No sooner did the FOMC embark upon normalization of its monetary policy stance by initiating its first interest-rate hike in seven years than pundits and policy commentators began offering their predictions for subsequent rate hikes in 2016. The Committee essentially invited such speculation because of the wording of its policy statement. In particular, there were two additions that were critical. The first indicated that the Committee would evaluate both “realized” as well as expected economic conditions, including developments in labor markets, movement towards its inflation objectives, and international developments. The second was that the Committee expects those conditions to evolve in such a way as to warrant only “gradual” increases in the policy rate; and even after its objectives for inflation and employment had been achieved, rates would remain low for some time thereafter.

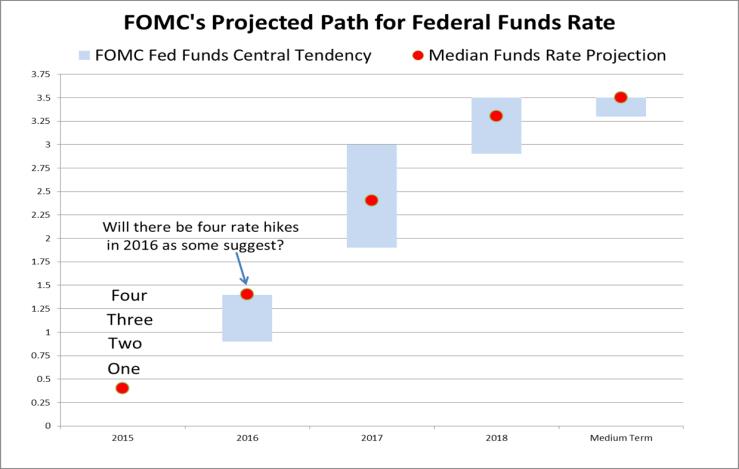

As for 2016, commentators looked at the median policy rate contained in the FOMC’s dot chart, and many began arguing that there would be four rate increases next year. We can see the rationale behind this inference in the following chart, which shows the median and central tendency of Committee participants’ views regarding the appropriate policy rate path to achieve their longer-run objectives. To get to the median policy rate in 2016 would require four policy moves.

However, note that the median of the funds rate target sits at the very top of the central tendency of the participants’ preferred range. Others offered the view that only two or at most three increases should be expected.

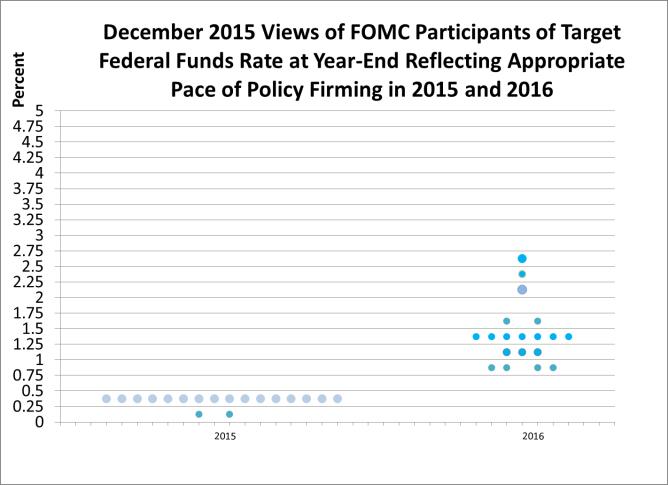

A more nuanced assessment can be made by looking at the actual distribution of the projections for the appropriate funds rate contained in the dot chart below, which was part of the Committee’s Summary of Economic Projections (SEP). Note that four participants saw only two increases as appropriate, while another three saw just three increases as being needed. As we have argued previously, to truly assess the policy options and where the FOMC is likely to come out, it is important to understand which participants are likely associated with each of the dots. If those who see only two or at most three rate increases are likely to be voting members, then where the others position themselves is largely irrelevant except for influencing the tone of the debate. We do know that two Board members, Governors Brainard and Tarullo, both spoke out prior to the FOMC meeting, voicing their concern about even moving in December. Note that there are two dots in the no-change range for December 2015.

Since there are five governors (there continue to be two unfilled vacancies after several years) who have never failed to support Chair Yellen, it is likely that all five are in the bottom two categories. Best guess now is that Stanley Fisher and President Dudley are among those suggesting that the funds rate would be between 1% and 1.25% by the end of 2016. It takes only six votes to constitute a majority (there are 12 voting members on the FOMC, but as mentioned previously there are two vacancies on the Board at present). In January, there will be four different reserve bank presidents voting, including Presidents Mester, Rosengren, George, and Bullard. Of those, President Rosengren has consistently argued for low rates and will most likely continue to do so in 2016. That puts the potential vote for a very gradual and cautious approach to policy rate moves next year with the five governors and Presidents Dudley and Rosengren controlling the decisions. Note too, that while Governor Fisher may be in that group seeing funds rate between 1% and 1.25% by year-end 2016, he was also Governor of the Bank of Israel when there was a policy reversal of a tightening move that was judged ex post to be premature.

