Investing.com’s stocks of the week

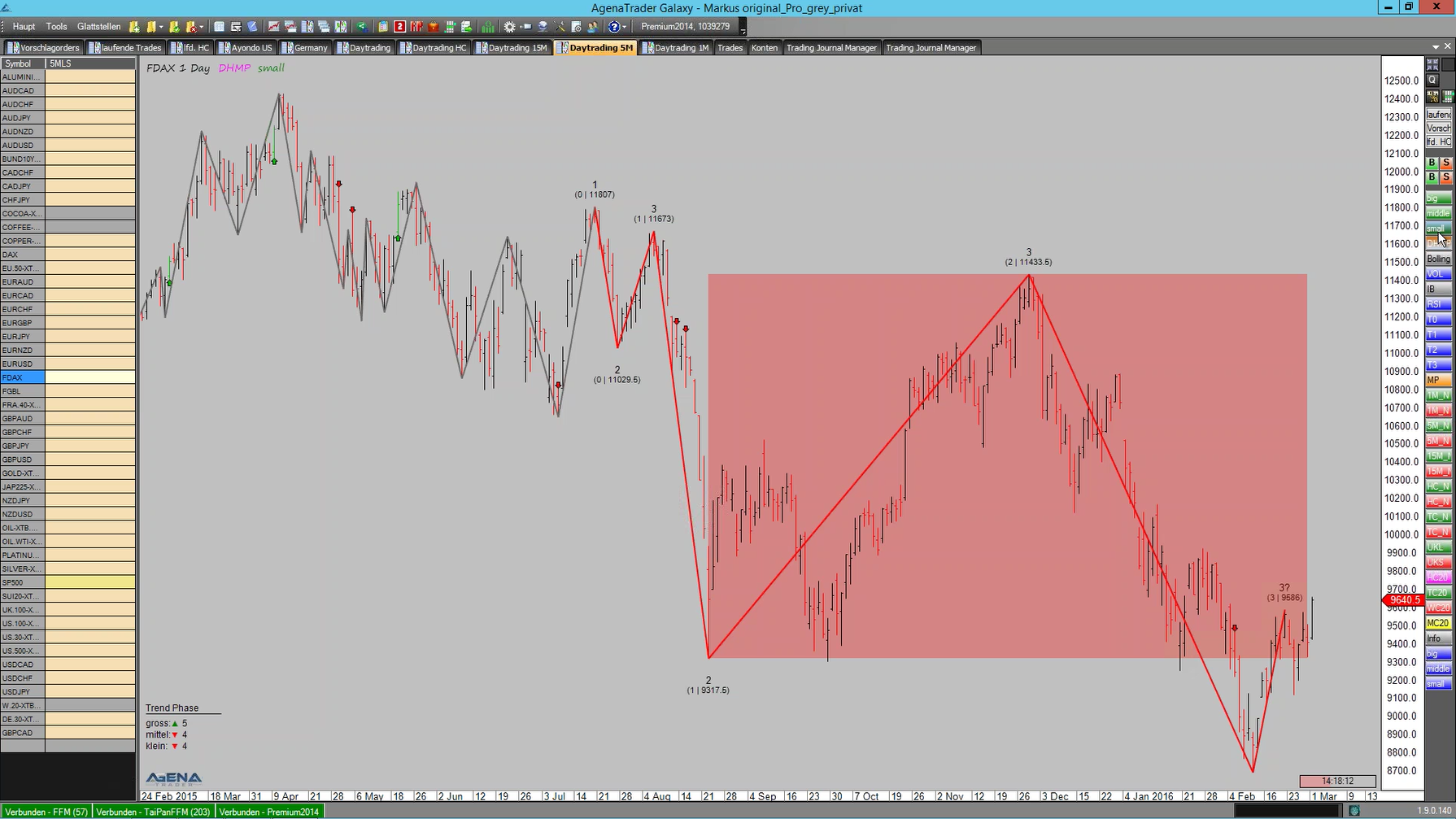

Today we are focusing on the German shares index, since some strong movements have been taking place here. The last few days were not easy; the big picture is clearly pointing downwards, as long as the marker at 11,433 is not overbid. Until then, the market will remain short, but a lot can happen in this large correction zone. But this is not the only trend size to be seen here. There is a further downwards trend in the daily chart.

If the last point 3 breaks, then this inferior downwards trend will be abandoned and it will look significantly more positive for this index. In the bigger picture, we are actually in very large upwards trend. The market has turned around in the correction zone and the big players seem to have bought a lot down there. But we might not have seen the absolute low yet – it can go further down at any point.

