I believe the market has been reversed and is ready to resume it's primary-term uptrend.

In this article, I want to show you related "before" and "after" charts to show you where we were just a few months back and where we are today.

There are always opinions, feelings, emotions, assertions, and predictions upon someone's biased view of the market because of their involvement or maybe a hidden agenda, which means people lie (intentionally or unintentionally).

Only the price-action is true, and it always prevails to beat all the potential "guesses" from the "Gurus."

- That's why Technical Analysis is the most effective way of gauging the market.

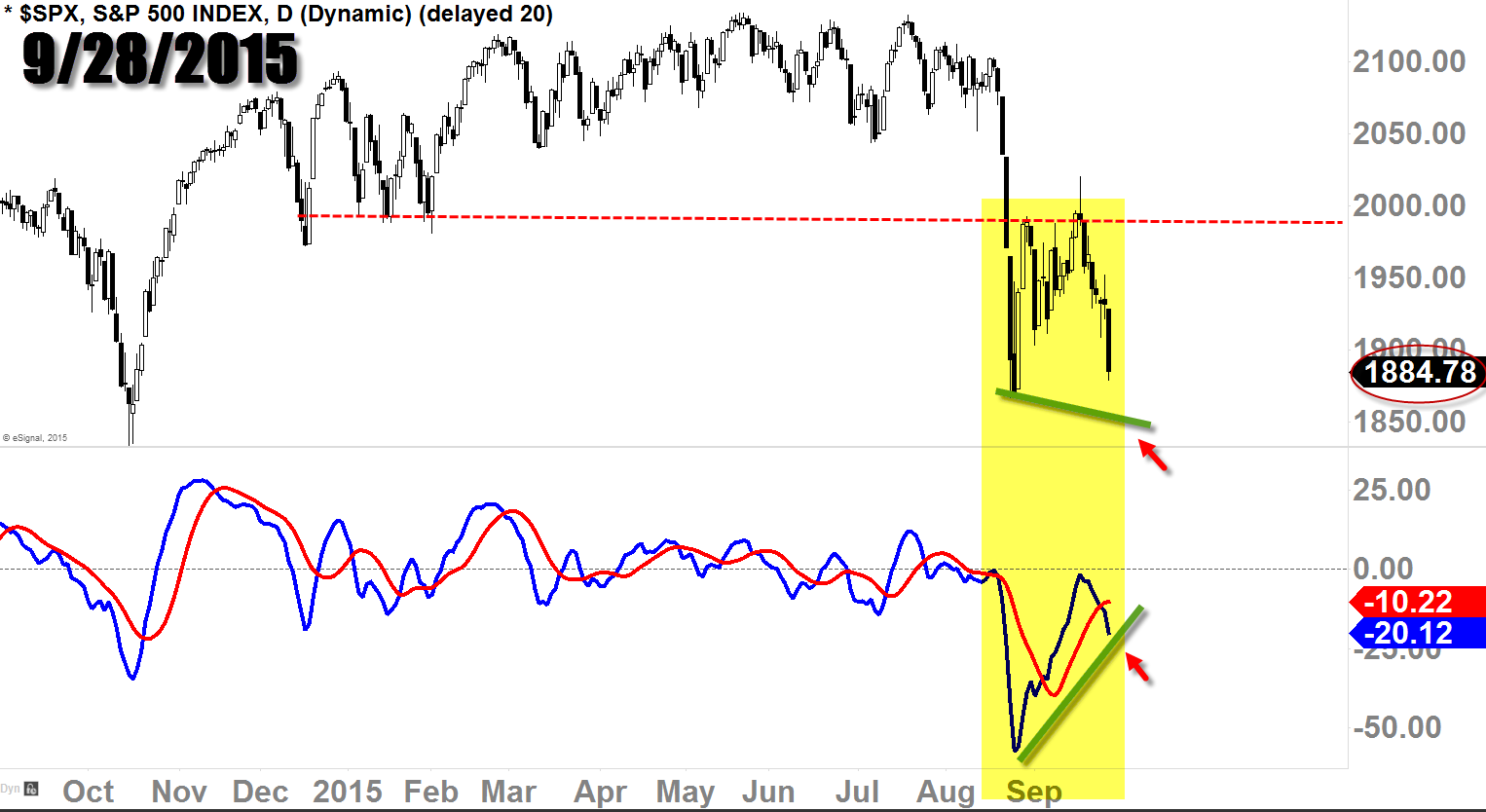

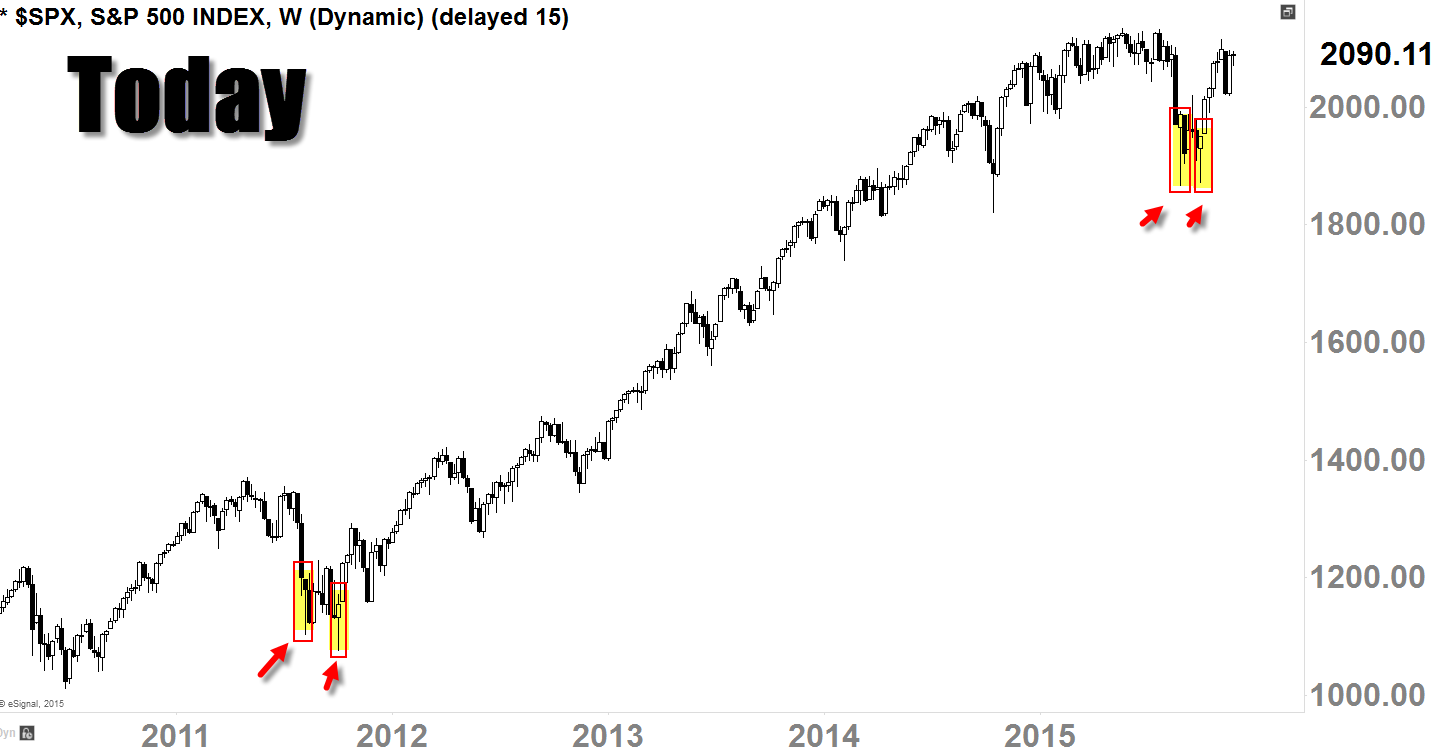

Bullish-Divergence Reversal

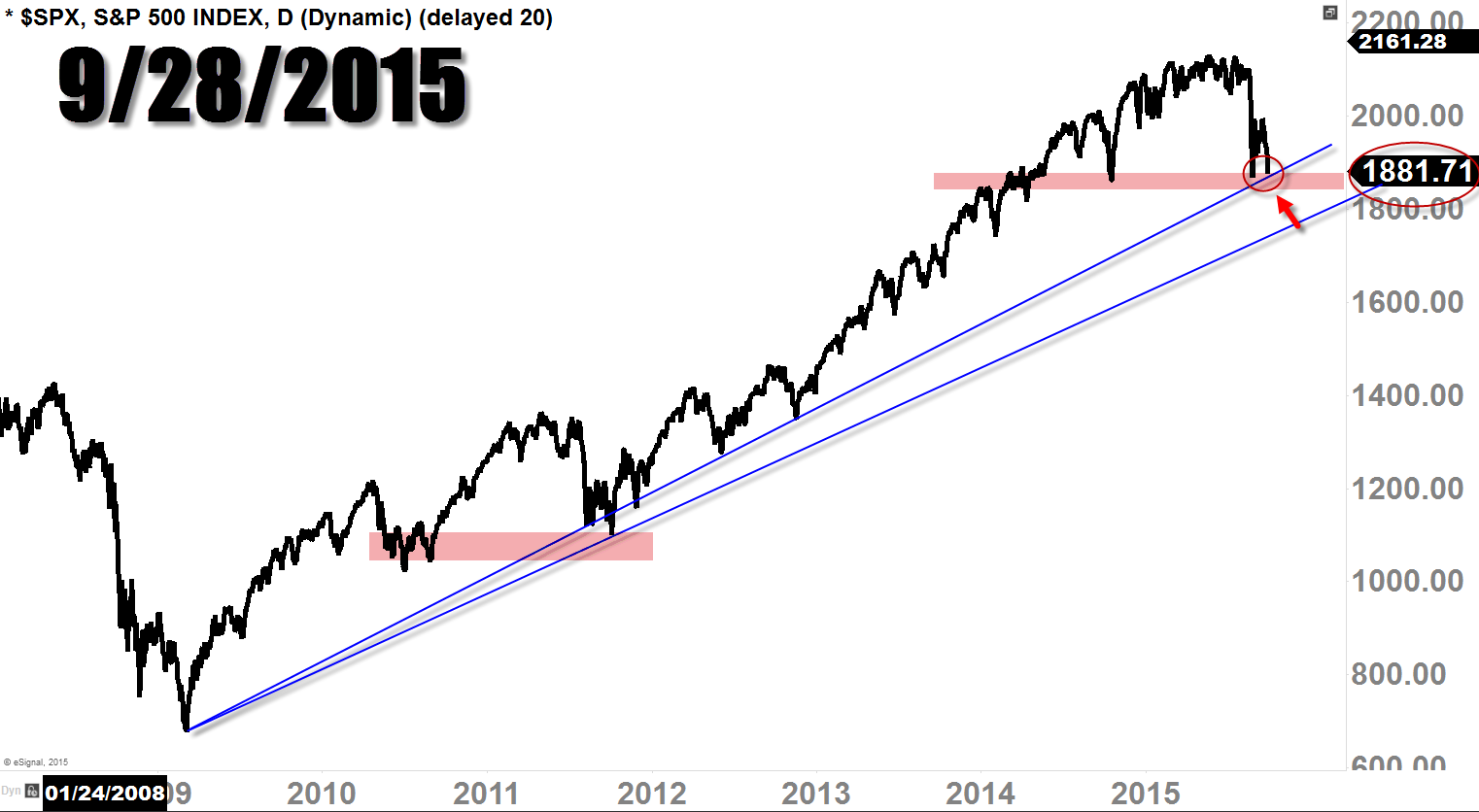

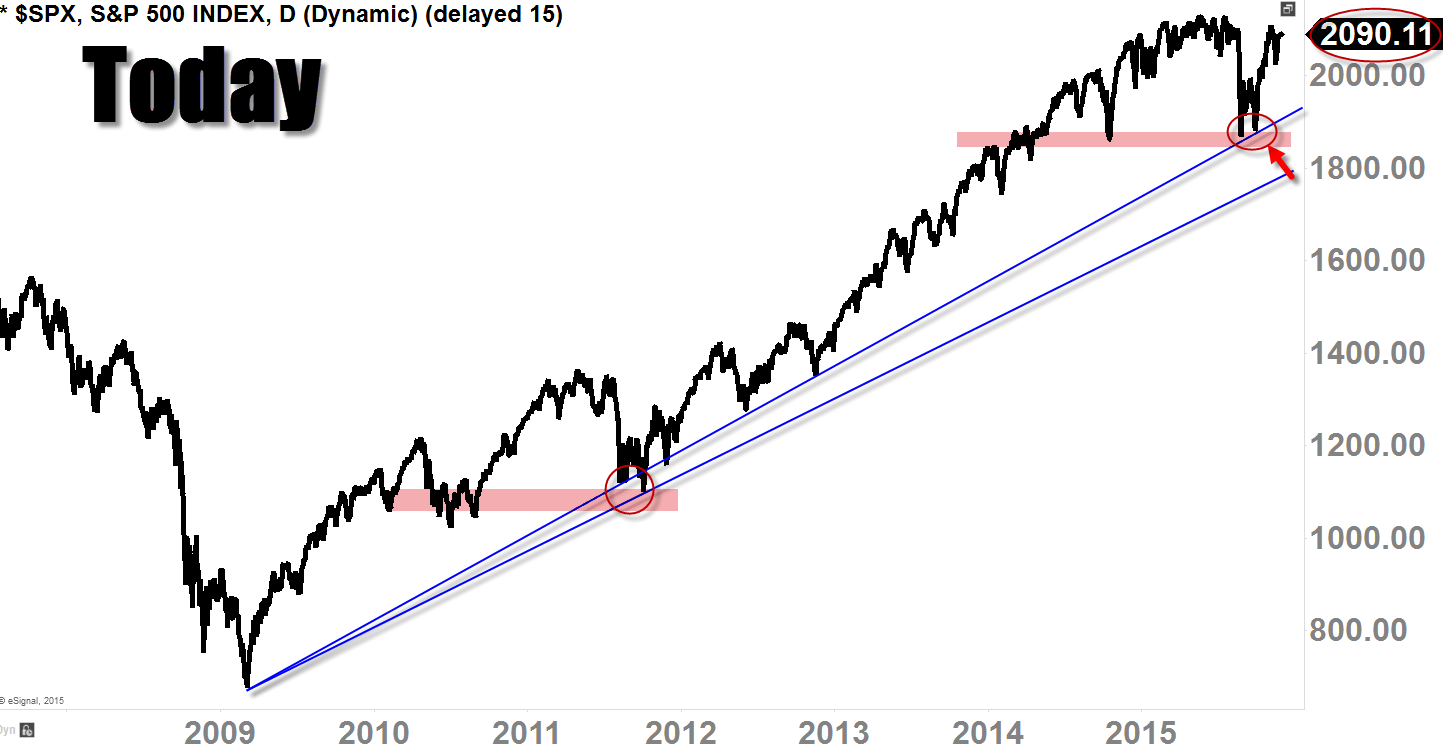

