After Friday’s fireworks, things got pretty quiet today, but there is plenty to ponder in the pipeline of event risks this week as we may have just seen the beginning of a bigger move.

And things got quiet

The market tried to pick up where Friday left off yesterday, but as is often the case on Mondays, there was little further momentum to come by and the rather large move from Monday to Friday last week saw traders perhaps reluctant to add to the frenzied euro sell-off until we see further developments. In Europe, peripheral spreads were generally wider, though the moves were a small fraction of what we saw late last week. EUR/USD touched a new low for the cycle below the previous 1.2289 low down towards 1.2230, but was well off that level and back above 1.2300 even by the time of this writing.

Draghi was out speaking to the EU parliament just before this was posted, exhorting the politicians to carry through on the plans recently announced and making generally very dovish sounds on inflation, though the emphasis was on the need for decisiveness in the political sphere rather than emphasizing that the ECB has anything new to offer, though Draghi did say that the ECB is searching for actions that could attenuate the crisis, though it is not asking for new powers.

Chinese data/markets

The Chinese inflation data published overnight showed the CPI etching another multi-year low, no huge surprise considering the drop in commodities prices of late. It is interesting to ponder not only what the Chinese regime will do next, but also the current trajectory of Chinese equities, as the Shanghai composite plunged to a new six-month low overnight. If the equity market is the least bit of a vague indicator on Chinese confidence, it would appear that investors are running scared. Also, from an FX perspective, it is interesting to ponder the two-way street that has been the USD/CNY rate of recent year. By that, I mean that the managed strengthening by the regime also saw corporations trying to front-run that strengthening for a long time now, meaning that the latter may be very heavily short a strengthening USD.

Safe haven, safe haven

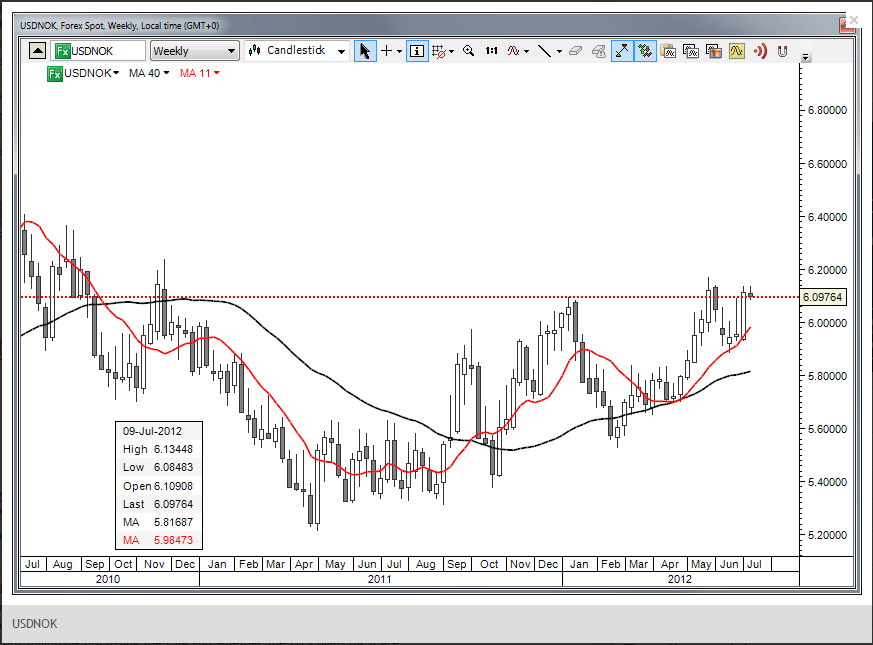

The USD/NOK chart is interesting these days, as the pair last week rejected a shooting star candle from the previous week and is back toward a cup and handle or upside down head and shoulders neckline-like area at 6.20. Stay tuned. Norwegian oil workers, probably some of the best paid workers in the world (though living in the world’s most expensive economy) are on strike as they are upset about their pension levels and they could completely disrupt oil production from tomorrow if the situation is not resolved. This is pretty lousy timing as oil prices have recently undergone a tremendous correction. The strike could wear on NOK safe haven status and it appears that the public attitude towards the strikers is rather hostile, particularly given the disruption of Iranian supplies, one would think. It will be an interesting test for the left-leaning government on whether they will force an end to the strike before it is called.

Chart: USD/NOK

Looking ahead

For further momentum, this market will be looking for the next moves (or lack thereof) from EU officialdom this week now that we have EU peripheral spreads backed up to uncomfortable levels again. The EU finance minister meeting this week could see more details emerge from the rather general statement made at the most recent EU summit. Meanwhile, the German constitutional court will be out tomorrow discussing the ESM and whether the EU’s plans for it are permissible under the German constitution.

And on Wednesday, the great hope for the QE crowd is that a juicy hint of QE gravy will show up. I am increasingly concerned about diminishing returns in QE expectations as the market very much got what it wanted last week, but this only saw profit taking in riskier assets.

Be careful out there.

Economic Data Highlights

- Japan May Adjusted Current Account Balance out at ¥282.2B vs. ¥401.4B expected and ¥288.6B in April

- China June Consumer Price Index out at +2.2% YoY vs. +2.3% expected and +3.0% in May

- China June Producer Price index out at -2.1% YoY vs. -2.0% expected and -1.4% in May

- Switzerland June Unemployment Rate out unchanged at 2.9% vs. 3.2% expected (but May data revised down to 2.9% from 3.2% so “no change”

- Germany May Trade Balance out at +15.3B vs. +!4.0B expected and +14.5B in April

- Eurozone July Sentix Investor Confidence out at -29.6 vs. -26.6 expected and -28.9 in June