Investing.com’s stocks of the week

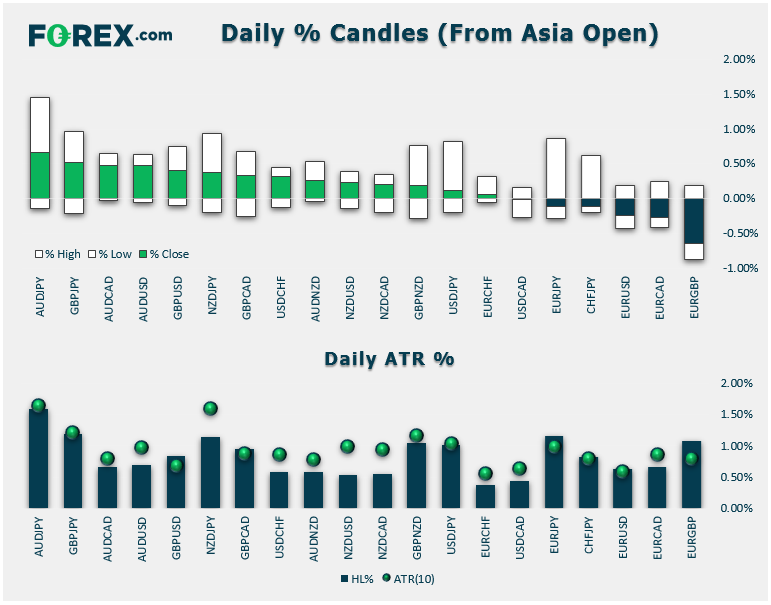

- FX: The pound was the strongest major currency on the day, while the safe-haven Swiss franc was the weakest.

- US Data: Perhaps due to Amazon's (NASDAQ:AMZN) big two-day “Prime Day,” promotion, July Retail Sales came in better than expected at +0.7% m/m vs. +0.3% eyed; Core retail sales was even stronger at +1.0% m/m. Both the Philly and Empire regional surveys also beat expectations. July Industrial Production figures came in a bit soft at -0.2% vs. +0.1% eyed.

- The Bank of Mexico joined the global easing party by cutting interest rates 0.25%, leading to a touch of strength in the peso.

- Commodities: Gold ticked higher (see our analysis of the correlation breakdown between gold and bitcoin) on the day while oil dipped about 1%

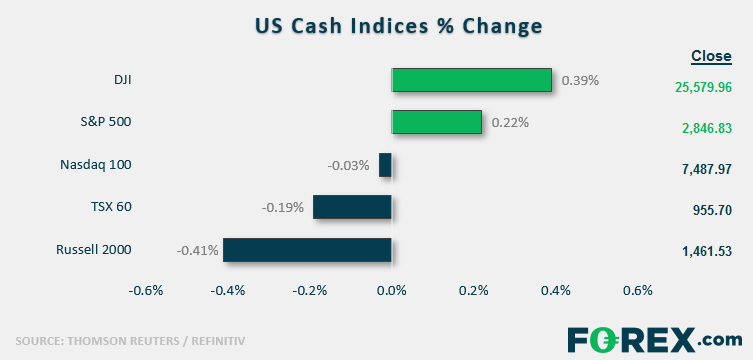

- US indices closed mixed in a choppy trading day as bond yields fell once again.

- Consumer Staples (NYSE:XLP) led the way higher on the day, while energy stocks (NYSE:XLE) were the weakest sector.

- General Electric (NYSE:GE) dumped more than 11% after the whistleblower for Bernard Madoff’s Ponzi scheme accused the company of shoddy bookkeeping.

Walmart (NYSE:WMT) surged 6% after a strong earnings report, putting the stock within striking distance of its record high.