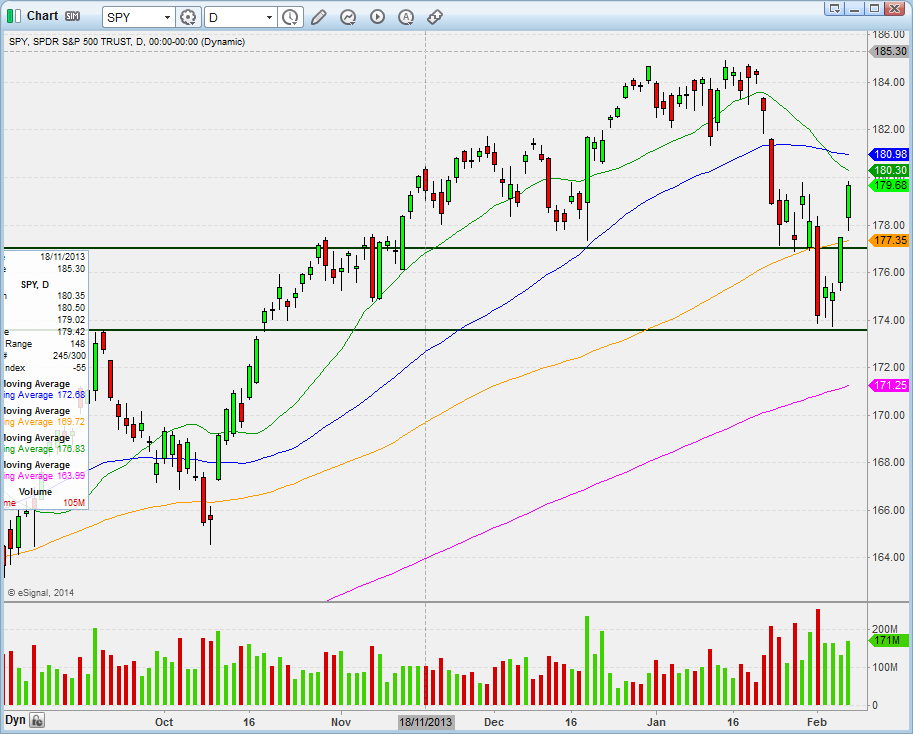

Our original post on the correction called for hard edges to trade against at SPY 177 and 173. We got trades off both but went to cash on Friday selling all our swings (including a great support long on CF Industries Holdings Inc, (CF) off 220 support from our newsletter) and a freebie Berkshire Hathaway (BRK.B) trade under 109 that we had posted real-time on our stream.

Trading against hard edges is where we excel– we have the experience and the conviction and no matter how “gross” it feels we are active in those areas. However, it’s the no-man’s land like the one we are entering this week where things get less clear. Those who didn’t buy off the 173.5 zone bottom are feeling nervous sitting in cash — thinking maybe that was the bottom? And people who sat through the decline and then enjoyed the rally up are thinking “maybe now I am back to break-even I should sell? Is this my chance?”

We don’t think market direction will clear up any-time soon. We have room to possibly 181-182 on SPY before we hit any major resistance.

Biotechs are acting decent, financials finally found a bid, and the leaders are acting well. However we do think it will be a choppier time going forward as opposed to a trending 2013. And as visibility is reduced, we’re back to shorter holds, and more active trading.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.