Wednesday's selloff proved to change the short-term outlook of the market as indicated by a reversal commonly referred to by technicians as a bearish engulfing pattern. Such a reversal is also corroborated in the loss of short-term bullish momentum as the percentage of stocks within the S&P 500 with a daily MACD buy signal plummeted to 41% from last week’s 75% reading. With that said, the market’s long and intermediate-term momentum still remains bullish as does the overall market trend. Cyclical sectors continue to be market leaders though the defensive health care sector continues to hold on to its leadership mantle.

S&P 500 Member Trend Strength

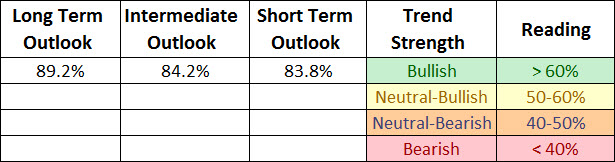

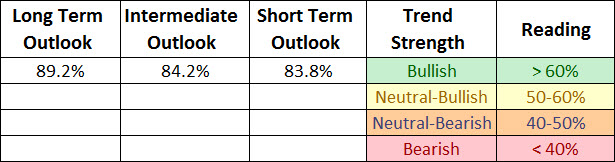

As shown below, the outlook for the S&P 500 is clearly bullish as more than 60% of stocks in the 500 member-index have bullish short, intermediate, and long-term trends. What is perhaps most important for the S&P 500 is that its long-term health is incredibly strong given nearly 90% of its members have rising long-term moving averages.

Note: Numbers reflect the percentage of stocks with rising moving averages. 200d MA is used for long-term outlook, 50d MA is used for intermediate outlook, and 20d MA is used for short-term outlook.

