Forex News and Events

Markets are getting for Christmas holidays

Equity markets across the globe are edging lower on profit taking, volumes are shrinking, FX implied volatilities are easing; there is no doubt, market participants are more concerned with the upcoming festivities than developments in financial markets. The one-week implied volatility in EUR/USD collapsed to 7.36% this morning, compared to 15.50% a week ago. The patterns in USD/JPY and USD/CHF have been similar as they fell to 8.26% and 5.83%, respectively. In the equity market, investors are securing their recent profits and pushing equities into negative territory. European equities are flirting with the neutral threshold as major indices are edging lower. Treasury yields are also consolidating as the rally is running out of steam with the U.S. 10-Year yields stabilising at around 2.54%, while the monetary policy sensitive 2-Year yields eased to 1.19% on Thursday, compared to 1.25% two days ago.

Globally, investors should remain sidelined, waiting for the year to end. The year 2017 is looking very promising according to Trump’s agenda. However, as we have stated many times, the likelihood that Trump does not deliver what has been promised is substantial. Such a scenario would see a major correction in the asset classes that profit the most from the recent rally. In other words, the greenback and equities will be the first in line should a correction sell-off take place.

Gold weakness is a short-term opportunity

The precious metal is currently trading around a 10-month low against the US dollar in an environment where several US rate hikes are expected next year. For several days, gold has stayed above $1130, setting up a base. The tail risk for US dollar is significant. In our view, there is a decent probability that the XAU/USD will retrace within the next few weeks.

Looking back to this time last year, the outlook for a US normalization was optimistic and as the Fed failed to deliver, it triggered one of the greatest first halves in 40 years.

Fundamentally, the gold industry is not looking great. Far from the outlook that seemed at first glance negative for next year, gold production is also on its way down. Miners are not finding the same quantities as they did a decade ago. More specifically, the discovery of gold has declined by 85% since 2006. It is also becoming more complicated for mining companies to dig up the yellow metal.

Nonetheless the scarcity of gold is not as close as the yearly gold output accounts for less than 2% of the gold that has been ever produced which in reality implies that there is definitely room for metals to get back into the market.

Normalisation coming to Sweden

In an unexpected twist, the Riksbank extended its QE program for another six months but reduced the pace of purchases over the period to SEK 30bn from 45bn. The initial FX reaction suggests that the market was caught flat-footed by the hawkish move. With three members dissenting and voting for less policy easing and two members voting to end purchases immediately, we can now see the end of the Riksbank’s easing cycle in sight (summer 2017). The solid performance of Sweden’s CPI and growth data indicates that there will be policy divergence between the Riksbank and ECB in 2017. Bearish bets are now building in EURSEK, however, we suspect that the pass through in SEK will be limited due to the cost of holding SEK, plus this trade has been in the market for a while now. It is likely that EURSEK will slowly and painfully grind lower from here heading towards 9.50 support. Timing on this trade will be everything.

EUR/CHF - Bouncing Back Above 1.0700.

The Risk Today

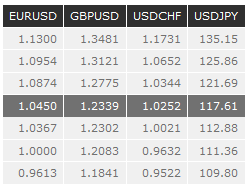

EUR/USD remains below 1.0500. Hourly support at 1.0367 (15/12/2016 low) has been broken. Hourly resistance can be found at 1.0480 (19/12/2016 high). Stronger resistance is given at 1.0670 (14/12/2016 high). Yet, very short-term buying seem to increase. In the longer term, the death cross late October indicated a further bearish bias. The pair has broken key support given at 1.0458 (16/03/2015 low). Key resistance holds at 1.1714 (24/08/2015 high). Expected to head towards parity.

GBP/USD is trading below former uptrend channel. Strong support can be found at 1.2302 (18/11/2016 low) while resistance lies at 1.2509 (16/12/2016 high). The technical structure suggests further weakness towards support at 1.2302. The long-term technical pattern is even more negative since the Brexit vote has paved the way for further decline. Long-term support given at 1.0520 (01/03/85) represents a decent target. Long-term resistance is given at 1.5018 (24/06/2015) and would indicate a long-term reversal in the negative trend. Yet, it is very unlikely at the moment.

USD/JPY's bullish pressures are still very strong despite some bearish retracements. The pair is heading towards the 120.00 level. Hourly support can be found at 116.56 (19/12/2016 low). Stronger support lies at 114.74 (12/12/2016 low). The technical structure suggests further strengthening. We favor a long-term bearish bias. Support is now given at 96.57 (10/08/2013 low). A gradual rise towards the major resistance at 135.15 (01/02/2002 high) seems absolutely unlikely. Expected to decline further support at 93.79 (13/06/2013 low).

USD/CHF is consolidating but remains above 1.0250 which seems a solid base. Hourly resistance is given at 1.0344 (15/12/2016 high). Key support is given at the parity. Expected to further consolidate towards former resistance area around 1.0205. In the long-term, the pair is still trading in range since 2011 despite some turmoil when the SNB unpegged the CHF. Key support can be found 0.8986 (30/01/2015 low). The technical structure favours nonetheless a long term bullish bias since the unpeg in January 2015.

Resistance and Support: