Monitoring purposes SPX; Sold long 2/11/14 at 1819.75 = gain 3.9%; Long SPX at 1751.64 on 2/5/14.

Monitoring purposes Gold: Gold ETF GLD long at 173.59 on 9/21/11.

Long Term Trend monitor purposes: Flat

We have "800" phone update that cost $2.00 a min. and billed to a credit card. Call (1-970-224-4441) for sign up. We update Eastern time at 9:45 and 4:10. Question? Call (402) 486-0362. Ord-Volume software available for $499 to Ord Oracle report subscribers.

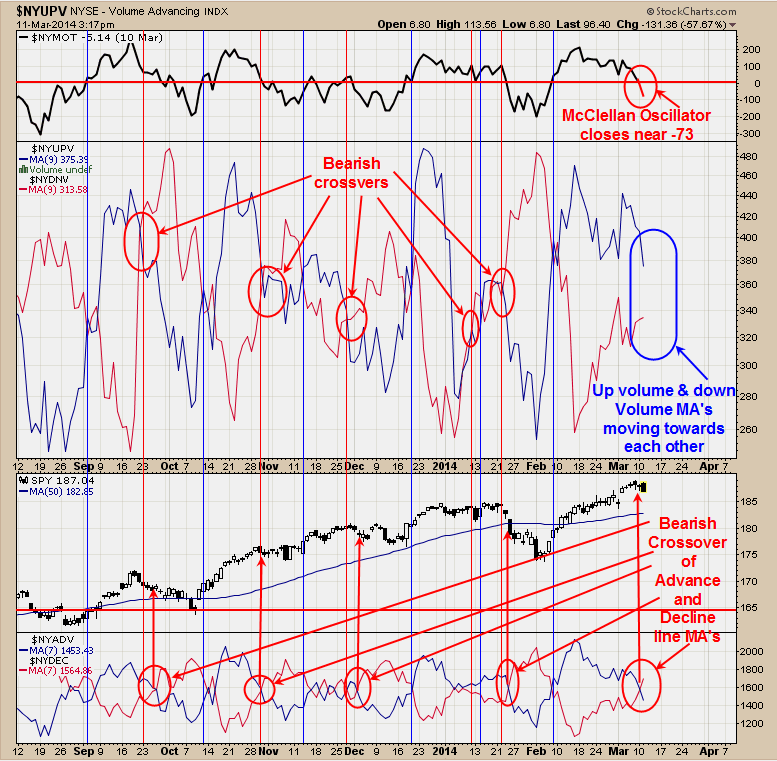

The chart above looks at the internals of the market to see if its getting stronger or weaker. The top window is the NYSE McClellan Oscillator. Readings below the “0” line (current reading is near -73) implies the market is in a downtrend. Next window down is the Up volume with 9 period moving average and down Volume with 9 period moving average. Bullish and bearish crossover occur when the up volume and down volume moving average cross. Currently these two moving average haven’t crossed but there are heading towards each other for a potential bearish crossover. Bottom window is the Advancing issues with 7 period moving average and declining issues with 7 period moving average. These two moving average are on a bearish crossover. Still expecting a pull back.

Downside on the SPY may find support at the Gap level of March 4 near 186. The gap low on March 4 came in at 186.75 and today’s low was 186.80 and the gap was not touched. However, if the SPY does push into the gap range below 186.75 ( which is expected) and volume is at least 10% lighter than the gap volume day of 169.6 million, than the gap area should hold as support for the SPY. Another bullish development appeared today in the TRIN and Tick closes. When the TRIN closes above 1.50 (today’s close came in at 1.24) the Ticks close below -300 (tick closed today at -418) a bottom normally forms in the SPY the same days of the readings to last late as two days later (which would be Thursday). The TRIN did not quite reach the bullish level of 1.50 today but it can give a warning that a bottom in the SPY is not far off. I might also state that some times right after a top in the SPY the TRIN and TICKS will expand near bullish levels and still head lower over the next several weeks. The way to tell of which condition will happen is wait to see what the market does over the next two days and see if more bullish or bearish reading develop. Its starting to appear the market is not heading down to the March 3 low near 184 but find support higher. Most signal develop during option expiration week which is next week. Sold our SPX on 2/11/14 for 3.9% gain.

The early to mid February rally Gold produce a “Sign of Strength” (SOS) days and a longer term bullish sign for GDX. This “Sign of Strength” rally also produced a Candlestick pattern called “Three Gap Play” which predicts a pull back to where the first gap formed which is near the 24 area on GDX. The 24 region on GDX is also where the Neckline of a Head and Shoulders bottom lies and is also a support area. Over the last month the GDX/GLD ratio has been making lower lows as GDX has been making higher lows and a bearish divergence and a bearish sign GDX short term. We have drawn a blue support line connecting the lows on GDX over the last month. This blue trend line should be broken with a “Sign of weakness” (SOW) to confirm a pull back to the 24 region on GDX. Today’s volume did pick up today pushing towards the blue support line and could mean the support line will be broken. Still neutral for now.

Long GDX at 23.65 on 2/7/14; sold 2/13/14 at 25.44 = 7.6%. Long GDX at 21.83 (1/7/14) sold 1/24/14 at 23.90, gain 9.5%. Long NG at 5.14 on 10/8/12. Long GDX 58.65 on 12/6/11. Long GDXJ average 29.75 on 4/27/12. Long GLD at 173.59 on 9/21/11. Long BRD at 1.67 on 8/3/11. Long YNGFF .44 on 7/6/11. Long EGI at 2.16, on 6/30/11. Long GLD at 147.14 on 6/29/11; stop 170 hit = gain 15.5%. Long LODE at 2.85 on 1/21/11. Long UEXCF at 2.07 on 1/5/11. We will hold as our core position in AUQ, CDE and KGC because in the longer term view these issues will head much higher. Holding CDE (average long at 27.7.Long cryxf at 1.82 on 2/5/08.KGC long at 6.07. Long AUQ average of 8.25.

Signals are provided as general information only and are not investment recommendations. You are responsible for your own investment decisions. Past performance does not guarantee future performance. Opinions are based on historical research and data believed reliable, there is no guarantee results will be profitable. Not responsible for errors or omissions. I may invest in the vehicles mentioned . Copyright 1996-2014. To unsubscribe email to tim@ord-oracle.com.