Given a solid core of voting members of the FOMC who are arguably not likely to favor more than two moves next year, what “realized” evidence will be available that might tip the balance one way or another? Clearly, it is hard to argue that the Committee’s employment objective remains far from being, if not actually, realized. With the unemployment rate at 5%, further improvements in other measures are mostly icing on the cake. Instead, it is the 0.2% headline PCE inflation index that is the policy problem.

Is it likely that we will see a sudden jump in that index to 2% or near 2% next year? Energy and commodity prices continued to decline in December, so the January release of that number will not provide ammunition for a move at the Committee’s January 26–27 meeting; and the February PCE number will not be released until a week after the FOMC’s March 15–16 meeting. By the April 26–27 meeting, the Committee will have only the number for February – the March number will not be available until after the April meeting. Clearly, one reading on inflation is not likely to show a significant acceleration and may not be sufficient to rationalize a policy move. Note too that the central tendency for PCE inflation in the FOMC’s SEP projections is still significantly below its 2% target by year-end 2016.

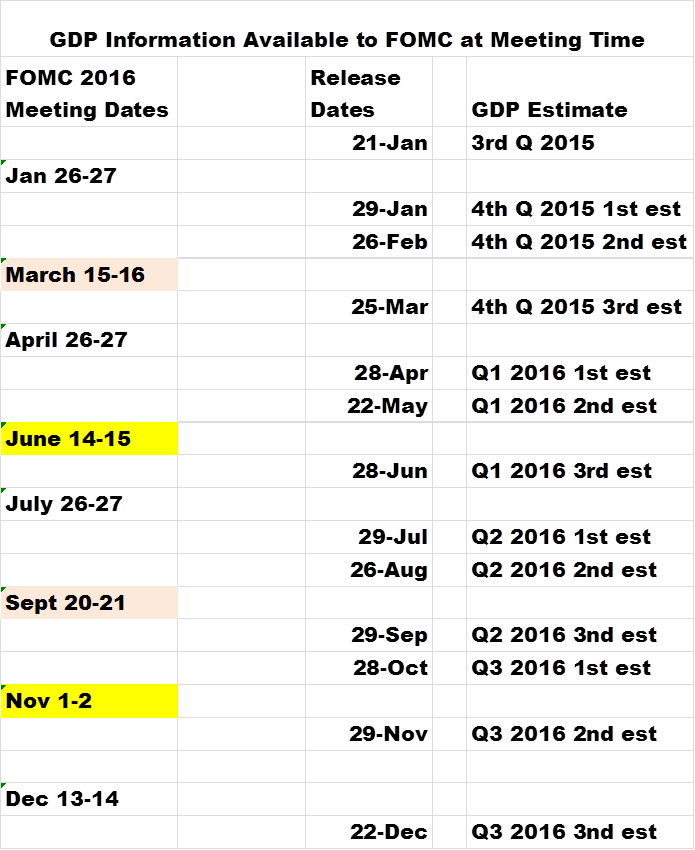

Of course, it is difficult to envision a significant move in inflation without robust aggregate demand, and clearly, the Committee sees only lack luster real GDP growth through 2018 in its SEP forecasts. Moreover, the committee will not have a significant amount of data to infer how GDP is trending after its policy move. Indeed, in January the Committee will have only the final reading for 2015 Q3. At both the March and April meetings, they will have stale data on 2015 Q4, generated before the December policy move. The following table details when the FOMC will have critical aggregate data on GDP.

Not until its June meeting will the Committee have any solid aggregate data on 2016 Q1, any action before then would have to be based upon robust public and private financial and sectoral data, labor market conditions, and Beige Book anecdotal information. If the Committee truly means that it would like to see actual progress towards its goals in the data, then its June 14–15 meeting would be the first one at which it would have really solid data in hand reflecting how the economy had absorbed and adjusted to the December policy move.

The table also reveals that the second likely opportunity for a data-dependent move will come at the November 1–2 meeting, when the Committee will have a reading on both 2016 Q2 and Q3 GDP. As some people will be quick to point out, however, that meeting falls just prior to the presidential election. Were there an incumbent running, there might be more reluctance to make another policy move. It is hard to see how a second move on the heels of an earlier move would be perceived as impacting either party’s chances, and a move then might be interpreted as an attempt on the part of the FOMC to assert its independence. At the same time, the December meeting is the one at which the FOMC would present its SEP forecasts and might be the better time to initiate a second policy move, free of the election, free of politics, and with solid data and projections in hand.