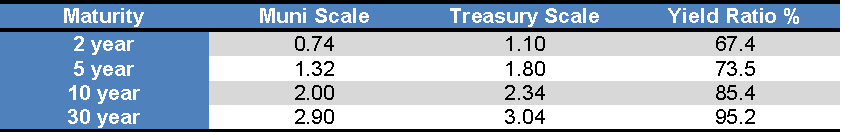

| The municipal market is now a much better relative-value buy than it was at the close of 2015.

There was a decent drop in muni supply relative to last year. In the first half of 2015 we were in the middle of a supply glut due to the surge in refinancings. Refinancings have slowed down since then. In addition, the demand side picked up in the first quarter of 2016. There was the normal, year-end rollover demand from maturing bonds, called bonds, and coupon payments. However, the equity markets’ extreme volatility at the start of 2016 resulted in some asset reallocation into the bond market, also experienced by municipal bonds. The first six weeks of 2016 saw a rapid fall-off in tax-free yields before they turned up some this month.

The same forces pushed US Treasury yields down even further. Quantitative easing by both the European Central Bank and the Bank of Japan brought negative interest rates on the short end into the picture. We believe the tactics of these central banks helped pull Treasury yields to lower levels than would be in place if these forces were not at work. The drop in the price, from nearly $40 per barrel to below $30, also exerted downward pressure on Treasury yields.

So where do we go from here?

At Cumberland Advisors, we continue to emphasize a barbell approach to the markets, with concentrations of shorter and longer maturities. The AAA Bloomberg scale printed above does not reflect most deals that come to market at yields that are significantly higher than this scale. Still, there have been a number of issues that have come to market with AA ratings or higher and yields of 4%. This is a Muni/Treasury yield ratio of nearly 150%, and we are still embracing this mismatch.

As discussed in previous Cumberland Advisors commentaries, this type of yield is defensive because of the ratio, even though it is usually at least a 30-year maturity. As we eventually head back to the normalcy of a Federal Reserve hiking cycle (granted this hike cycle will be slower – maybe much slower – than past cycles), we believe the Muni market will return to longer-maturity yield ratios below 100%.

Take into account a top Federal marginal tax rate of 39.6% and the Obamacare tax of 3.8%. At those rates, a 4% tax-free yield is over 7% taxable equivalent, and even more if state taxes are taken into account.

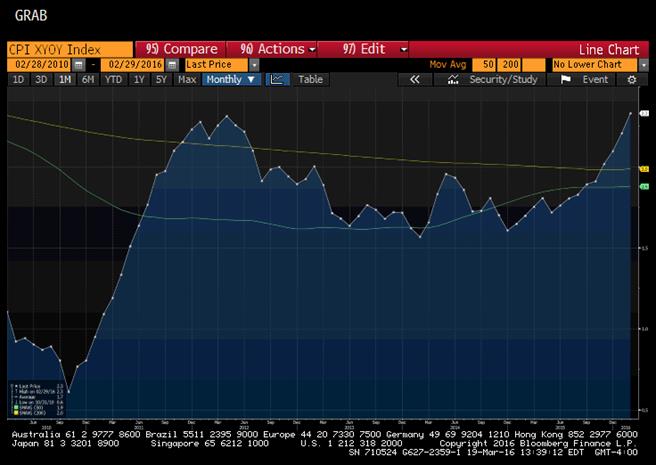

We are a bit more concerned about inflation, going forward, than we have been in the past few years. A good part of this concern is due to the unwinding of the deflationary pressure caused by the drop in the oil price – along with the fall-off in capital expenditures tied to energy. From the current level, a rise in the price of oil from $30 to $40 is more than a 30% gain and will have implications for inflation. More important is that the labor participation rate has shown signs of bottoming out. (In other words, people out of work are increasingly looking for work.). Thus, the drop in below 5% is a very positive sign for the economy.

This employment pressure means that wage growth should start to seep over into the general inflation numbers. Core inflation (excluding food and energy) has stayed between 1.5% and 2% for over three years. However, it has recently broken above 2%, and we are watching it carefully. This core number (though it is not the preferred inflation measure of the Fed) does reflect a jump in services. Deflationary forces, which have seemingly been with us for years, are starting to appear in the rear-view mirror. Below is the graph for the (includes food and energy) for the trailing 12 months.

|