Market Brief

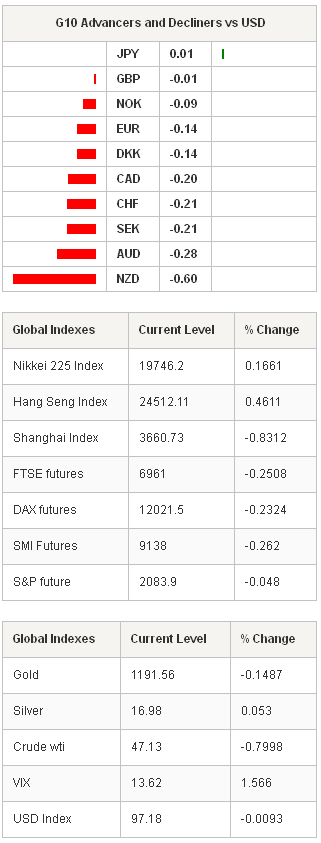

It has been the second consecutive USD-positive Asian trading session. The majority of the G10 and EM currencies underperformed the US Dollar as the market is in effort to determine a bottom in the recent USD slide post-FOMC. Yesterday’s very slight improvement in the US CPI has therefore been a reason enough to revive the USD-bulls. This behavior supports our view that the USD weakness should now be curbing.

EUR/USD advanced to 1.1029 yesterday. Impotent to break above last week’s high (1.1043), the pair eased to 1.0901/38 range in Asia. The sentiment in EUR remains skeptical as no bailout agreement has been reached between Greece and the EU, and the month-end deadline is approaching fast. We see two-sided event risk in Greece talks. The downside risks (failure to service debt, default) have not dissipated yet the market is currently pricing in an arrangement to prevent a “Graccident”. The latter, and the basecase scenario suggests a relief rally after weeks of uncertainty and should have the potential to temporary push the EUR/USD higher. Break above 1.1043 (last week high) will shift the next resistances to 1.1280 (Fib 76.4% on Feb-Mar sell-off), then 1.1534 (Feb 3rd high). In the mid-run however, the divergence between the ECB and the Fed keeps the bias on the downside, with the parity being still the key target. EUR/GBP is now testing the 50-dma / Fib 38.2% resistance at 0.73746/935 area, if broken should pave the way toward the daily cloud cover (0.74922/0.76774).

EUR/CHF trades below what the market has accepted as the SNB’s 1.05/1.10 implicit band, despite the good buying interest in the majority of EUR-crosses. And the decoupling is believed to widen due to safe heaven inflows into the Swiss franc. EUR/CHF legged down to 1.04222 in New York yesterday, in completely de-correlated fashion with other EUR-crosses. The break below 1.05 threshold triggered some stress on the euroswiss futures, up to 100.890 for the first time since the SNB refrained to cut rates on March 19th scheduled meeting. We stand ready for unscheduled SNB intervention should the franc positive pressures rise. The market should easily absorb 15-25 basis point cut given the global macro conditions.

In New Zealand, the trade data fell significantly short of market expectations. The trade surplus printed a poor 50 million NZD in February verse 350 million expected (!) as exports did not pick-up as anticipated (3.92 bn vs. 4.10 bn exp. & 3.70 bn last). The 12-month ytd deficit deepened from -1,409 million NZD to -2,181 million. NZD/USD has certainly topped at 0.7697 as we see exhaustion in positive momentum above 100-dma.

In Brazil, the BCB President Tombini sees no need to reduce the currency swap volumes. The main goal of the swap operations is to temper the volatilities on the FX market and provide a hedge for the real in this volatile environment, rather than to push for an artificial BRL appreciation. The fundamental bias in USD/BRL is positive given the globally strengthening US dollar. We see 3.00/10 area as strong downside challenge and believe that Rousseff has some time to go before gaining back investors trust and pulling capital back in Brazil.

The economic calendar of the day: Swiss February UBS Consumption Indicator, French March Business and Manufacturing Confidence and Production Outlook, Spanish February PPI m/m & y/y, Swedish March Consumer and Manufacturing Confidence, IFO March Business Climate, Current Assessment and Expectations in Germany, UK February BBA Loans for House Purchases, US March 20th MBA Mortgage Applications, US February Durable Goods Orders and French February Jobseekers Net Change and Total Jobseekers.

| Today's Calendar | Estimates | Previous | Country / GMT |

|---|---|---|---|

| SZ Feb UBS Consumption Indicator | - | 1.24 | CHF / 07:00 |

| FR Mar Business Confidence | 95 | 94 | EUR / 07:45 |

| FR Mar Manufacturing Confidence | 100 | 99 | EUR / 07:45 |

| FR Mar Production Outlook Indicator | - | -8 | EUR / 07:45 |

| FR Mar Own-Company Production Outlook | - | 12 | EUR / 07:45 |

| SP Feb PPI MoM | - | -0.50% | EUR / 08:00 |

| SP Feb PPI YoY | - | -2.80% | EUR / 08:00 |

| SW Mar Consumer Confidence | 98 | 97.4 | SEK / 08:00 |

| SW Mar Manufacturing Confidence s.a. | 106.7 | 106.8 | SEK / 08:00 |

| SW Mar Economic Tendency Survey | - | 104.8 | SEK / 08:00 |

| GE Mar IFO Business Climate | 107.3 | 106.8 | EUR / 09:00 |

| GE Mar IFO Current Assessment | 112 | 111.3 | EUR / 09:00 |

| GE Mar IFO Expectations | 103 | 102.5 | EUR / 09:00 |

| UK Feb BBA Loans for House Purchase | 36650 | 36394 | GBP / 09:30 |

| US Mar 20th MBA Mortgage Applications | - | -3.90% | USD / 11:00 |

| US Feb Durable Goods Orders | 0.20% | 2.80% | USD / 12:30 |

| US Feb Durables Ex Transportation | 0.20% | 0.30% | USD / 12:30 |

| US Feb Cap Goods Orders Nondef Ex Air | 0.30% | 0.60% | USD / 12:30 |

| US Feb Cap Goods Ship Nondef Ex Air | 0.30% | -0.30% | USD / 12:30 |

| FR Feb Total Jobseekers | 3491.6k | 3481.6k | EUR / 17:00 |

| FR Feb Jobseekers Net Change | 10 | -19.1 | EUR / 17:00 |

Currency Tech

EUR/USD

R 2: 1.1280

R 1: 1.1043

CURRENT: 1.0929

S 1: 1.0768

S 2: 1.0613

GBP/USD

R 2: 1.5166

R 1: 1.4986

CURRENT: 1.4870

S 1: 1.4635

S 2: 1.4547

USD/JPY

R 2: 122.03

R 1: 120.50

CURRENT: 119.70

S 1: 119.22

S 2: 118.50

USD/CHF

R 2: 0.9984

R 1: 0.9812

CURRENT: 0.9599

S 1: 0.9537

S 2: 0.9450