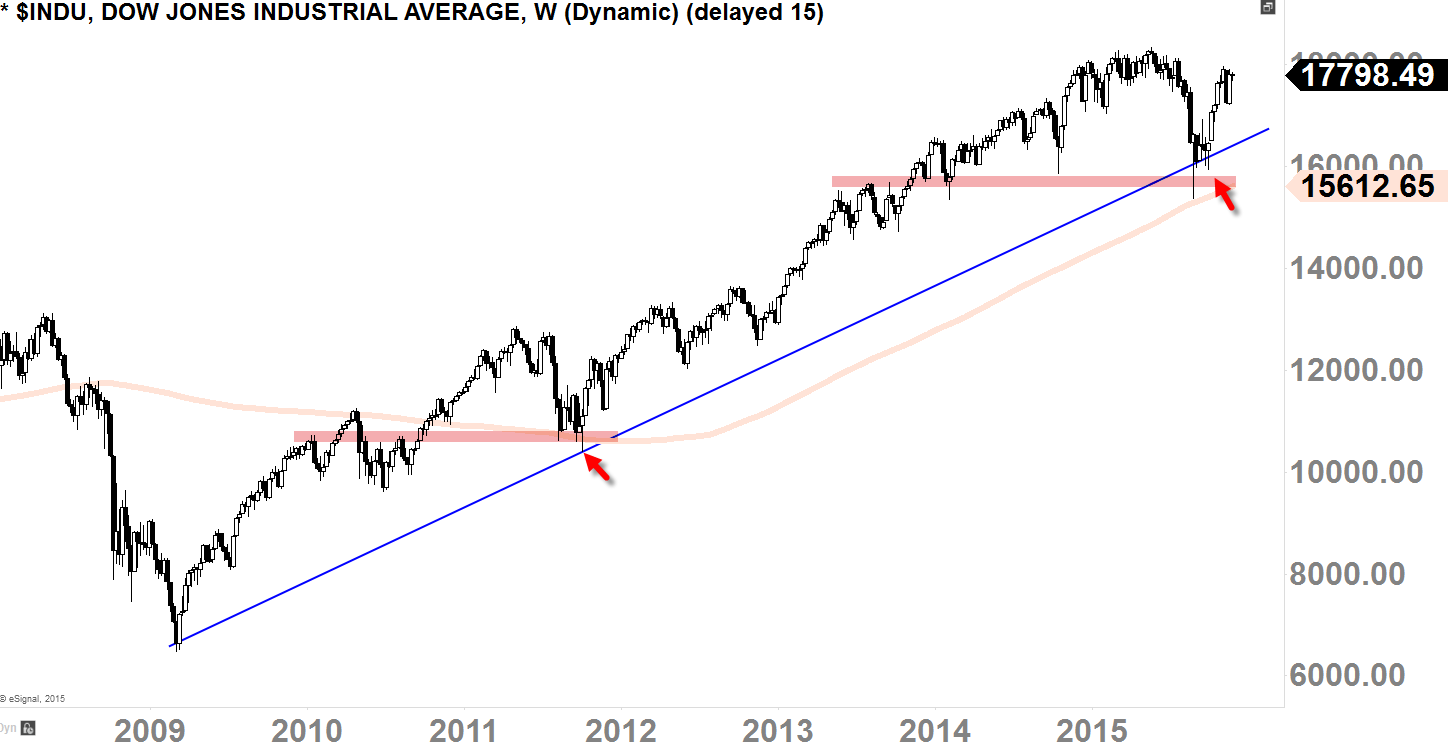

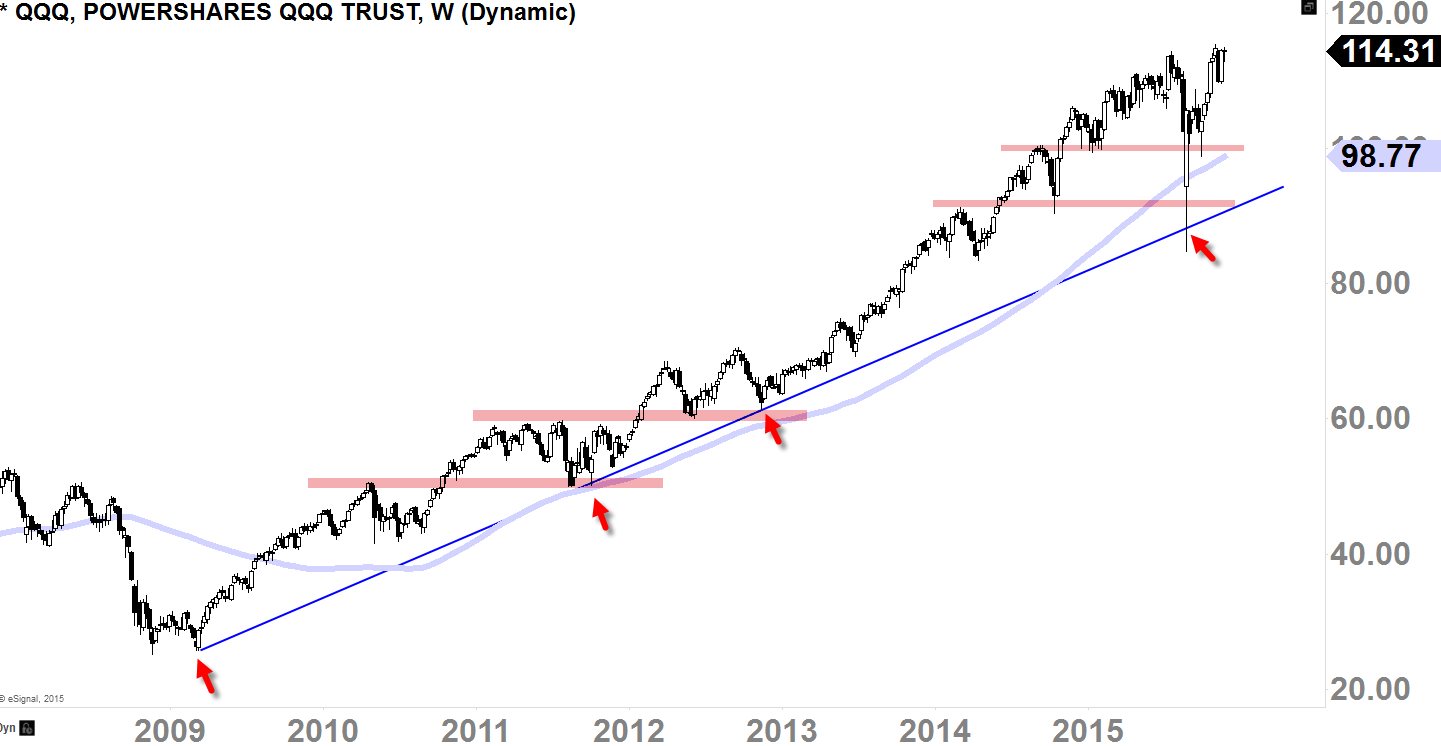

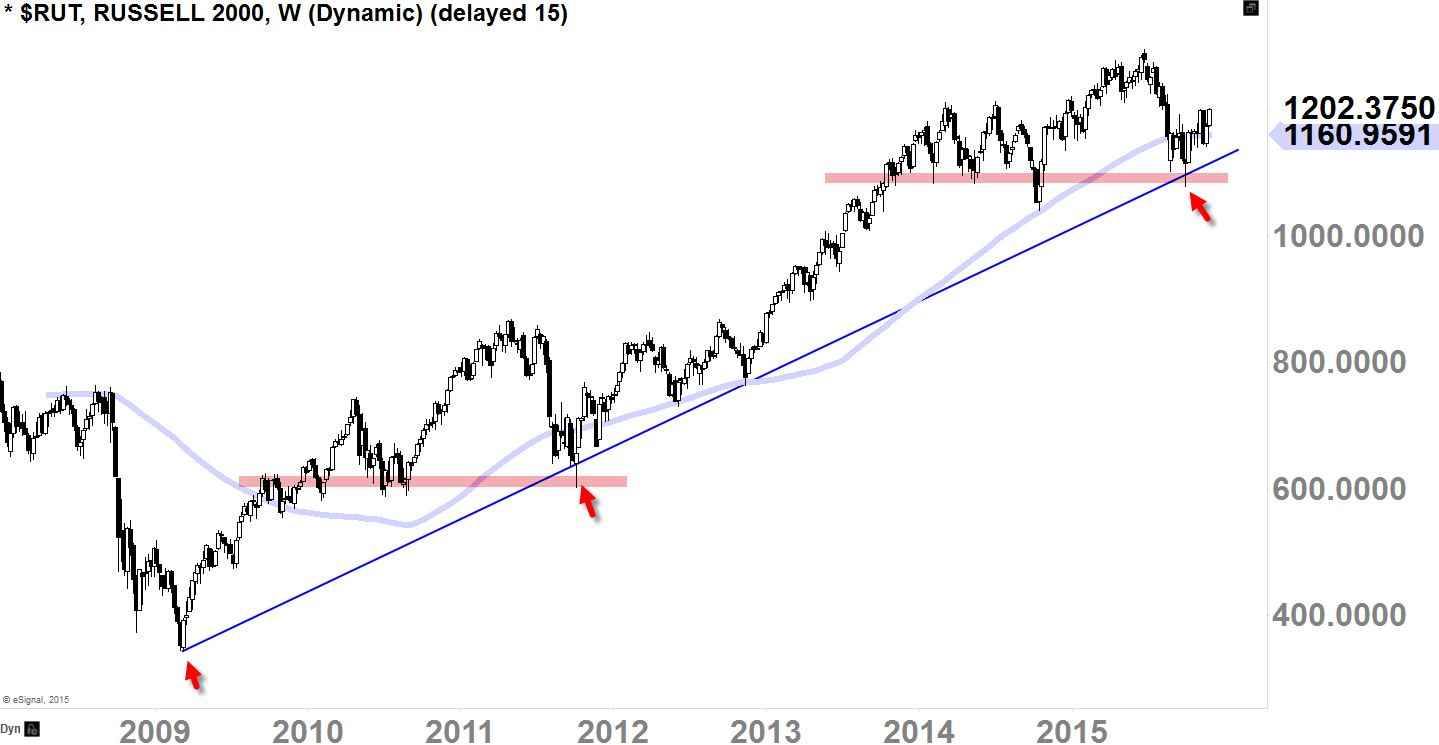

Uptrend Support

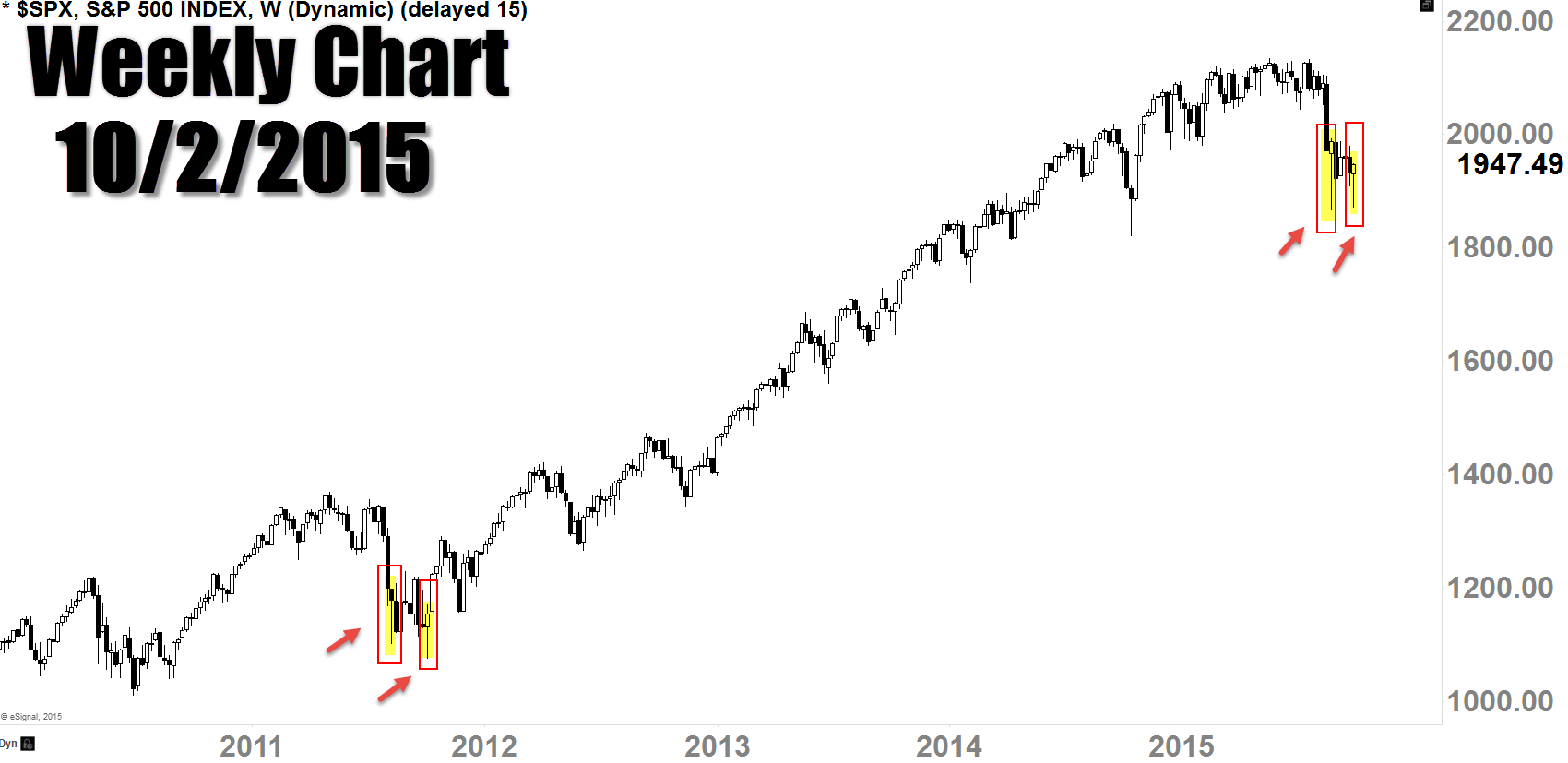

Reversal Candles

Weekly-Chart Primary Uptrend

Final Thoughts

"Trend is assumed to be in effect until it gives us a clear signal that it has been reversed."

As of today, we do not have a clear signal (no reversal signal at all for that matter--technical speaking) that the market has been reversed.

Yes, we do have "fear" in the market, but where is that fear coming from? From the market? No; from the people.

The market does not care what people feel or what their emotional-level is like.

Our job is not to predict things, but to react to the market's behavior. We are dealing with a prolonged uptrend since 2009, it means we must understand the big picture, and we must scrutinize it's primary-term uptrend to understand current market sentiment.

The major uptrend is still in effect, which means, we must give the "benefit of the doubt" to the buyers.

As I have been saying in my videos, this is an opportunity as the market resumes back up to it's primary-term uptrend.