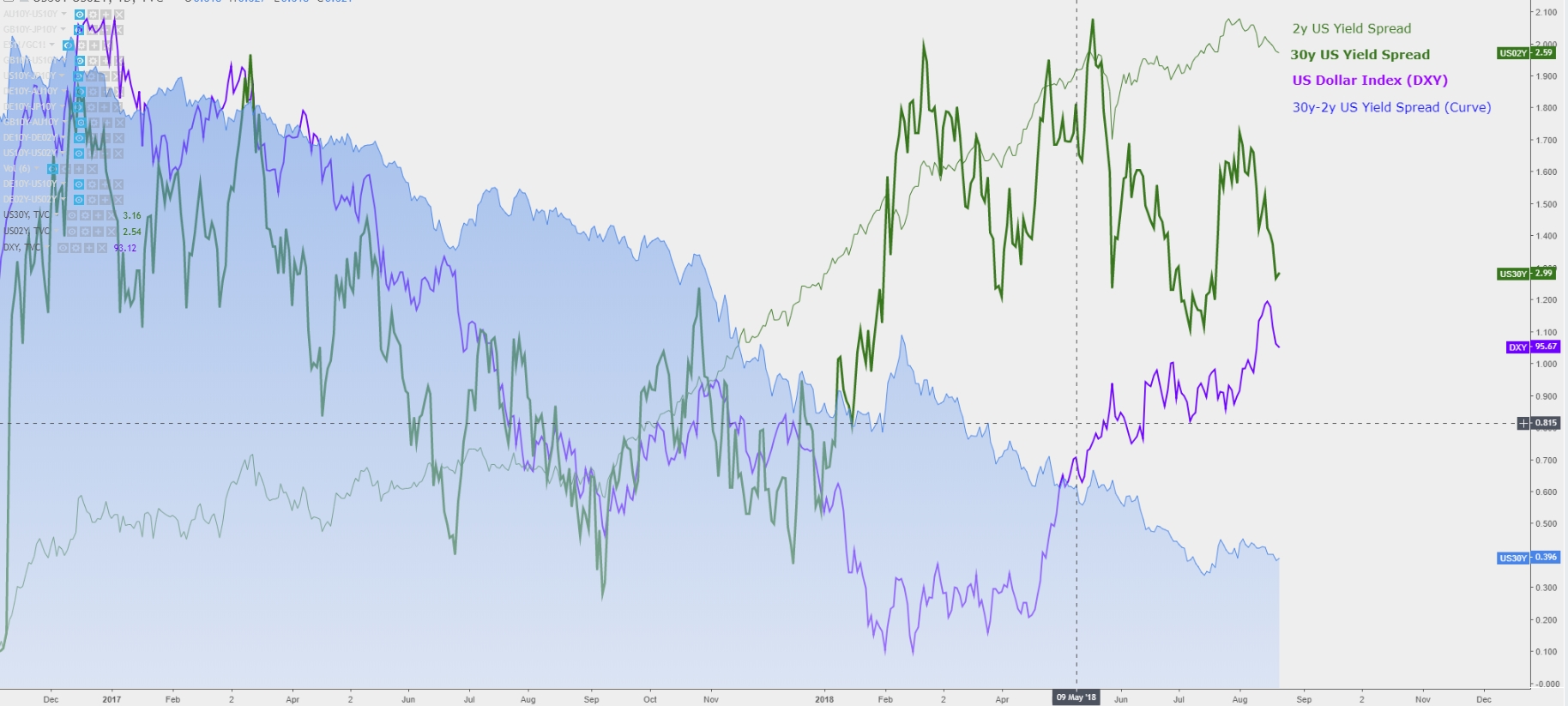

Monday leaves behind different market dynamics than the ones we’ve been used to in recent times with moves entirely dominated by broad-based US Dollar, driven by a double whammy of Atlanta Federal Reserve Bank President Raphael Bostic not sounding as optimistic about an aggressive tightening campaign (sees one more rate hike this year vs the growing assumption for two in 2018), while Bostic also expressed concerns about the flattening of the US yield curve, which might raise the chances of a potential recession.

Adding fuel to the fire was US President Trump, who at a fundraiser event at the Hamptons on Friday, was reportedly disagreeing with the Fed’s current course of action to tighten up policy via the increase of interest rates. Trump continues to put his nose into Fed’s matters, and one cannot help but anticipate that it may only backfire as the Fed is undeniably an independent entity and will be undeterred and even firm up its course as they see most suitable for the interest of the US economy. Trump also shared, according to unnamed sources, a familiar line about China and European manipulating its respective currencies.