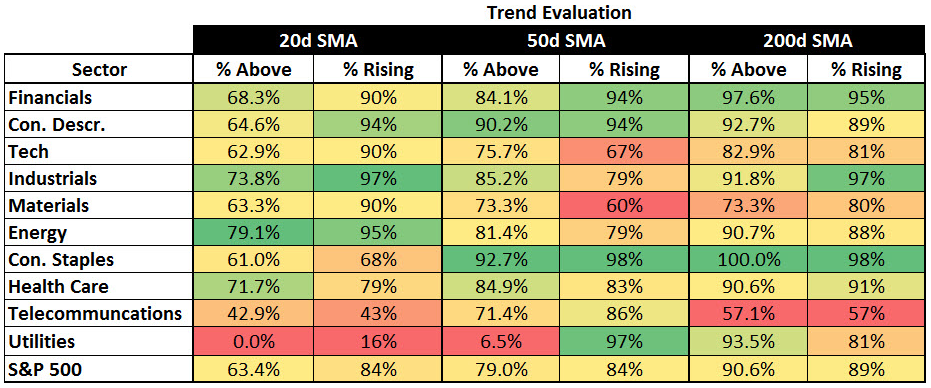

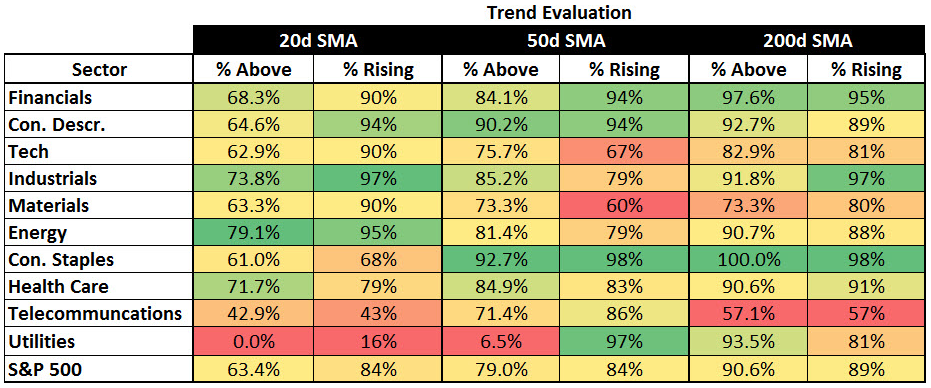

Breaking out the 500 stocks within the S&P 500 into their respective sectors and viewing their long (200d SMA) and intermediate trends (50d SMA) shows the cyclical sectors are surfacing as short-term leaders as they possess the strongest short-term breadth (% of members above their 20 day moving average). The most important section of the table below is the 200d SMA column, which sheds light on the market’s long-term health. As seen in the far right columns, you have 89% of the S&P 500 members with rising 200d SMAs and 90.6% of its members above their 200d SMA with nine out of ten sectors in bullish territory and more than 60% of their members having rising 200d SMAs. The two sectors showing the healthiest overall trend are the financial and consumer staples sectors as they have the best long-term and intermediate-term trends.

The defensive sectors were market leaders until recently as there is a rotation away from defensive to more aggressive sectors. Perhaps this is most evident when looking at the utility sector which has 0.5% of its members above their 20d SMA while the energy sector has 79.1%.

Market Momentum

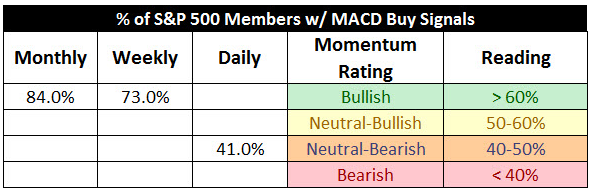

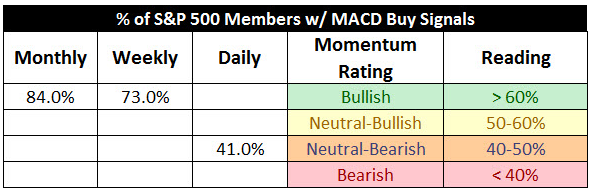

The Moving Average Convergence/Divergence (MACD) technical indicator is used to gauge the S&P 500’s momentum, on a daily, weekly, and monthly basis for short, intermediate, and long-term momentum evaluation. As seen in the table below, the momentum for the S&P 500 has weakened in the short-term with a daily sell signal this week, though the market's intermediate and long-term momentum remain bullish.

Digging into the details of the 500 stocks within the S&P 500 we can see that the daily momentum for the market has weakened as the percent of stocks within the S&P 500 with daily MACD BUY signals was at 75% last week and has fallen to 41% currently, pushing the market’s short-term momentum into neutral-bearish territory.

The intermediate momentum of the market remains strong and well into bullish territory at a reading of 73%.

Perhaps most significant is that the S&P 500’s long term momentum rests near a one year high as 84% of the 500-member S&P 500 have monthly MACD buy signals.

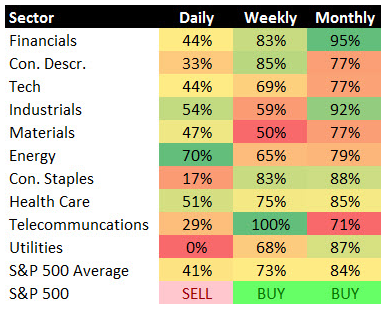

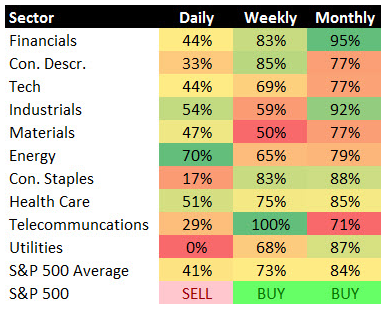

Further evidence of the rotation out of defensive sectors and into cyclical sectors can be seen when viewing the weekly and daily % MACD buy signals for all ten S&P 500 sectors. Many of the cyclical sectors had the worse readings for weekly MACD buy signals while the defensives had the best. However, recent changes in market momentum, when viewing the daily % MACD buy signals, shows the cyclical sectors having the greatest improvement at the expense of the defensive sectors. An example of this is that no stock within the S&P 500 utility sector is currently on a daily MACD buy signal while 70% of the S&P 500 energy sector are on daily MACD buy signals.

