USD: Lady Yellen remained dovish to assure the markets that interest rates wil remain low

GBP: M4 Money Supply m/m came in above expectations at 0.7% vs 0.5% forecast, and at the 6-month high mortage approvals. Howeverwere down following last month's 5-year high but still strong at 70k.

EUR: CPI Flah Estimate disappointed coming in at 0.5% vs 0.6% expected, it's lowest since -0.1% in October 2009

CAD: GDP m/m beat expectations at 0.5% vs 0.4% forecast to see a 6-month high

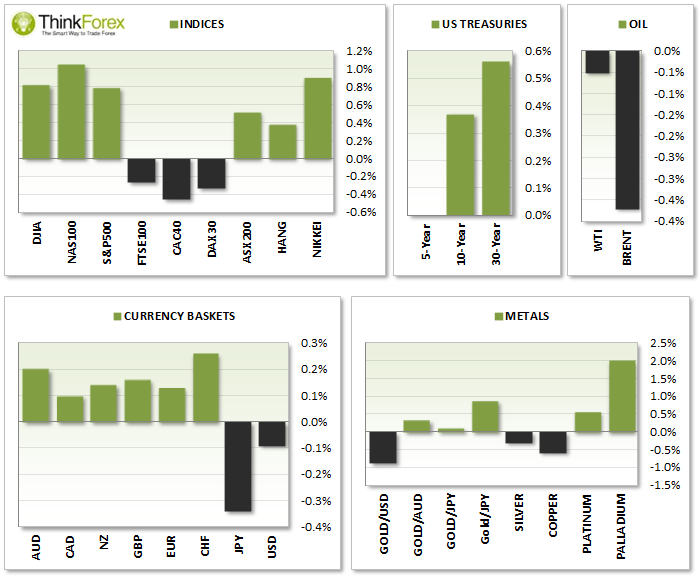

Forex:

AUD/USD continues to look strong, held above 19/03 trendline to finish up 0.17% but below last week's high

EUR/USD intraday broke above 1.380 resistace but closed with a volatile doji and back below weekly pivot

GBP/USD closed highewr for a 6th session, respected 1.66 support but also closed with a small-bodies doji

USD/CAD tested 1.10 support for a 2nd sesseion but potential bullish hammer has formed

USD/CHF wide ranging spining top and a down day to suggest topping price action

USD/JPY held above 102.80 support and achieved oue 103.20 target but closed beneath weekly R1 pivot

NZD/USD remains bullish above 30/01 trendline but trades sideways in a correction

Indices:

Nasdaq 100: Shooting star beneath monthly pivot and 50 day eMA

S&P 500: up 0.7% however trades within potential pennant

Commodities:

Gold: Bearish engulfing candle to close at 7-week lows

Silver: Shooting Star tested $20 to suggest pivotal high

Copper: A bearish close but looks strng above $3.00 with weekly pivot acting as support

ETFS WTI Crude Oil (PCRD.LSE): and Brent show similar wide-ranging doji's as they await the next catalyst