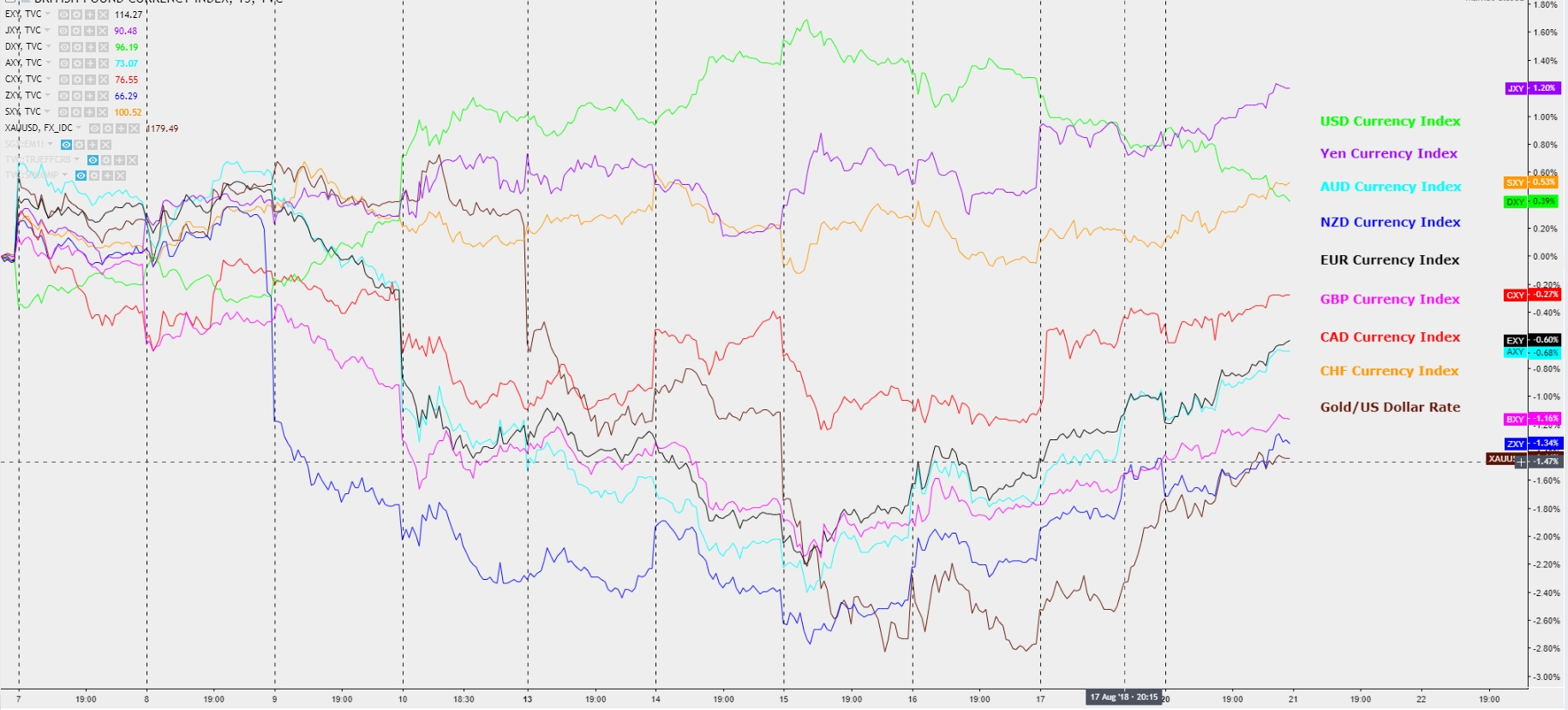

After all said and done, the Swiss Franc and the Japanese Yen were the main beneficiaries, closely followed by the Euro, the British Pound, and the Aussie. The Canadian Dollar and the Kiwi failed to gain much traction even on a broadly lower USD. It’s worth noting that the fact that ‘risk-off’-centric currencies were the top performers on Monday still depicts a rather gloomy backdrop, and tells us that the recovery in the Euro, Sterling or Aussie can be explained as a story of ‘demerits’ by the USD.

FX performance: CHF and JPY climb the most, DXY suffers

An interesting snippet of information was reported on Monday, which falls in line with the growing concerns by Fed’s Bostic over a flattening US yield curve. According to a business survey by NABA on over 250 business economists, an overwhelming 91% of respondents answered that tariffs are unfavorable for US growth while exhibiting major concerns that the effects of the tax cuts are expected to fade by 2019.