52-Week Highs and Lows Data

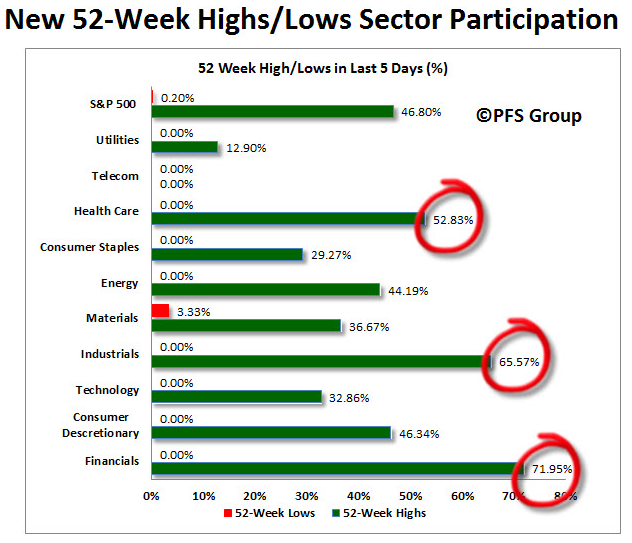

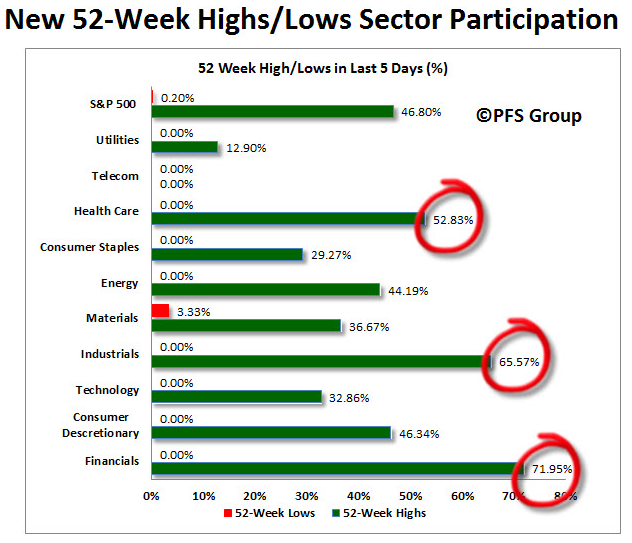

Confirming the data in the trend and momentum sections above, looking at new 52-week highs/lows data over the last trading week shows a clear rotation away from defensive sectors and into cyclical sectors. Below is the 52-week highs/lows snapshot where 46.8% of the S&P 500 members had reached a 52-week high over the prior trading week, with the financial, industrial, and health care sectors the clear leaders while the defensive sectors had far fewer members hitting new highs.

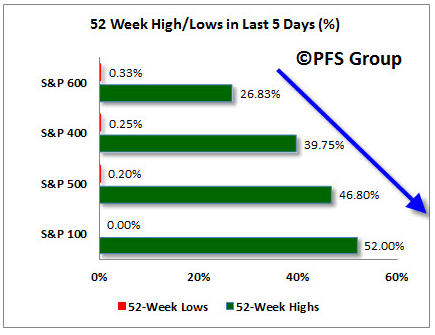

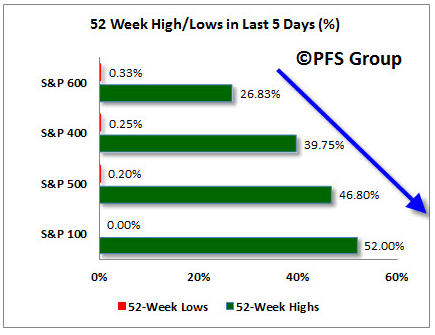

There is also a clear preference for larger cap companies as the S&P 600 Small Cap index has the fewest percentage of new highs over the trading week compared to the S&P 100 Index showing the highest percentage of new highs.

