If you bought Bio-Tech ETF IBB last summer, you've been none too pleased. That's because between July 2015 and June 2016, IBB had lost over a third of its value.

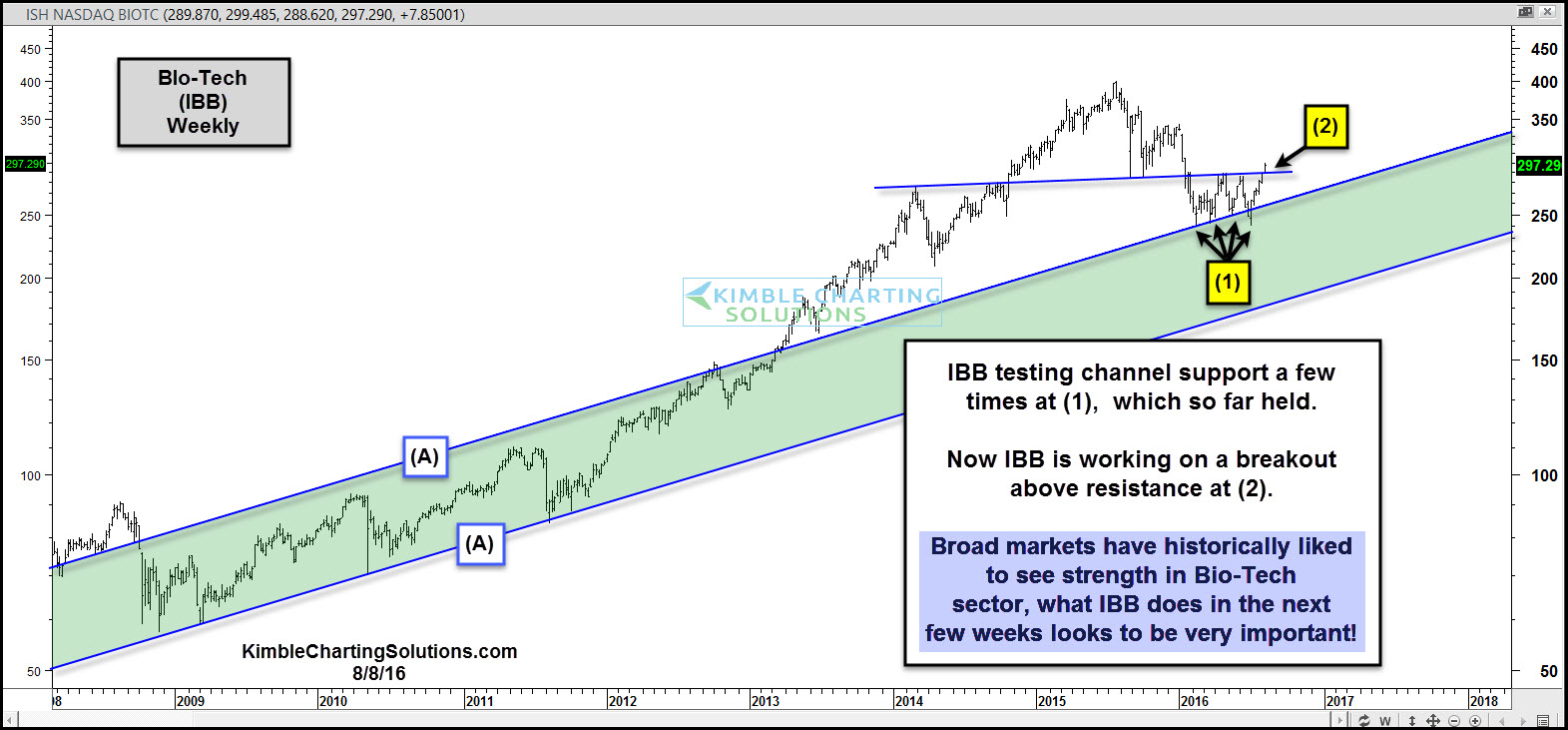

During the past 9 years, IBB has been inside rising channel (A), until it managed to break out in 2013 when it embarked on a 2-year rally. It peaked last July, when it came back down to test old channel resistance as new support at (1) several different times.

So far, rising channel support (A) has held.

Now IBB is trying a break out at (2) above. Further price appreciation at (2) will be good news for both IBB and the broader market.

What IBB does in the next few weeks -- can it breakout? -- should tell us a good deal about this leader. If it continues higher, it will send a positive price message to the risk-on trade.

It'll be important for IBB to stay above the top channel line (A) going forward.