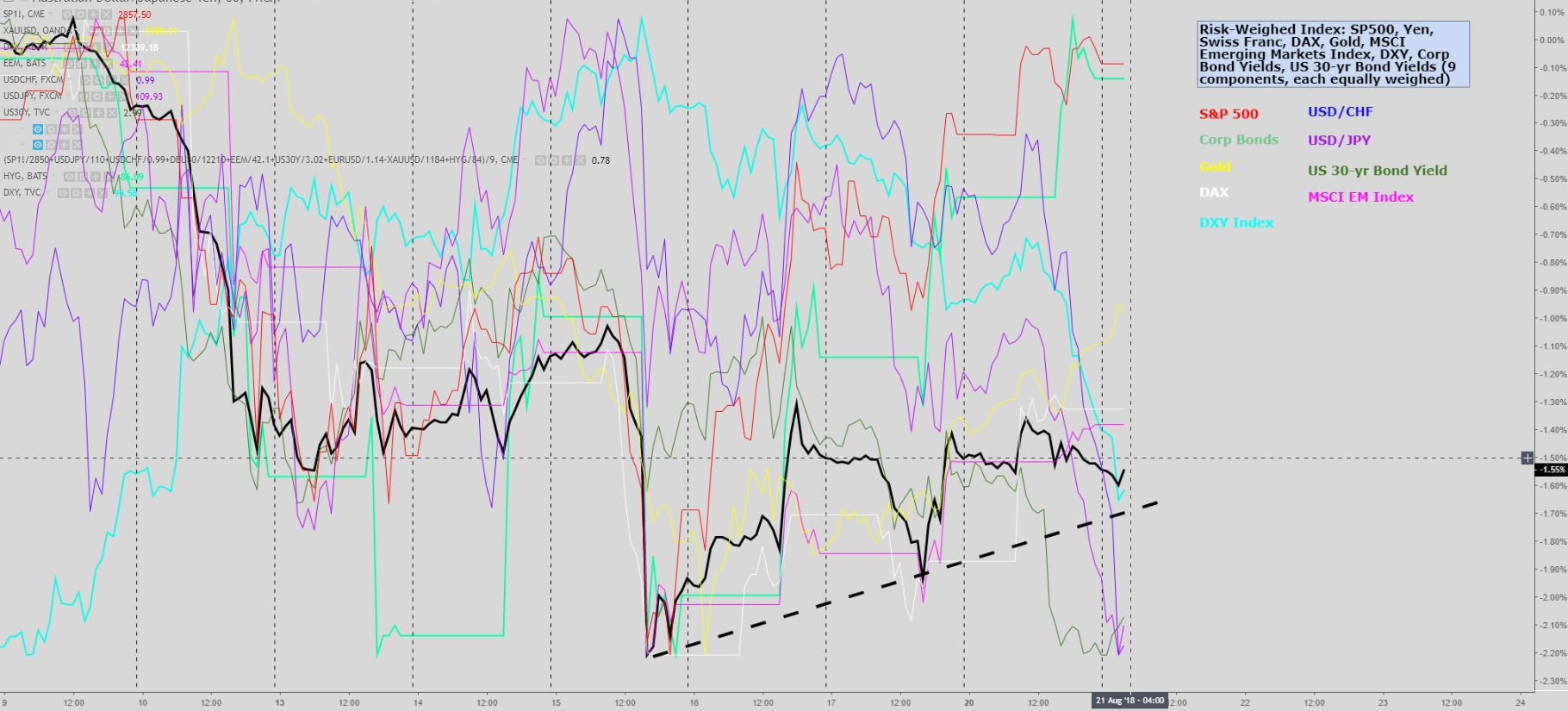

Unpacking Monday’s risk profile, we continue to see equities in the US marching to the beat of its own drum, tracking the recovery in European and EM shares, including China. Meanwhile, pushed by a lower USD, gold is also making headways. However, capping the potential fortitude of the ongoing ‘risk-on’ leg is the obvious outperformance of the Swiss Franc and the Yen, which raises a red flag and is being reflected in the risk-weighted index (black line), which should be interpreted as a barometer of risk conditions.

