**These are my thoughts on the SPDR S&P 500 (NYSE:SPY) ETF in my Daily Trade Ideas.**

“Only one who devotes himself to a cause with his whole strength and soul can be a true master. For this reason mastery demands all of a person.” Albert Einstein

We started with a large gap higher to begin this week, so congrats if you guessed at this move and guessed right.

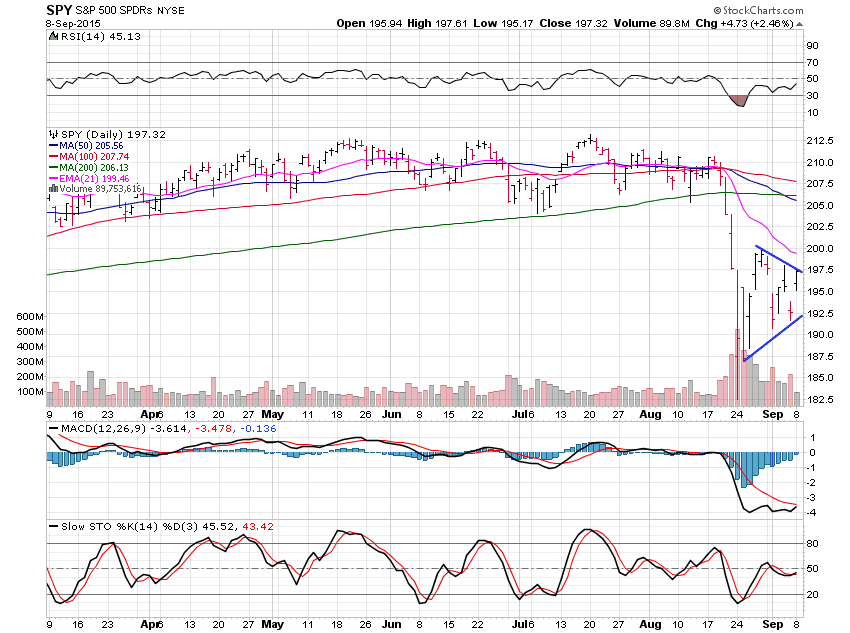

The market charts remain bearish, so locking in gains quickly remains key if you are playing this game of Russian roulette.

I’m all cash, but I did take a 10% weighting SPY trade from 196.25 today, and I locked in half my gains at 197.20 and the other half near the close at 197.55.

Today’s move was on very little volume, so do not expect it to last.

I’d expect a move lower now off the upper level of this bear wedge at 197.50, and I’d honestly be surprised if we don’t see a large gap lower overnight tonight, but I’m not willing to bet on it.

Many stocks are showing that they are almost set to put in another low, and then we can begin to build out the right side of their bases, as we do remain on track to see normal

Seasonal strength through November into years end.