FX Brief:

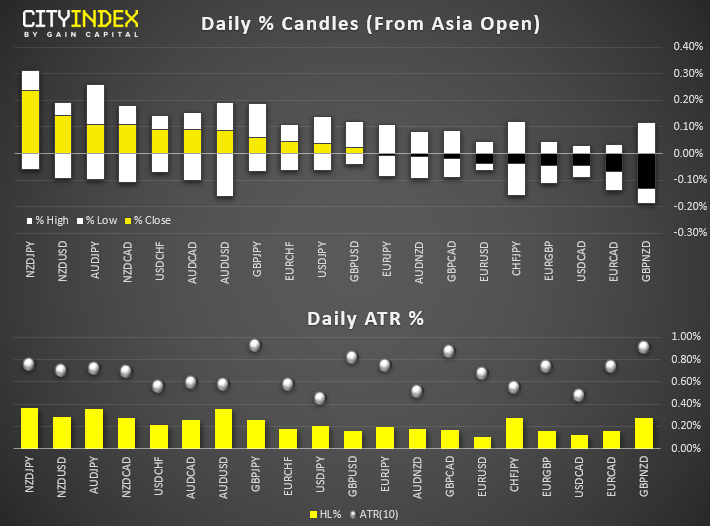

Quiet on the economic data-front or market moving headlines, it was narrow ranges for FX pairs overall. All majors and crosses remain within their typical daily ranges, but we could see EUR, NZD or AUD pairs break out of range looking at today’s agenda.

- Japan’s manufacturing PMI contracted for a fourth consecutive month and at its fastest rate since February. Service PMI slipped to 52.8 but remain in expansive territory.

- Producer prices in South Korea fell -0.6% YoY in September, making it the second contraction in two months.

- EUR/USD is consolidating just below 1.10 ahead of German IFO sentiment. AUD/USD has broken above yesterday’s small, bullish inside candle ahead of Philip Lowe’s speech. NZD/USD has broken to a two-day high ahead of the RBNZ meeting overnight.

Equity Brief:

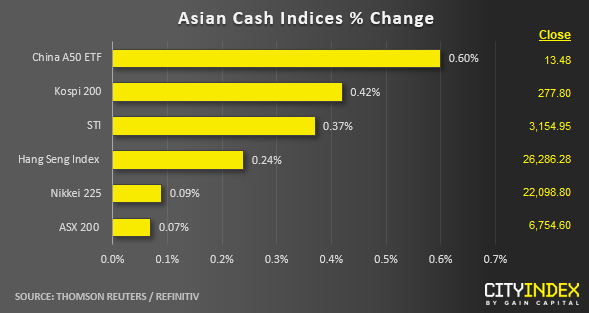

- The S&P/ASX 200 was initially led higher by financials and gold stocks as it tries to tally a 6th consecutive bullish week, although the index is currently flat heading into the close. At the time of writing, 38.9% of stocks advanced, 37.4% declined and 23.6% were unchanged.

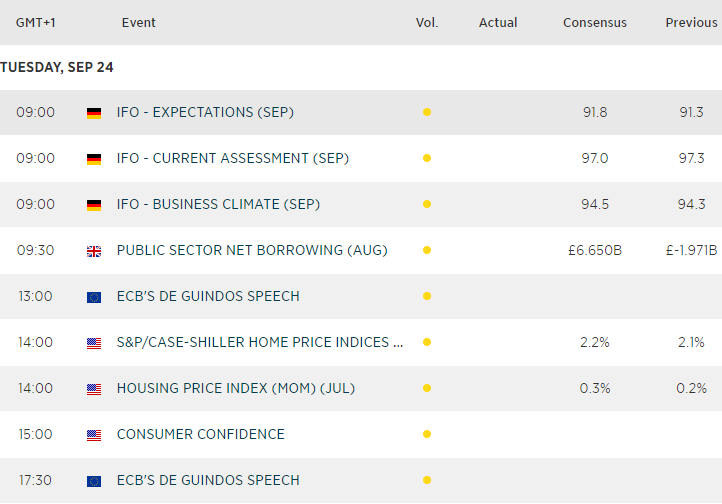

Up Next