Risk-weighted index: Fails to make higher highs on Aug 20

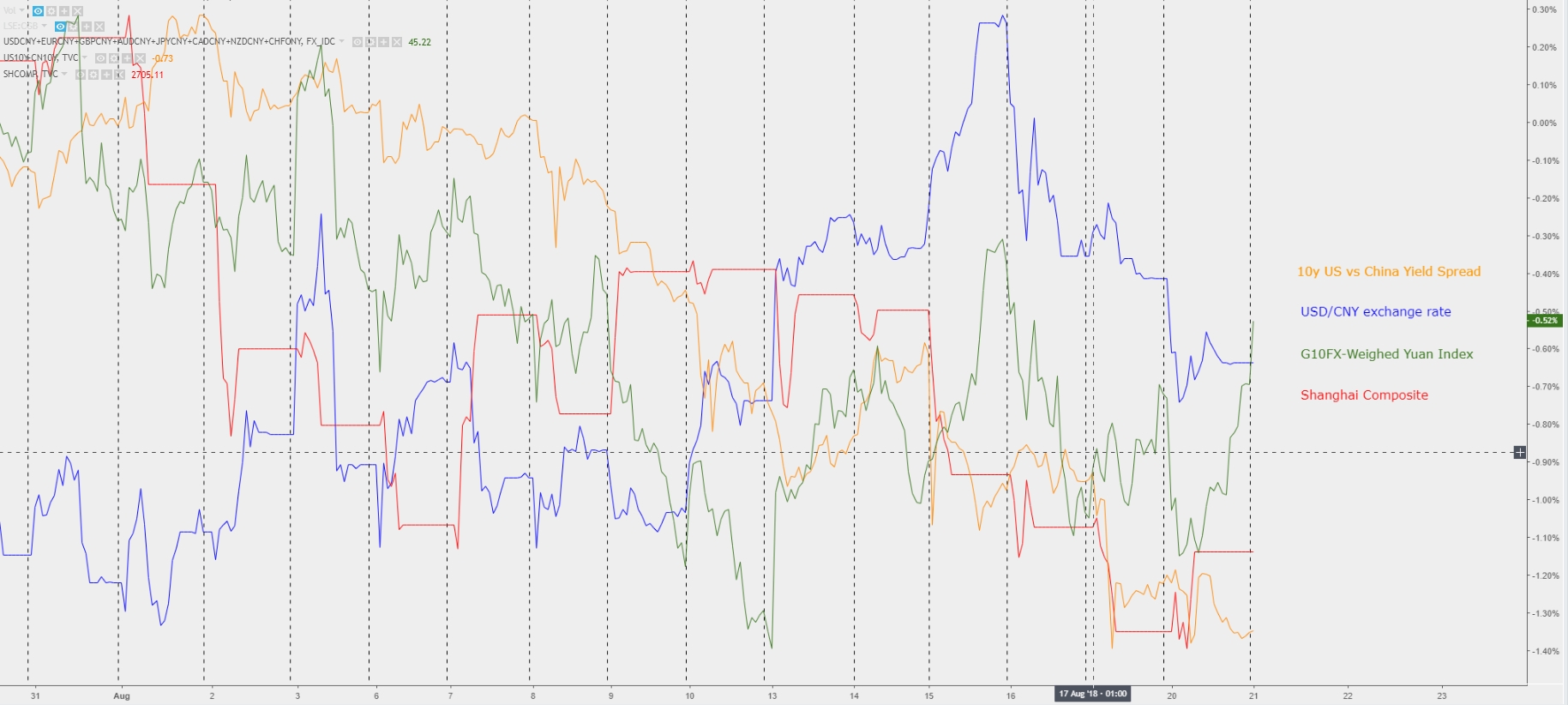

The Yuan strengthens vs USD, not against the basket of G10 FX

One of the key events to watch out for this week will be the low-level trade talks between the US and China as tariffs bite. The Wall Street Journal had reported that the talks will be on Aug 22 and 23. However, Trump has already thrown cold water by noting that he doesn’t anticipate much coming from China trade talks this week. The same day, the focus will also stay in the FOMC minutes while later on the week, Fed Chair Powell will speak on ‘Monetary Policy in a Changing Economy’ at the Kansas City’s annual symposium at Jackson Hole on Friday, August 24, with consensus agreeing that no substantive policy announcements are expected.

Note that the proximity of key technical levels to engage on USD buy-side business in line with the underlying bullish trend, combined with an unequivocal USD positive CoT report, a risk-off environment that is far from over (CHF, JPY still outperforming) and Trump playing down any short-term glimmers of hopes to disentangle the current trade disputes between the US and China, are enough indications to keep the US Dollar ruling the G10 FX, with the permission of the Swiss Franc and the Japanese Yen.