Well, we survived the Fed announcement and trading after that—more or less. And that, my friends, is the LAST scheduled event of any importance until next year. So we’re basically in the pure psychology zone. No economic news. No earnings. Just…………feelings.

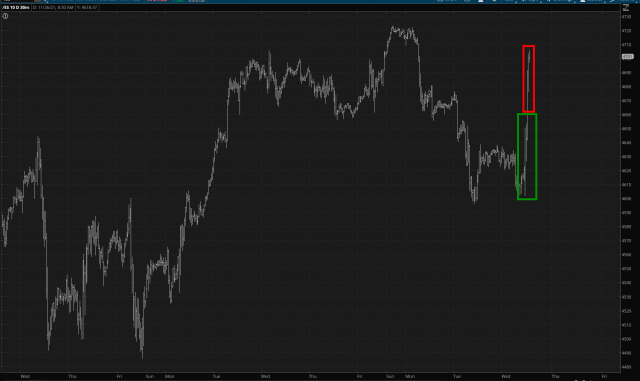

I thought it would be valuable, for you and me both (but probably me most of all) to reflect on the yesterday's events and sort of where my head is at on the market. I’ll commence the reflection with this chart of the ES futures:

The portion I’ve boxed in green made total sense to me. It’s a relief rally, as well as a short-covering rally. No problem. Indeed, even at the peak of this, I had a profit on the day.

The red area—nope. Didn’t anticipate that at all. And since I was short it basically turned the day from a 5% gain to a 5% loss. Not the end of the world, but, hey, I liked it earlier before.

As for what I’ve been doing right lately, I would say………….

- Taking profits on my semiconductor shorts on Tuesday (NVIDIA (NASDAQ:NVDA), Advanced Micro Devices (NASDAQ:AMD));

- Taking profits on most of my QQQ puts on Tuesday, and the remainder of them on Wednesday before the Fed announcement;

- Keeping a meaningful amount of “powder” (AKA cash) dry;

- Taking profits on my SPDR® S&P Oil & Gas Exploration & Production ETF (NYSE:XOP) puts yesterday, before the Fed, as I stated in this dedicated post;

- In recent days, moving out of January puts and having no new positions earlier than February expirations

What I’d prefer to not have done, includes:

- Being too cocksure that yesterday’s rally was over, and rushing into SPY puts (down 15% so far);

- Getting into SPDR® S&P Metals and Mining ETF (NYSE:XME) and Alcoa (NYSE:AA) puts too swiftly (also down 15% so far);

And that’s seriously about it. I was simply too impatient and rushed in where angels fear to tread.

So, regrettably, the smoke has far from cleared. If the rally yesterday had pooped out to some degree (even partly reversing the surge) I’d be feeling a lot more confident right now. But the prospect of the so-called Santa Clara Rally becoming a self-fulfilling prophecy gives me pause. All I can say at this point is:

- My options have an ungodly amount of time left on them, going out as far as April 2022;

- Most of my positions remain profitable, even with the dreadful soar yesterday;

- None—not a single one—of the charts thatare important to me got damaged today.

I’m kind of relieved there are two trading days left this week, since it’ll give the FOMC smoke much more time to clear.