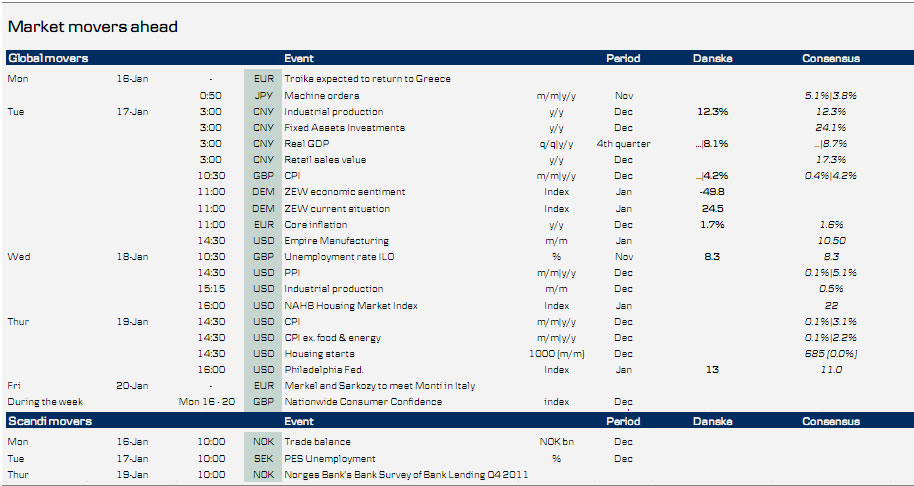

• In the US regional business surveys in terms of the Empire index and Philadelphia Fed survey should show further improvement. The Philadelphia Fed survey rose to 10.3 in December from 3.6 in November and we expect it to rise further to 13 in January. Inflation data is expected to show a decline in the annual inflation rate to 3.1% from 3.4% whereas core inflation should be unchanged at 2.2% y/y and rise 0.1% m/m. Next week also offers a batch of housing data in terms of housing starts and NAHB housing market index. Both have shown improvements in recent months, pointing to a bottoming in housing. We expect this picture to be confirmed in the coming week’s data as well. PPI and industrial production will also be released.

In a week with few important releases in the euro area, attention could centre on the negotiations in Greece. Representatives from the Greek government and the private sector are negotiating the size of the voluntary haircut (PSI). The main disputes remain what the new interest rates should be, whether the new bonds should be issued under Greek or UK law, and whether there should also be a haircut on some of the official money – for instance the ECB’s holdings. At the European Council meeting on 26 October, it was announced that the haircut in the private sector involvement (PSI) would probably be 50%. The Greek commercial banks will have to endure big losses, which (according to EBA) imply that these banks will need a recapitalisation amounting to EUR30bn, which will have to be financed through the EFSF.

The Troika is expected to return to Greece in the coming week, and will follow the PSI negotiations and continue the preparation of the second bailout package for Greece.

On the data front, we expect euro area core inflation to increase to 1.7% in December from 1.6% in November. Furthermore, ZEW could attract attention. This figure tends to be very sensitive to market sentiment so a decent improvement seems likely.

At the end of the week Merkel, Sarkozy and Monti are set to meet in Italy to continue their discussion ahead of the EU Summit at the end of the month.

The annual UK inflation rate is set to come down rapidly even though prices actually moved slightly higher in December. The lower inflation rate will mean households will not see spending possibilities eroded by higher prices which could lead to higher consumption. More positive consumer sentiment must be expected and it can also have a positive spill-over to other markets. The Bank of England is well aware of the lower price growth and probably welcomes the lower CPI prints, closer to the inflation target. We see inflation declining from 4.8% in November to 4.2% in December. Unemployment remains on a rising trend but we do not see the overall jobless rate going higher in December.

In China, Q4 11 GDP growth is due to be released Tuesday next week. In Q4 we expect GDP growth to have eased substantially from 9.1% y/y to 8.1% y/y.

Sequentially, we expect GDP to have increased 7% q/q AR, which is largely unchanged growth compared to the previous two quarters. Q4 will be the third quarter in row with GDP growth below trend. Industrial production, retail sales and fixed asset investment for December will also be released on Tuesday. In line with consensus, we expect growth in industrial production to ease slightly to 12.3% y/y from 12.4% y/y in the previous month. Seasonally adjusted, this is equivalent to a 0.7% m/m increase in industrial production, suggesting that growth in industrial production has stabilised but remains slightly below trend. With inflation continuing to ease, we believe it is highly likely that the People’s Bank of China will cut the reserve requirement by another 50bp next week.

The presidential election in Taiwan on 14 January could get some attention in the market because it could have considerable political implications beyond Taiwan. Political tensions between Taiwan and China have eased considerably since Ma Yingjeou became Taiwan’s president in 2008, because Ma (unlike the previous DPP-led government) has not attempted to challenge the political status quo but has instead focused on improving the economic co-operation with China. Ma is slightly ahead in the polls, but should he lose the presidential election it would not just increase tension between Taiwan and China but could also poison the relationship between China and the US.

There is a relatively light calendar in Japan next week. Most interesting will be domestic machinery orders, which we expect to have recovered in November

following a sharp decline in October.

Scandi

No significant data on the agenda in Denmark in the coming week.

• Very slow week ahead in Sweden. In terms of data, the only thing of interest (and only marginally so) is the labour market board’s unemployment rate (Tuesday, 08:00 CET). In itself that is not what we find most interesting in the report, but rather the pace of lay-offs which have picked up steam over the past month(s). Will that negative trend continue?

Two releases in the coming week will shed new light on how the European debt crisis is affecting Norway. First,Norges Bank’s bank lending survey will reveal how growing funding problems for Norwegian banks are affecting credit policies. We expect it to show that banks are tightening their policies, partly through growing credit margins,but far more moderately than in autumn 2008, and we do not expect the data to signal a full-blown credit squeeze. Second, the week brings figures for foreign trade in December. In light of the steep fall in the index for export orders in the PMI during Q4, it will be interesting to see whether this materialises as a sharp drop in traditional exports towards the end of the year. Even a moderate decrease would eliminate some of the downside risk to the Norwegian economy signalled by the PMI.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Market Movers Ahead

Published 01/13/2012, 11:32 AM

Updated 05/14/2017, 06:45 AM

Market Movers Ahead

Global

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.