Summary

We have seen a clear deterioration in the market’s short-term trend but this is a welcome event helping to alleviate the market’s overbought condition. With the market’s intermediate-term and long-term trends and momentum still in bullish territory coupled with cyclical leadership, we have a very robust market that is likely to head to new highs once this short-term pullback exhausts itself.

S&P 500 Member Trend Strength

As shown below, the outlook for the S&P 500 is clearly bullish as more than 60% of stocks in the 500 member-index have bullish short, intermediate, and long-term trends. What is perhaps most important for the S&P 500 is that its long-term health is incredibly strong given nearly 90% of its members have rising long-term moving averages.

Note: Numbers reflect the percentage of stocks with rising moving averages. 200d MA is used for long-term outlook, 50d MA is used for intermediate outlook, and 20d MA is used for short-term outlook.

Breaking out the 500 stocks within the S&P 500 into their respective sectors and viewing their long (200d SMA) and intermediate trends (50d SMA) shows the cyclical sectors are surfacing as short-term leaders as they possess the strongest short-term breadth (% of members above their 20 day moving average). The most important section of the table below is the 200d SMA column, which sheds light on the market’s long-term health. As seen in the far right columns, you have 89% of the S&P 500 members with rising 200d SMAs and 90.6% of its members above their 200d SMA with nine out of ten sectors in bullish territory and more than 60% of their members having rising 200d SMAs. The two sectors showing the healthiest overall trend are the financial and consumer staples sectors as they have the best long-term and intermediate-term trends.

The defensive sectors were market leaders until recently as there is a rotation away from defensive to more aggressive sectors. Perhaps this is most evident when looking at the utility sector which has 0.5% of its members above their 20d SMA while the energy sector has 79.1%.

Market Momentum

The Moving Average Convergence/Divergence (MACD) technical indicator is used to gauge the S&P 500’s momentum, on a daily, weekly, and monthly basis for short, intermediate, and long-term momentum evaluation. As seen in the table below, the momentum for the S&P 500 has weakened in the short-term with a daily sell signal this week, though the market's intermediate and long-term momentum remain bullish.

Digging into the details of the 500 stocks within the S&P 500 we can see that the daily momentum for the market has weakened as the percent of stocks within the S&P 500 with daily MACD BUY signals was at 75% last week and has fallen to 41% currently, pushing the market’s short-term momentum into neutral-bearish territory.

The intermediate momentum of the market remains strong and well into bullish territory at a reading of 73%.

Perhaps most significant is that the S&P 500’s long term momentum rests near a one year high as 84% of the 500-member S&P 500 have monthly MACD buy signals.

Further evidence of the rotation out of defensive sectors and into cyclical sectors can be seen when viewing the weekly and daily % MACD buy signals for all ten S&P 500 sectors. Many of the cyclical sectors had the worse readings for weekly MACD buy signals while the defensives had the best. However, recent changes in market momentum, when viewing the daily % MACD buy signals, shows the cyclical sectors having the greatest improvement at the expense of the defensive sectors. An example of this is that no stock within the S&P 500 utility sector is currently on a daily MACD buy signal while 70% of the S&P 500 energy sector are on daily MACD buy signals.

52-Week Highs and Lows Data

Confirming the data in the trend and momentum sections above, looking at new 52-week highs/lows data over the last trading week shows a clear rotation away from defensive sectors and into cyclical sectors. Below is the 52-week highs/lows snapshot where 46.8% of the S&P 500 members had reached a 52-week high over the prior trading week, with the financial, industrial, and health care sectors the clear leaders while the defensive sectors had far fewer members hitting new highs.

There is also a clear preference for larger cap companies as the S&P 600 Small Cap index has the fewest percentage of new highs over the trading week compared to the S&P 100 Index showing the highest percentage of new highs.

Summary

We have seen a clear deterioration in the market’s short-term trend but this is a welcome event helping to alleviate the market’s overbought condition. With the market’s intermediate-term and long-term trends and momentum still in bullish territory coupled with cyclical leadership, we have a very robust market that is likely to head to new highs once this short-term pullback exhausts itself.