Stock Markets will likely rise Tuesday in a “dead cat bounce” fashion

US stock markets will likely rise on Tuesday in a dead cat bounce, due to technical indicators and a temporary stall in debt ceiling discussions. Stock markets yesterday finished in the red, with the S&P 500 (SPY) losing .85%, the Dow Jones Industrial Average (DIA) losing .90%, and the NASDAQ 100 (QQQ) losing -.98%.

US Congressional leaders continued their impasse yesterday, with some GOP lawmakers calling a US default “not a big deal.” Regardless of what anyone thinks will happen if the United States defaults, we are likely some time away from any compromise between both political parties. The current government shutdown in Washington DC has almost become the new normal, with the debt ceiling deadline still long enough away to mitigate any investor anxiety for now, which is why I predict a “dead cat bounce” for US stock markets tomorrow.

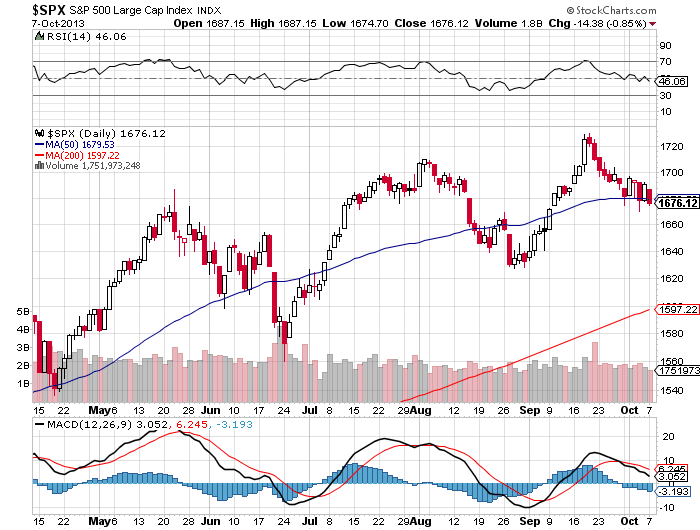

The technical perspective for the S&P 500 (SPY) suggests a dead cat bounce and up market for Tuesday as well, considering that the index just barely broke through its 50 day moving average, a strong level of support. The S&P 500 just barely broke through the 50 day moving average floor last week, but continued to move sideways. Although the S&P 500′s MACD is still very negative (-3.193), the RSI has dipped below the neutral 50 mark (46.06), suggesting that markets are in a short term over sold situation, but in a long term down trend overall. Since a debt ceiling solution is likely out of sight for Tuesday and investors appear to be “content” with the “as-is” situation, I think the S&P 500 and major indexes will bounce tomorrow into the green:

Internationally, European markets finished in the red, albeit by only two or three tenths for major indexes. Asian markets are a mixed bag, with the Hang Seng closed for the day and the Nikkei flat at the time of this writing. So, the world too appears to be watching only to see what happens next in Washington.

Futures markets appear to have the same neutral sentiment, with major futures markets trading on the red side of flat at the time of this writing.

Our infamous fear indicator had a monster day yesterday, with the VIX Index rising into the green by 15.95%. The VIX Index is the master of huge volatility, huge swings, and huge corrections, so I would not be surprised if the VIX tanks itself tomorrow in a corrective manner, which would further indicate a slight rise in equity markets tomorrow, since the VIX usually trades opposite of equity markets.

Tuesday also brings us the NFIB Small Business Index Report, the trade deficit report, and the job openings report, although we will likely see only the NFIB report because of the shutdown. The NFIB report will likely have little impact on markets, as all investors will likely be watching Capitol Hill for any next move regarding the debt ceiling debate and the government shutdown, as Congress and its decisions (or lack therof) are clearly driving market moves right now.

Lastly, our fun fact of the day is the confirmation that billionaire Warren Buffet has made over $10 billion since the onset of the Great Recession, as Buffet invested in many floundering companies and which in turn brought these companies “back to life.” Danger always arrives with Opportunity hand in hand.

Bottom Line: I predict a “dead cat bounce” tomorrow for major stock markets, due to continued gridlock in Congress and the proximity of the 50 day moving average for the S&P 500. If a miracle or a disaster occurs tomorrow in Congress, the stock markets will likely react in full.

Disclaimer: The content included herein is for educational and informational purposes only, and readers agree to Wall Street Sector Selector's Disclaimer, Terms of Use, and Privacy Policy before accessing or using this or any other publication by Wall Street Sector Selector or Ridgeline Media Group, LLC.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Market Likely To Rise On Technical Indicators, Halt In Debt Discussions

Published 10/08/2013, 08:35 AM

Market Likely To Rise On Technical Indicators, Halt In Debt Discussions

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.