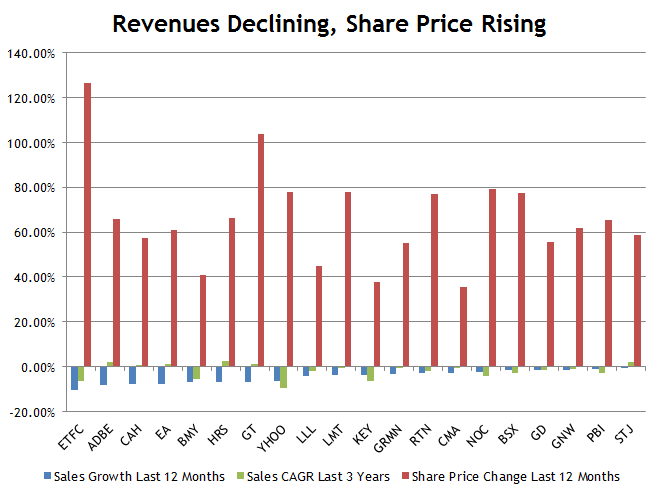

Below are 20 S&P 500 stocks that appear to defy the laws of market gravity. The 20 companies shown are ones that have seen:

A) Sales decline in the last 12 months

B) Sales grow by less than 3% in the last three years

C) Still saw their share price rise by 35% or more in the last 12 months

Stock prices are supposed to follow companies’ fundamental sales and earnings results, but for these 20 companies, price and fundamentals have truly diverged. As sales have stagnated and declined, their value has risen.

Admittedly, I’m not showing the earnings piece of the puzzle here, and for some of these companies that is an important piece. Some of these companies went from losing money to making money, which could have led to a pop from a positive surprise. Still, 13 of these 20 companies grew EPS by less than 10% last year, which is still 25% less than the smallest share price increase on the list. Six saw EPS decline.

Also, if some of these stocks bounced because results were less bad than expected, they don’t appear to have been priced with low expectations. This basket of companies isn’t exactly cheap. The average price-to-sales multiple of the group is 2.8x compared to 1.68 for the rest of the S&P 500.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.