will discuss again its recovery plan, after Austria, Sweden, Denmark and Netherlands opposed to the plan for a EUR 500bn recovery fund proposed by France and Germany. If things point that there is still no common ground, we could see another correction lower in European equities.

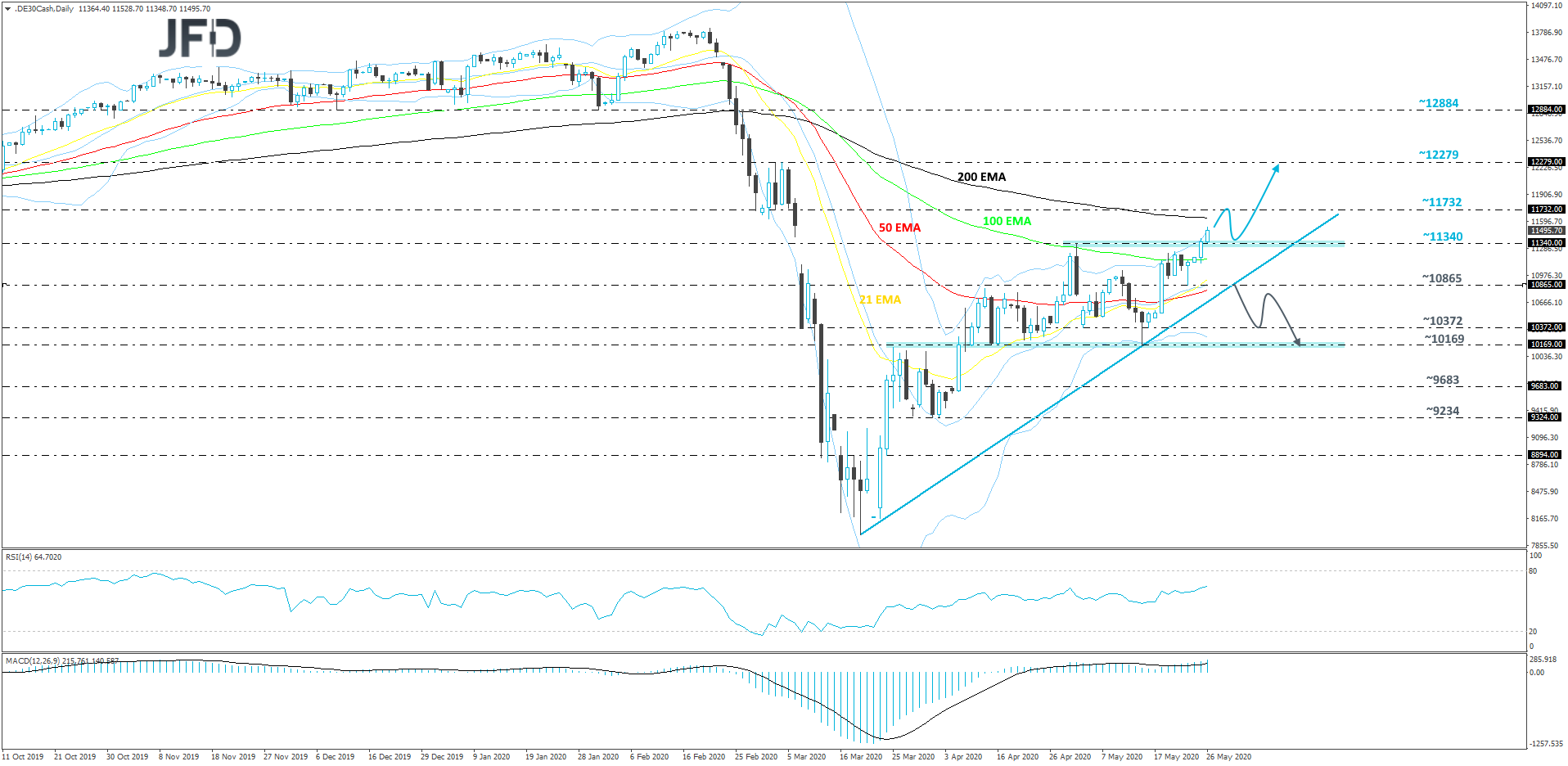

DAX – TECHNICAL OUTLOOK

Looking at our daily chart of DAX, we can clearly see that the German index finally managed to exit its range through the upper side of it. That range was roughly between the 10169 and 11340 levels. In addition to this, we can see that the price is still balancing above its short-term tentative upside support line drawn from the low of March 19th. For now, we will stay positive, at least with the short-term outlook, and continue aiming a bit higher.

A further push north could bring the German index to the 200-day EMA, or the 11732 zone, which is marked near the lows of February 28th, March 3rd and 5th. The price could stall there for a bit, but if the buying power is still strong, the next potential target to consider might be the 12279 level. That level marks the highest point of March.

On the other hand, if the bulls fail to push DAX higher, and the index ends up falling back into the range and also breaks below the aforementioned upside line, all this could make the buyers worry again. Such a move would also place the price below last week’s low, at 10865, and increase DAX’s chances of drifting further down. That’s when we will aim for the 10372 obstacle, a break of which may clear the way to the lower side of the previously-discussed range, at 10169.

