FX Brief:

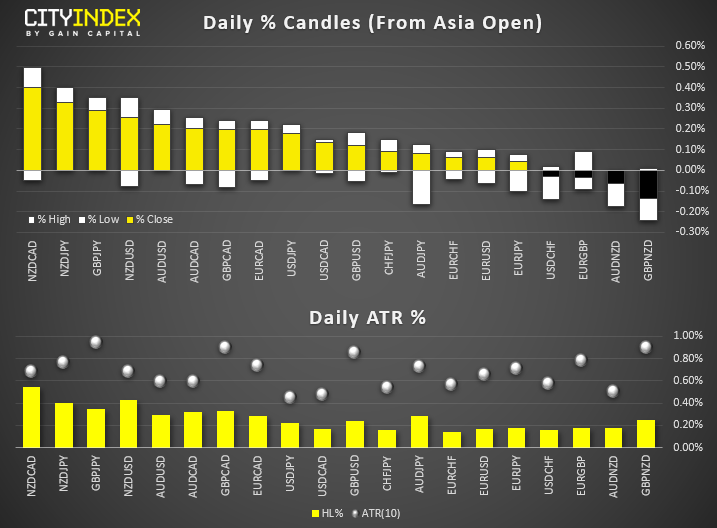

In contrast to the second half of last week, NZD and AUD are the strongest majors whilst JPY is the weakest.

- Australian’s manufacturing PMI contracted in September, although services reverted to growth to lift the composite PMI back above 50.

Equity Brief:

- Thomas Cook Group PLC (LON:TCG) group, the world’s oldest travel firm collapsed after rescue talks broke down over the weekend. This brings an end to the 178-year travel company, which survived two world wars and leaves thousands of holiday makers stranded. AlixPartners have been appointed to manage the administration, subject to the approval of courts.

- Softbank Group Corp. (T:9984) are exploring ways to replace WeWork’s CEO Adam Neuman, after delaying its IPO last week.

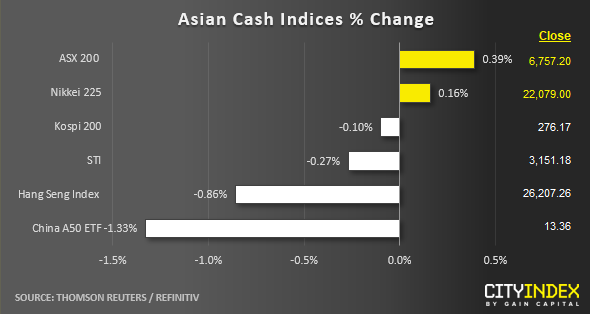

- Asian equities were broadly higher according to MSCI indices, on hopes that talks between US and China were improving, with both countries describing them as “productive” and “constructive”.

- At the index level, China’s CSI 300 and the Hang Seng were down -1.3% and -0.86% respectively, whilst the S&P/ASX 200 was higher with rising expectations of an RBA cut in October. S&P500 E-mini futures also climbed 0.5%.