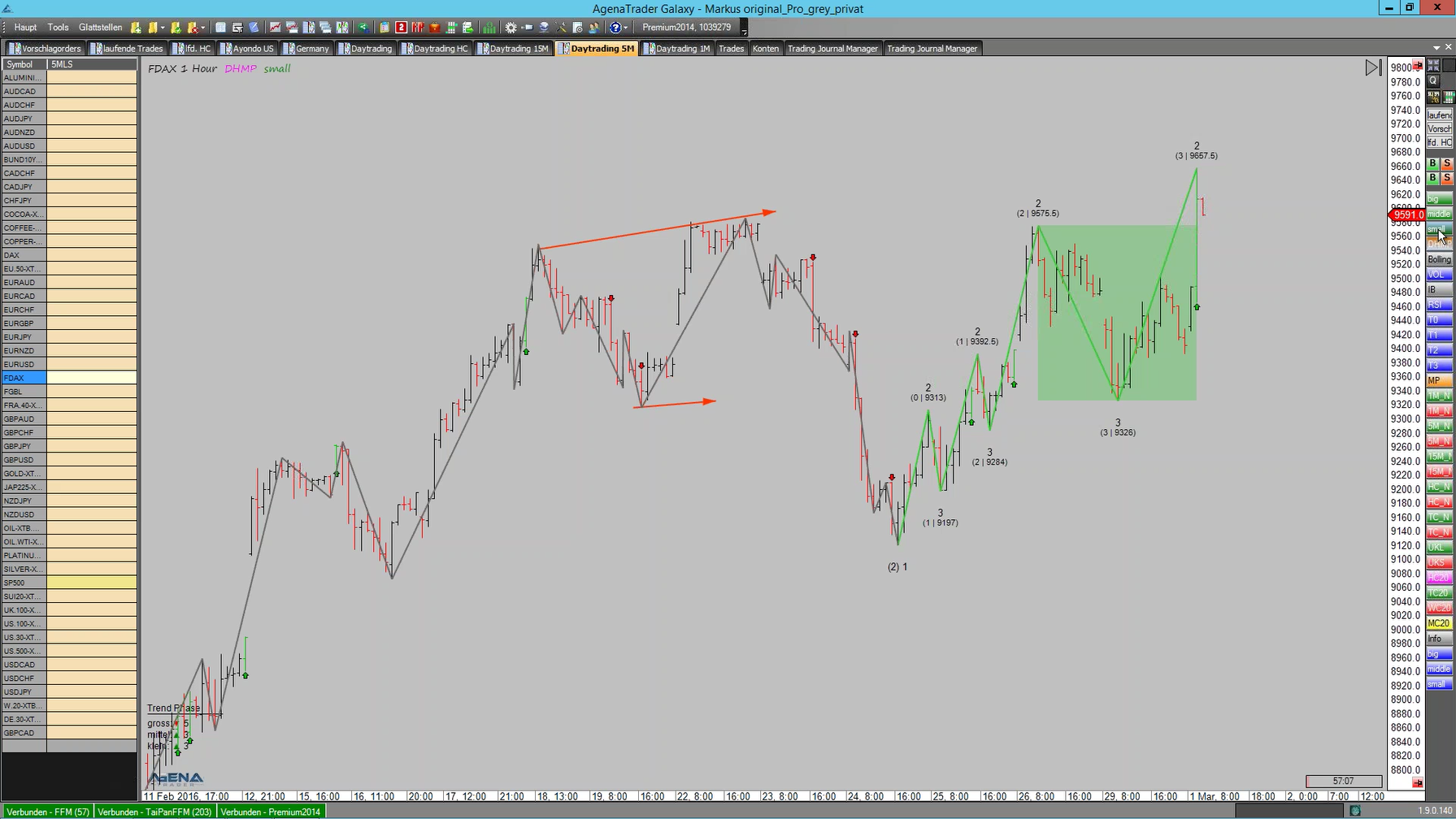

Here we see a beginning new movement; we have a downwards trend that could, however, be the beginning of a bottom formation. This could be the starting point for a larger upwards movement. A trend continuation above 9575 will allow us to search for upwards chances today, because the probabilities are clearly still on the upper side – since the deeper the price has gone into the correction, the more space it has to shoot upwards out of it. Of course the more mature the trend becomes, the less likely this is.

In the DAX 1 hour chart, we now have a closing price above 9575, meaning that we have a new correction zone. The market is now coming up by about 350 points, so it is completely logical that a correction will follow this, because the big players who are now in the plus will start to cash in their profit. But as long as the price remains in this green correction zone, the market can still go upwards at any point.

In the 15-minute chart we also have a very young trend, with a great chance to enter when the market is in a correction.

For presentation purposes the trading software "AgenaTrader" has been used.

IMPORTANT NOTE: Exchange transactions are associated with significant risks. Those who trade on the financial and commodity markets must familiarize themselves with these risks. Possible analyses, techniques and methods presented here are not an invitation to trade on the financial and commodity markets. They serve only for illustration, further education, and information purposes, and do not constitute investment advice or personal recommendations in any way. They are intended only to facilitate the customer's investment decision, and do not replace the advice of an investor or specific investment advice. The customer trades completely at his or her own risk. Please refer to the current version of the Terms and Conditions.