Jim Bianco at Bianco Research makes a case for an emergency rate cut and a recession.

Emergency Rate Cut Expected

Please consider the Market is Expecting The Fed to Cut 50 Basis Points Tomorrow Morning

Since January 2001, all inter-meeting Fed moves come between 60 to 30 minutes before the NYSE open. So the market is expecting it tomorrow morning.

Why is the market expecting a 50 bps cut tomorrow? It will be starting a rate-cutting campaign that will take the funds rate under 50 bps by the end of the year (see December 2020 futures above).

Our guess is this market is expecting thousands of positive infection cases in the US over the next month, leading to huge disruptions. Think tens of millions idled from work, school kids home for weeks, if not the rest of the school year.

So, it is penciling in a plunge in Q2 GDP to well into negative territory. It is also possible that March inflections and disruption push Q1 GDP negatively as well.

This market action says it believes a recession is about to begin.

Australia Too

2001 Flashback

Fed minutes show that Greenspan saw it way too late. His fear in 2000 was of overheating.

Important Note

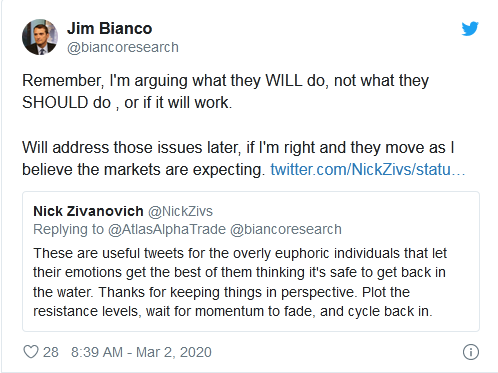

Bianco's call is on what the market expects, not what he expects or would do.

I agree with Bianco's recession observation and the coronavirus disruptions.

We find out Monday morning about emergency cuts but two weeks won't make much of a difference.

A recession is baked in the cake.