Ahead of Thursday's CPI inflation print, the stock market rose on Wednesday, extending gains for the week. The stakes for the Fed-critical report are high since most investors expect a lower CPI Print.

Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT), Alphabet (NASDAQ:GOOGL), Amazon (NASDAQ:AMZN), and Tesla (NASDAQ:TSLA) all gained on Wednesday, potentially signaling a modest recovery in tech in the works, or they could all plunge tomorrow.

As we ring in the Year of the Rabbit, investors have high hopes for what this new year can bring to their portfolios.

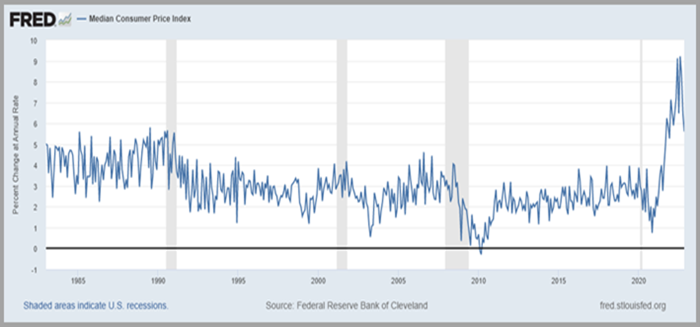

With the Federal Reserve's expectations set that inflation will return to its target rate of 2% in 18-24 months, media coverage has recently been focused on this narrative, which is far from reality.

There is no consensus on how much the US will grow; or how deep a recession might be felt.

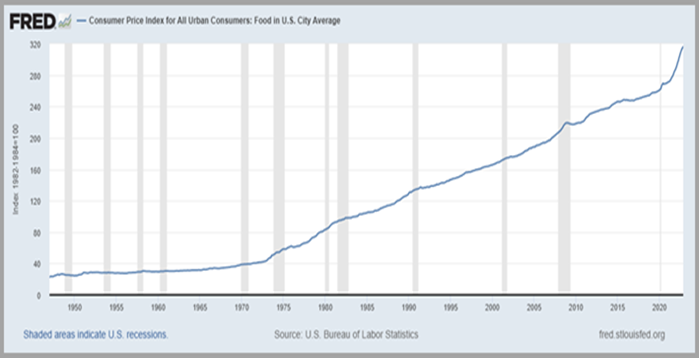

Energy prices have relaxed for now, which is positive. The shelter is 30% of CPI and trending higher. The prevailing narrative in the media today is that "inflation has peaked," maybe, but it will not be 2% again for many years.

The shelter component is 30% of the total CPI calculation. Wages are going up. Food is soaring.

Inflation will remain way above the Fed rate of 2%, and we will see if the CPI Print is softer tomorrow. It is positive if trending lower, but lower does not equal 2%.

With the end of 2022 and the turn of the New Year, investors must consider what lies ahead of tomorrow and beyond.

As we enter 2023, the Year of the (Water) Rabbit - according to Chinese zodiacs –many stakeholders will need insight to profit in 2023.

ETF Summary

- S&P 500 (NYSE:SPY): 389 support and 401 resistance.

- iShares Russell 2000 ETF (NYSE:IWM): 179 support and 184 resistance.

- Dow Jones Industrial Average ETF Trust (NYSE:DIA): 336 support and 344 resistance.

- Invesco QQQ Trust (NASDAQ:QQQ): 274 support and 280 resistance.

- S&P Regional Banking ETF (NYSE:KRE): 56 support and resistance 62.

- VanEck Semiconductor ETF (NASDAQ:SMH)): Support is 216 and 224 resistance.

- iShares Transportation Average ETF (NYSE:IYT): 220 pivotal support and 230 is now resistance.

- iShares Biotechnology ETF (NASDAQ:IBB): 127 is pivotal support 138 overhead resistance.

- S&P Retail ETF (NYSE:XRT): 68 is now resistance.