Forex News and Events

Euro zone finance ministers meet in Riga

The hot topic this morning is the meeting between Euro zone finance ministers and Greece in Riga, during which Greece should present a package reforms that would help access more funding from the European Institutions. Greece government 5-year yields have rallied above 20% illustrating the market’s impatience with Greece. The rise of Spanish and Italian rates last week set the stage for a contagion into the European bond markets. However, the pressure weakened during the week as the Spanish 5-year returned below 0.60% at 0.58% while its Spanish counterpart stabilised at 0.56%. On the negotiation side, the situation didn’t improve much lately as the Tsipras’ government tries not to break its election promises, while European institutions are not ready to bow down as well. However, we do not expect much from today’s meeting as several finance ministers already lowered their expectations for a positive outcome. We will find out today if the Greek government is willing to agree on a “mutual beneficial” deal with the Institutions.

Is India the new China?

As discussed previously (see Weekly Report from last week), China's economy is growing at a slower pace, 7%y/y during the first quarter, as the second-biggest economy is facing major challenges like overcapacity of the economy, debt burden or the reorganization of its economy toward slower but sustainable growth. Investors are therefore wondering where to find some above-average long-term growth opportunities. The answer may be India. The Indian economy grew 7.5%y/y (according to the new Market-Price Calculation) during Q4 2014 while China's GDP came in at 7.3%y/y. Regarding Q1 2015, Chinese economy grew 7% while the Indian one is expected to have expanded by 7.4%.

Nevertheless, India must also deal with its own challenges to pave the way toward a solid, long-term growth. In February the government announced its intention to implement major structural reforms to put the country back on track. The package proposed by the government aimed to rationalize a capricious tax system feared by many foreign investors, to prioritize investments in infrastructure or to declare war on tax evasion. Despite these welcomed news, the government has to move from words to actions. As a good start, the government and the RBI reached a historical agreement by introducing inflation targeting monetary policy, aiming first to bring inflation below 6% by January 2016, then to set the target to 4% with a tolerance band of +/-2%.

Raghuram Rajan, the Reserve Bank of India governor, already lowered twice its policy interest rate (repo rate) by 25bps down to 7.5% during two unscheduled meetings (February and March). The governor is taking advantage of low inflationary pressure (5.11%y/y in January, 5.19% in February and 5.17% in March) and still has room to lower rates further. Mr. Rajan didn't cut rate on April 7, waiting on banks to transmit those rates cuts to the real economy as the base rate is still at 10%y/y. However, India has to take into account monetary policy of other countries as currency war rages across the globe. The Fed will certainly postpone the first rate hike later this year, we expect the RBA to cut rates in May while China just cut its RRR to 18.5% and is ready to ease further its monetary policy. We believe that the RBI is prone to cut rates as it wrote in its First Bi-monthly Monetary Policy Statement (released on April 7): 'Going forward, the accommodative stance of monetary policy will be maintained, but monetary policy action will be conditioned by incoming data'.

We therefore think that the RBI still has room to act and we expect the central bank to lower its repo rate by at least 25bps to 7.25% in its next policy meeting on June 2. However, the RBI may trigger a rate cut during an unscheduled meeting if inflation remains subdued.

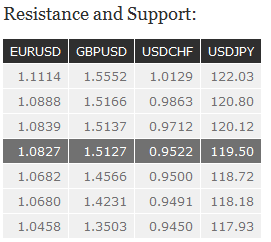

The Risk Today

EUR/USD is moving broadly sideways since the second half of March. The successful test of the hourly support at 1.0660 and the subsequent break of the hourly resistance at 1.0849 (17/04/2015 high) indicate an improving short-term technical configuration. The hourly resistance at 1.0888 is challenged. A key resistance stands at 1.1043. An hourly support can be found at 1.0785 (intraday low). In the longer term, the symmetrical triangle favours further weakness towards parity. As a result, we view the recent sideways moves as a pause in an underlying declining trend. A strong resistance stands at 1.1114 (05/03/2015 low). Key supports can be found at 1.0504 (21/03/2003 low) and 1.0000 (psychological support).

GBP/USD continues to rise and is now challenging the key resistance area between 1.5137 (09/03/2015 high) and 1.5166 (see also the declining trendline). Hourly supports can be found at 1.4960 (23/04/2015 low) and 1.4857 (21/04/2015 low). In the longer-term, the break of the strong support at 1.4814 opens the way for further medium-term weakness towards the strong support at 1.4231 (20/05/2010 low). A break of the key resistance at 1.5166 (18/03/2015 high) is needed to invalidate this scenario. Another key resistance stands at 1.5552 (26/02/2015 high).

USD/JPY has broken the hourly support at 119.35 (22/04/2015 low), indicating persistent selling pressures. Monitor the test of the hourly support at 119.17 (21/04/2015 low). Another support stands at 118.53. Hourly resistances are given by 120.12 and the declining trendline (around 120.42). A long-term bullish bias is favoured as long as the strong support at 115.57 (16/12/2014 low) holds. A gradual rise towards the major resistance at 124.14 (22/06/2007 high) is favoured. A key support can be found at 118.18 (16/02/2015 low), whereas a key resistance stands at 121.85 (see also the long-term declining channel).

USD/CHF bounced sharply on Wednesday only to erase all these gains yesterday. Prices are once again challenging the key support area between 0.9491 and 0.9450 (see also the 38.2% retracement). Hourly resistances can now be found at 0.9628 (intraday low) and 0.9712. In the longer-term, the bullish momentum in USD/CHF has resumed after the decline linked to the removal of the EUR/CHF floor. A test of the strong resistance at 1.0240 is likely. As a result, the current weakness is seen as a countertrend move. Key supports can be found at 0.9450 (26/02/2015 low, see also the 200-day moving average) and 0.9170 (30/01/2015 low).