Last week’s Thursday’s Unemployment Claims number release has been a real eye-opener for the financial markets. The scheduled economic data releases may show coronavirus crisis impact on the economy. So, markets will likely pay more attention to the releases in the near future. Let’s take a look at the details.

The Week Behind

The economic data releases have been overshadowed by the ongoing coronavirus crisis developments again. But we had one exception – Thursday’s Unemployment Claims number surpassing 3 million! And it was the first data to show the impact of the pandemic on the U.S. economy.

The week ahead

What about the coming week? It is very likely that investors will continue to react to the mentioned virus scare again this week. However, we could also see more evident data showing the virus crisis impact on the economy. Investors will likely await Tuesday’s Consumer Confidence number, then Wednesday’s and Friday’s PMI numbers. We will also have the monthly jobs data release on Friday, preceded by ADP Non-Farm Employment Change number release on Wednesday. The monthly employment data releases may also show the initial pandemic impact on the economy. Let’s take a look at the key highlights:

- On Friday we will get monthly Nonfarm Payrolls along with Unemployment Rate.

- Investors will also wait for Tuesday’s Consumer Confidence, Wednesday’s and Friday’s PMI numbers and Thursday’s Unemployment Claims releases.

- Wednesday’s ADP Non-farm Employment Change will precede the mentioned Friday’s monthly jobs data release.

- Oil traders will await Wednesday’s inventories data release.

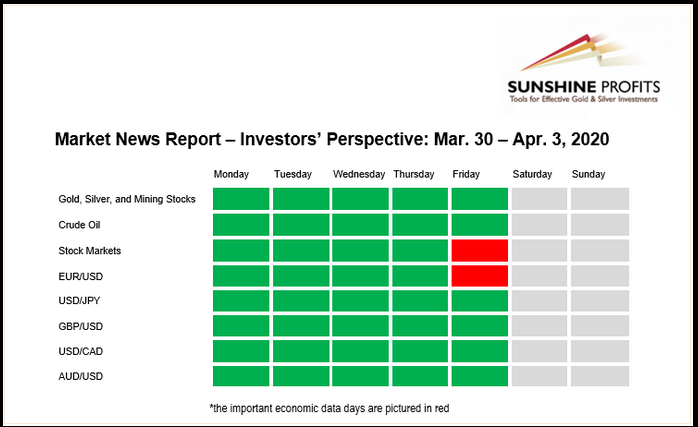

You will find this week’s key news releases below (EST time zone). For your convenience, we broke them down per market to which they are particularly important so that you know what to pay extra attention to if you have or plan to have positions in one of them. Moreover, we put particularly important news in bold. This kind of news is what is more likely to trigger volatile movements. The news that is not in bold usually doesn’t result in bigger intraday moves, so unless one is engaging in a particularly active form of day trading, it might be best to focus on the news that we put in bold. Of course, you are free to use the below indications as you see fit. As far as we are concerned, we are usually not engaging in any day trading during days with “bold” events on a given market. However, in the case of more medium-term trades, we usually choose to be aware of the increased intraday volatility, but not change the currently opened position.

Our Market News Report consists of two different time-related perspectives. The investors’ perspective is only suitable for long-term investments. The single economic data releases rarely cause major outlook changes. Hence, we will only see a handful of bold markings every week. On the other hand, the traders’ perspective is for traders and day-traders, because the assets’ prices are likely to react on a single piece of economic data. So, there will be a lot more bold markings on potentially market-moving news every week.

Investors’ Perspective

Gold, Silver, and Mining Stocks

Tuesday, March 31

- 10:00 a.m. U.S. - CB Consumer Confidence

Wednesday, April 1

- 8:15 a.m. U.S. - ADP (NASDAQ:ADP) Non-Farm Employment Change

- 10:00 a.m. U.S. - ISM Manufacturing PMI

Thursday, April 2

- 8:30 a.m. U.S. - Unemployment Claims

Friday, April 3

- 8:30 a.m. U.S. – Nonfarm Payrolls, Unemployment Rate, Average Hourly Earnings m/m