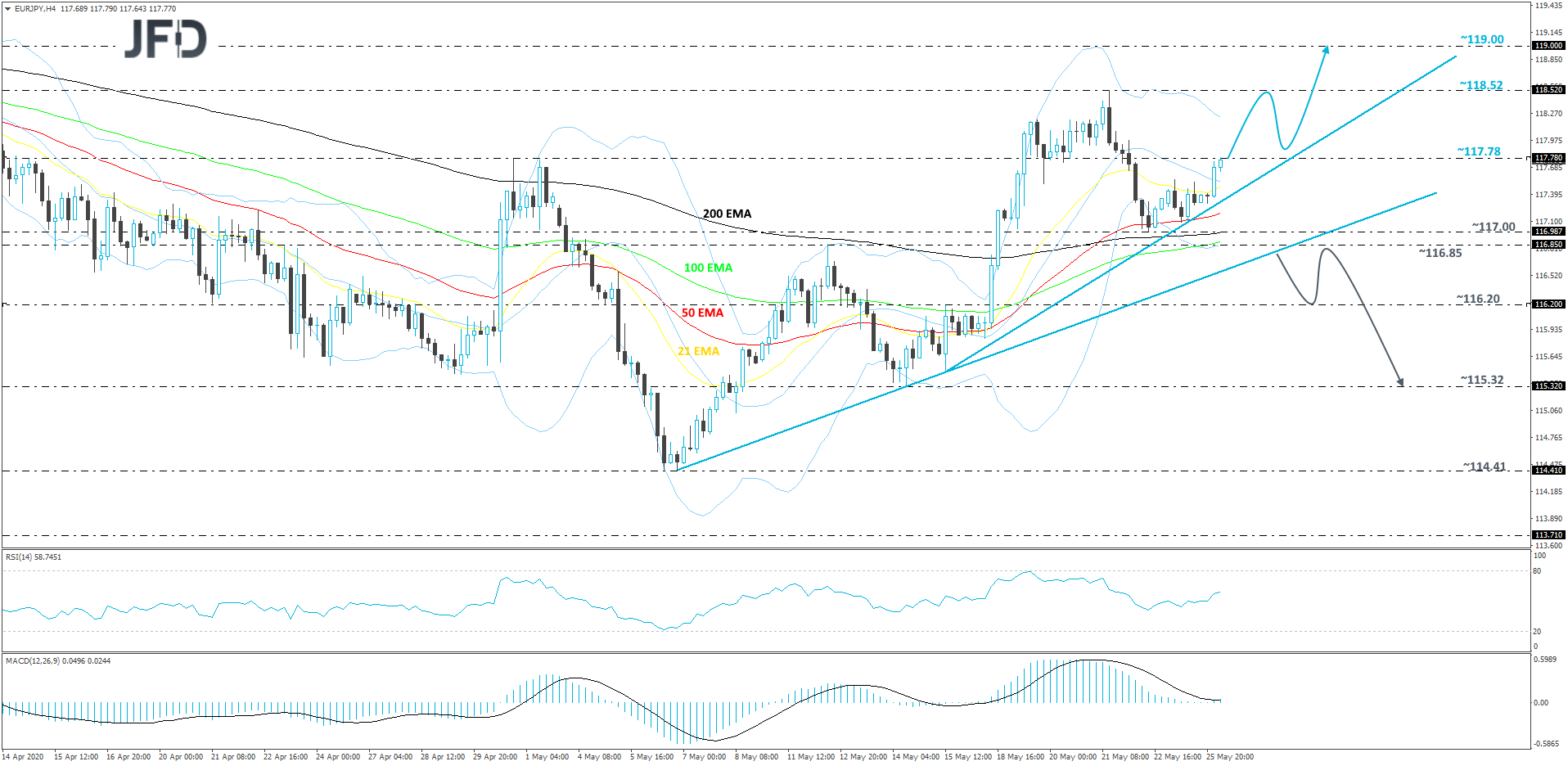

EUR/JPY – TECHNICAL OUTLOOK

After reversing higher in the beginning of May, EUR/JPY continues to balance above a couple of short-term tentative upside lines: one is taken from the low of May 6th and the other (steeper one) is drawn from the low of May 15th. At the time of writing, the pair is getting a hold-up near the 117.78 barrier, which is the high of April 30th. So far, the RSI is still pointing higher, which suggests there might be more upside to come in the near term. Therefore, as long as the rate remains above those upside lines, we will stay positive, at least for now.

A push above the previously-discussed 117.78 barrier could clear the way towards the current highest point of May, at 118.52. The rate might stall there temporarily, or even retrace back down slightly. However, if EUR/JPY continues to trade above the aforementioned steeper upside line, the pair may get another boost from the bulls, who could lift it back up to the 118.52 hurdle. A break above that hurdle would confirm a forthcoming higher high and could send the rate further north, possibly targeting the 119.00 level, marked by the high of April 9th.

Alternatively, if the pair breaks all of the aforementioned upside lines, that may spook the buyers from the field temporarily and allow the sellers to dictate the rules for a while. EUR/JPY could move further south, potentially targeting the 116.20 obstacle, a break of which may clear the path to the 115.32 level, marked by the low of May 14th.

AS FOR TODAY’S EVENTS

Today, the calendar appears very light with the only data releases worth mentioning being the US Conference Board consumer confidence index for May and the nation’s new home sales for April. The CB index is expected to have slid to 85.5 from 86.9, while new home sales are anticipated to have accelerated their slide in April, to -17.0% mom from -15.4%.

As for tonight, during the early Asian morning, BoC Governor Poloz and Deputy Governor Wilkins will testify before Parliament’s Standing Senate Committee on National Finance. At its latest meeting, the BoC expanded its QE purchases, while the most recent inflation data disappointed. Thus, ahead of next week’s BoC gathering, it would be interesting to see whether more stimulus is on the cards.

With regards to the rest of the speakers, today, we will get to hear from ECB Executive Board member Philip Lane and Minneapolis Fed President Neel Kashkari.