Asia Roundup:

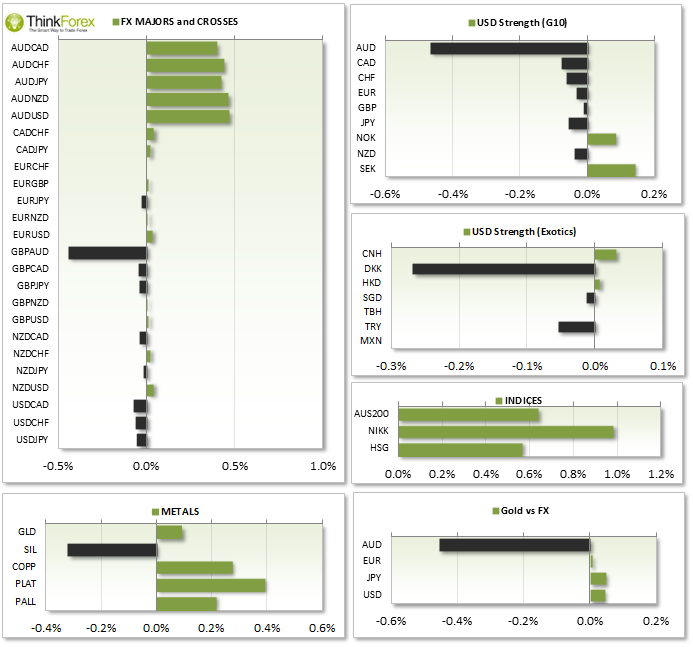

Had it not been for AUD strength then Asia would have witnessed a very narrow ranged day.

- AUD saw positive employment figures with unemployment down steady at -5.8% vs -5.9% expected and job creation up 14.2k vs 9k expected. Aussie rallied 42 pip following the positive data.

- Chinese Trade balance soon followed to see imports and exports beat forecasts at 0.8% vs -3.2% expected and 0.9% vs -3.5% expected. Iron Ore imports also exceeded expectations to see A$ trade back to the Monthly highs.

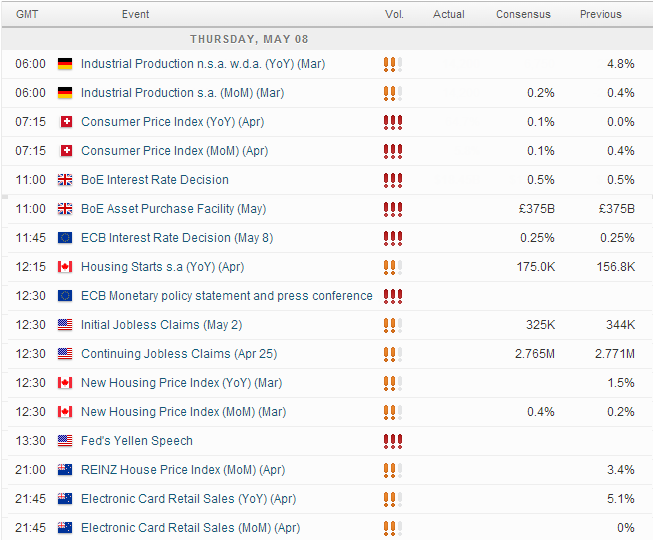

Upcoming Events:

- Tonight's ECB monetary policy meeting will attract a lot of attention and no doubt bring the usual volatility to EURUSD as the market awits clues on ECB stimulus. Interest rates expected to remain at 0.25% for EUR and 0.5% for UK

- CAD New housing is viewed as a leading indicator of economic health and released alongside US Employment data. A par to monitor for those who like volatility would be USDCAD but mixed results usually end with confused, whipsawing price action. So one scenario that would be desirable is higher new home sales for CAD and bad employment figures for US which would fit in with the near-term bearish technicals on USDCAD

Technical Analysis:

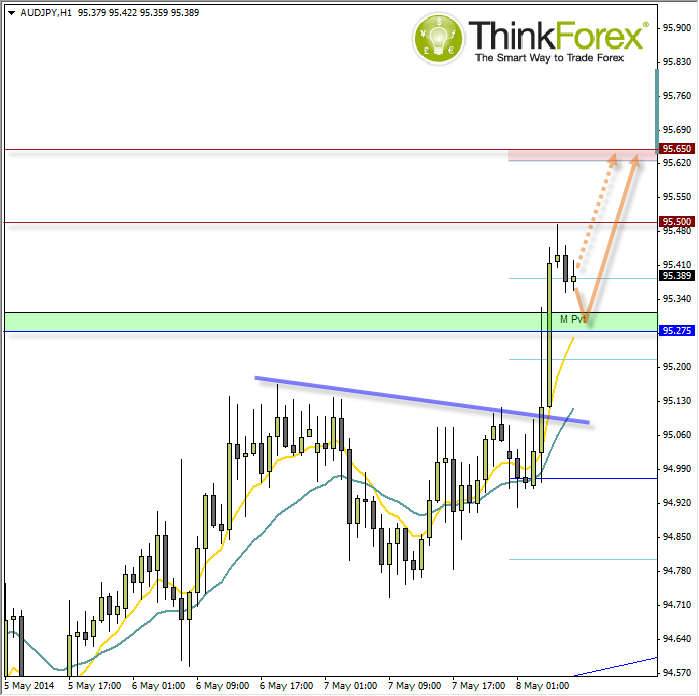

AUD/JPY: Above 95.20 targets 95.65

I am curious to see if the positive sentiment carries over into London and New York open. Now trading above the range of the past 2 weeks and above the monthly pivot I seeking any trend continuation patterns to target 95 and 95.65.

The breakout was aggressive and holding into recent gains so there is a chance we may witness another bullish breakout after London open.

Failing that a pullback to the Monthly pivot would also be welcomes as we can expect better support around this level.

Overall, I suspect we have seen a pivotal swing low on D1 and I have raised my target to 97.00.

Gold: Below $1300 targets $1280 lows

After yesterday's bearish engulfing candle I suspect any pullbacks to be limited. I am seeking bearish setups below $1297-$1300, and whilst Gold could break either way out of the consolidation pattern it does have a tendency to produce a volatile spike, before travelling the more obvious route.

Therefore, a suspect a whipsaw move towards $1297 before a resumption of a downtrend, which would be suited to a sell-limit order. A break above $1300 invalidates the near-term analysis and risks recycling back up to $1307 and $1315.