- 10:00 a.m. U.S. - ISM Non-Manufacturing PMI

Crude Oil

Tuesday, March 31

- 10:00 a.m. U.S. - CB Consumer Confidence

Wednesday, April 1

- 8:15 a.m. U.S. - ADP Non-Farm Employment Change

- 10:00 a.m. U.S. - ISM Manufacturing PMI

- 10:30 a.m. U.S. - Crude Oil Inventories

Thursday, April 2

- 8:30 a.m. U.S. - Unemployment Claims

Friday, April 3

- 8:30 a.m. U.S. – Nonfarm Payrolls, Unemployment Rate, Average Hourly Earnings m/m

- 10:00 a.m. U.S. - ISM Non-Manufacturing PMI

Stock Markets

Monday, March 30

- 9:00 p.m. China - Manufacturing PMI

Tuesday, March 31

- 10:00 a.m. U.S. - CB Consumer Confidence

Wednesday, April 1

- 8:15 a.m. U.S. - ADP Non-Farm Employment Change

- 10:00 a.m. U.S. - ISM Manufacturing PMI

Thursday, April 2

- 8:30 a.m. U.S. - Unemployment Claims

Friday, April 3

- 8:30 a.m. U.S. – Nonfarm Payrolls, Unemployment Rate, Average Hourly Earnings m/m

- 10:00 a.m. U.S. - ISM Non-Manufacturing PMI

EUR/USD

Tuesday, March 31

- 10:00 a.m. U.S. - CB Consumer Confidence

Wednesday, April 1

- 8:15 a.m. U.S. - ADP Non-Farm Employment Change

- 10:00 a.m. U.S. - ISM Manufacturing PMI

Thursday, April 2

- 8:30 a.m. U.S. - Unemployment Claims

Friday, April 3

- 8:30 a.m. U.S. – Nonfarm Payrolls, Unemployment Rate, Average Hourly Earnings m/m

- 10:00 a.m. U.S. - ISM Non-Manufacturing PMI

USD/JPY

Tuesday, March 31

- 10:00 a.m. U.S. - CB Consumer Confidence

Wednesday, April 1

- 8:15 a.m. U.S. - ADP Non-Farm Employment Change

- 10:00 a.m. U.S. - ISM Manufacturing PMI

Friday, April 3

- 8:30 a.m. U.S. – Nonfarm Payrolls, Unemployment Rate, Average Hourly Earnings m/m

- 10:00 a.m. U.S. - ISM Non-Manufacturing PMI

GBP/USD

Wednesday, April 1

- 8:15 a.m. U.S. - ADP Non-Farm Employment Change

- 10:00 a.m. U.S. - ISM Manufacturing PMI

Friday, April 3

- 8:30 a.m. U.S. – Nonfarm Payrolls, Unemployment Rate, Average Hourly Earnings m/m

- 10:00 a.m. U.S. - ISM Non-Manufacturing PMI

USD/CAD

Tuesday, March 31

- 8:30 a.m. Canada - GDP m/m

- 10:00 a.m. U.S. - CB Consumer Confidence

Wednesday, April 1

- 8:15 a.m. U.S. - ADP Non-Farm Employment Change

- 10:00 a.m. U.S. - ISM Manufacturing PMI

Thursday, April 2

- 8:30 a.m. U.S. - Unemployment Claims

Friday, April 3

- 8:30 a.m. U.S. – Nonfarm Payrolls, Unemployment Rate, Average Hourly Earnings m/m

- 10:00 a.m. U.S. - ISM Non-Manufacturing PMI

AUD/USD

Wednesday, April 1

- 8:15 a.m. U.S. - ADP Non-Farm Employment Change

- 10:00 a.m. U.S. - ISM Manufacturing PMI

Friday, April 3

- 8:30 a.m. U.S. – Nonfarm Payrolls, Unemployment Rate, Average Hourly Earnings m/m

- 10:00 a.m. U.S. - ISM Non-Manufacturing PMI

Summing up, the financial markets will likely continue to react to scary news about globally spreading coronavirus in the coming week. The scheduled economic data releases seem less important than monetary policy updates or news about governments’ interventions recently. However, if you’re an investor and not a trader, you should pay extra attention to Friday’s U.S. monthly jobs data release. This week’s PMI numbers, Consumer Confidence, and Unemployment Claims releases may show the virus's impact on the economy.