Market Roundup

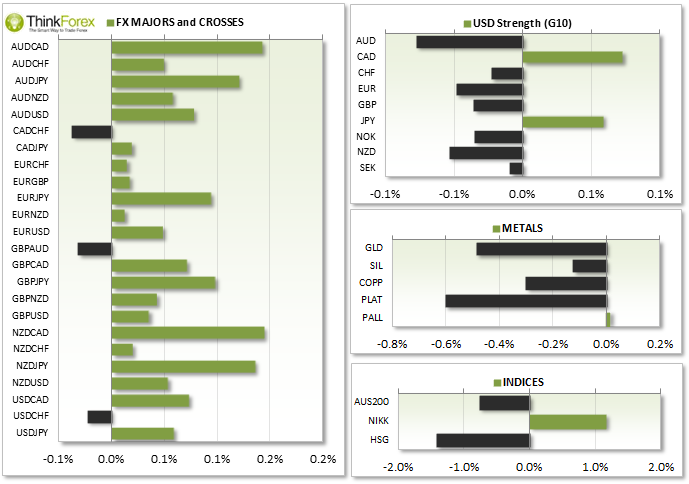

- AUD import prices and smashed expectations at 3.2% to see the Aussie trade above 0.930 following the release and break the bearish channel. Currently trading at 0.9293 and appears bullish on intraday timeframes.

- JPY domestic auto sales down -11.4% y/y

- CNY manufacturing came in soft at 50.4 vs 50.5 expected

UP NEXT:

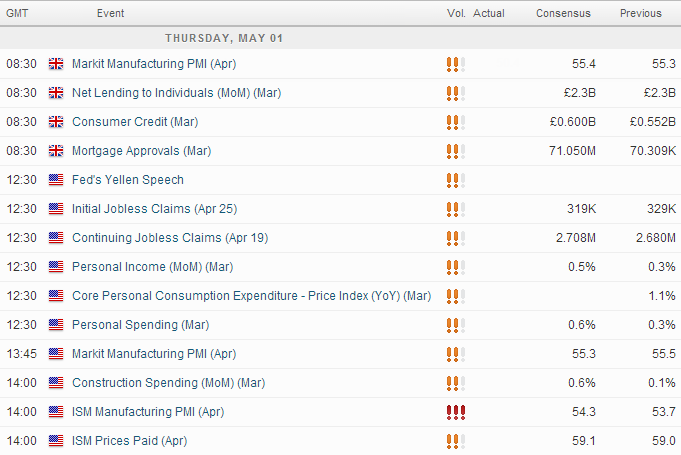

- Bank holiday for EUR and CHF so lower volumes can be expected during NYLON session

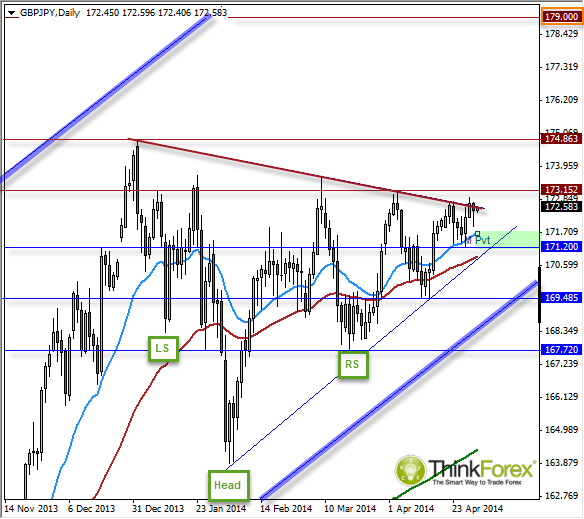

- UK PMI is forecast slightly higher over last month however we have seen 4 consecutive declines from the manufacturing index to suggest a top is in place. The closer to 50 we get the more negative an impact GBP pairs will suffer, with a shock number below 50 no doubt providing fireworks (and celebrations for GBP bears).

- FED Chair Lady Yellen will be closely monitored by the markets to see if any clues slip regarding timing for interest rate hikes. I expect extra volatility but no particularly directional moves from the speech.

- US Unemployment claims whilst may provide some volatility, should be fairly muted compared to tomorrow's NFP but if it comes in positive I suspect we'll see USD bullishness priced in prior to NFP.

- US Manufacturing is the last red news event tonight. We have seen 2 consecutive increases with a 3rd expected, so any disappointment should see USD Index remain near weekly lows.

Pairs to Monitor: USD, GBP, Gold, GBP/JPY, Indices