Forex News and Events

Draghi warns banks and SNB’s Jordan to speak on Monday (by Yann Quelenn)

This week has seen a pretty intense round of central bank decisions. Of course, the BoJ and the Fed were the main attractions, although in the end nothing really new has emerged with the exception of the rate target (to around zero) for 10-year government bonds.

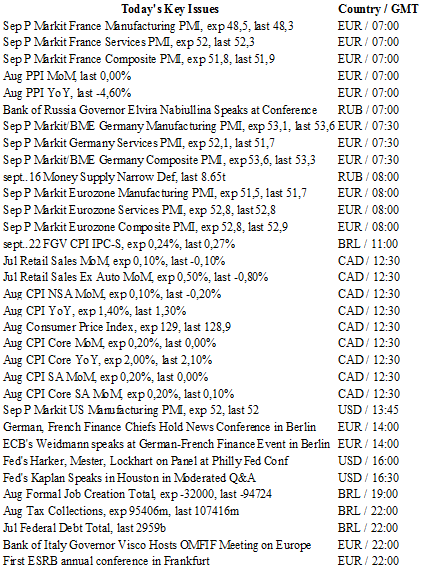

Yesterday, ECB President Mario Draghi spoke at the European Systemic Risk Board in Frankfurt, where he stated that the banking sector is too crowded to be profitable. It is true that banks are in the eye of the storm. We continue to believe that Italian banks for example may trigger further banking disruption in the Eurozone. The recent stress test has revealed that the €360 billion of bad loans are a major threat for the stability of the European financial system.

Also yesterday, the euro weakened against the Swiss franc on these comments. Thomas Jordan is set to speak on Monday in Geneva after the release of the sight deposit data. The SNB remains deeply under pressure and in our view, Swiss policymakers remain on the edge, but ready to act at any time. When looking at the situation in the US or Japan, it is difficult not to believe that the franc is set to remain strong for quite some time more. On the other hand, the Swiss economy is adjusting to a strong franc. Growth is expected to print for Q2 at 2% y/y versus 1.1% y/y for the first quarter, mostly driven by government spending and foreign trade. However, this situation is fragile as any evidence, or turmoil could potentially send the CHF higher. This is why we remain bearish on the EUR/CHF.

US debate risk (by Peter Rosenstreich)

With the BoJ and Fed meeting in the rear view mirror investors will turn their attention on the first US presidential election debate on Monday. The relative calm that has spread over financial markets as both central bank meeting were basically markets friendly increase the probability that an unexpected outcome trigger significant market volatility. Global equities indices have a bullish tone with the S&P returning to August highs while the retraced aggressively to 12 from 20. US debates have a long past of making or breaking presidential candidates including a sickly Nixon juxtaposed with a healthy Kennedy or Hillary Clinton inability to pronoun the future Russian president’s Dmitri Medvedev name correctly. With Donald Trump’s surging popularity and historical uneven debating performance squaring up against Hillary’s waning poles number but master of details both candidates will be going for the kill. With polls indicating the race is a coin-toss this could be a most momentous yet of the 2016 election. Currently the markets expecting a Clinton victory yet has we have witnesses with Brexit tail risk still exists. A decisive debate win by Trump will unnerve the markets and spark short-term volatility as investors consider a Trump reign. Baring a clear trump victory or Hillary defending her lead we anticipate that risk seeking will dominates investor behavior in the near term. We remain bullish on EM nations with firming fundamentals and higher yields such as IDR, INR and RUB.

Gold - Setting Lower Highs.

The Risk Today

Yann Quelenn

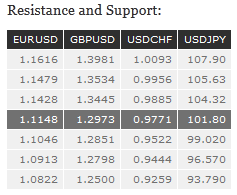

EUR/USD's short term momentum is bearish. Hourly support is given at 1.1123 (31/08/2016 low) while hourly resistance is given at 1.1257 (22/09/2016 high). Key resistance is given at 1.1352 (23/08/2016 high) then 1.1428 (23/06/2016 high). Strong support can be found at 1.1046 (05/08/2016 low). Expected to decline towards 1.1100. In the longer term, the technical structure favours a very long-term bearish bias as long as resistance at 1.1714 (24/08/2015 high) holds. The pair is trading in range since the start of 2015. Strong support is given at 1.0458 (16/03/2015 low). However, the current technical structure since last December implies a gradual increase.

GBP/USD is back around 1.300. Hourly resistance is given at 1.3121 (22/09/2016 high). Key resistance lies at 1.3445 (06/09/2016 high). Hourly support can be found at 1.2947. Expected to show continued downside pressures. The long-term technical pattern is even more negative since the Brexit vote has paved the way for further decline. Long-term support given at 1.0520 (01/03/85) represents a decent target. Long-term resistance is given at 1.5018 (24/06/2015) and would indicate a long-term reversal in the negative trend. Yet, it is very unlikely at the moment.

USD/JPY's selling pressures are strong. The pair keeps on pushing lower. Strong resistance can be found at 104.32 (02/09/2016 high) while hourly resistance is given at 102.79 (21/09/2016 high). Psychological support at 100 is not far away. A key support lies at 99.02 (24/06/2016 low). Expected to further weaken. We favour a long-term bearish bias. Support is now given at 96.57 (10/08/2013 low). A gradual rise towards the major resistance at 135.15 (01/02/2002 high) seems absolutely unlikely. Expected to decline further support at 93.79 (13/06/2013 low).

USD/CHF is set to monitor one more time support given at 0.9632 (26/08/2016 low). There are alternating periods of strong and low volatility and the pair seems without direction. Hourly resistance can be found at 0.9885 (01/09/2016 high). Next resistance lies at 0.9956 (30/05/2016 high). Expected to show increasing selling interests. In the long-term, the pair is still trading in range since 2011 despite some turmoil when the SNB unpegged the CHF. Key support can be found 0.8986 (30/01/2015 low). The technical structure favours nonetheless a long term bullish bias since the unpeg in January 2015.