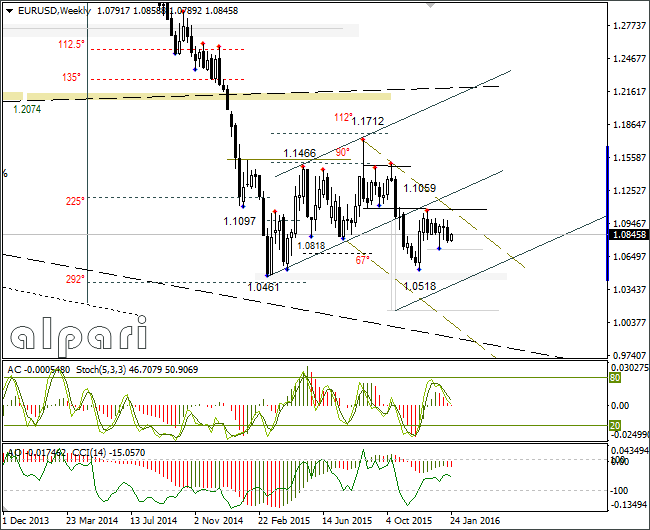

EUR/USD 1H

Yesterday’s Trading:The euro/dollar on Monday was up to 1.0856. The movement went against that of Friday. The euro received support from falling stock indices and oil prices. It’s a mystery to me how falling oil prices can have a negative effect on indices or oil indices. Market participant activity was low. Traders are waiting for the results of the US FOMC meeting which is set for Wednesday.

Main news of the day (EET):

- 12:45: BoE’s Carney to speak;

- 16:45: US Market service sector activeness index for January;

- 17:00: January consumer confidence and manufacturing index from the Richmond Fed.

Market Expectations: The economic calendar on Monday was empty and there’s not much planned for Tuesday either. No one expects to see rates lifted again. The announcements following the meeting will be important. I think the regulator will carefully word what it says in order not to rock the boat. From today’s events it’s worth having a listen to what the BoE’s Mark Carney has to say. He is set to say something about a financial stability report and he could mention interest rates. I expect the euro/dollar to slide to 1.0815 on Tuesday.

Technical Analysis:

- Intraday target maximum: 1.0862, minimum: 1.0815, close: 1.0825;

- Intraday volatility for last 10 weeks: 100 points (4 figures).

The euro/dollar was trading at 1.0845 at 6:29 EET. The price has restored from a 1.0788 minimum by 67 degrees to 1.0858. I expect the euro to return to 1.0815. The majority of Asian indices are in the red zone, so the euro could update the maximum at trade opening in Europe. Afterwards things will stabilise and the euro will head as forecasted.

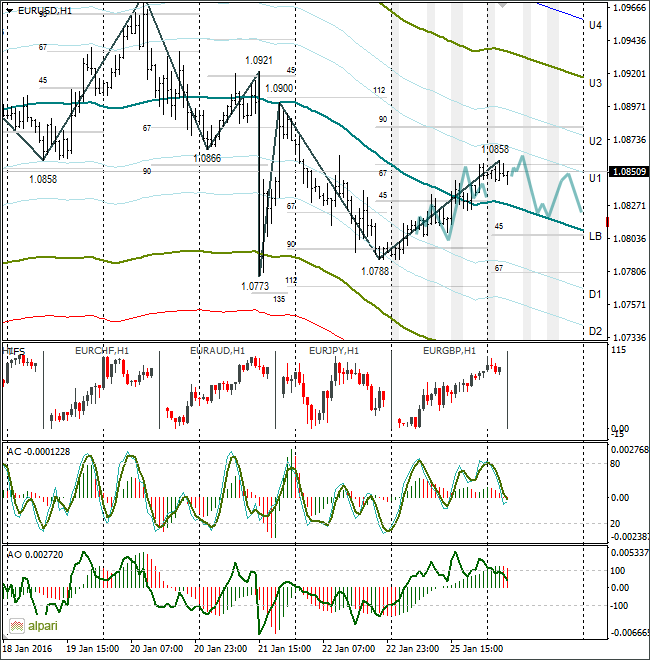

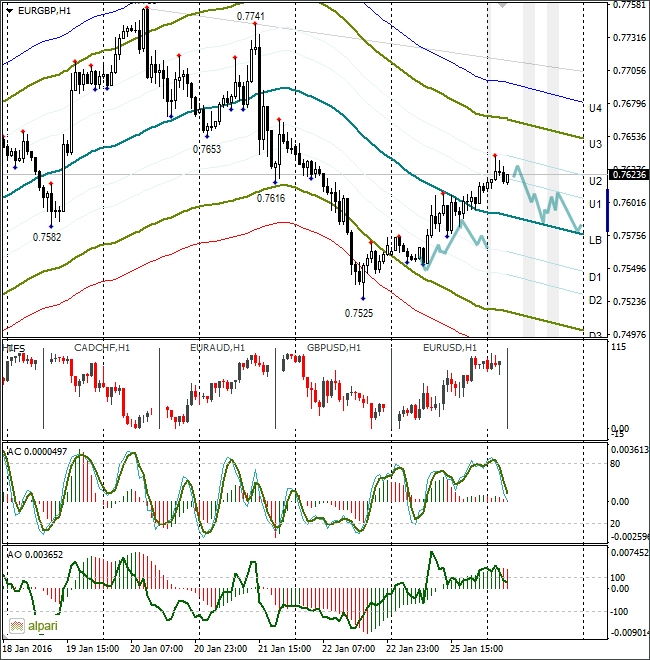

EUR/GBP 1H

The euro/pound has returned to the LB. Due to a rise in the euro/dollar it could lift all the way to the 67th degree. Today I expect the cross to fall to the LB. The hourly indicators are overloaded, so the euro will find it hard to strengthen against the pound. Carney is speaking at 12:45 EET. He is the only person who can annul the technical signals. I haven’t taken his speech into account in my forecast.

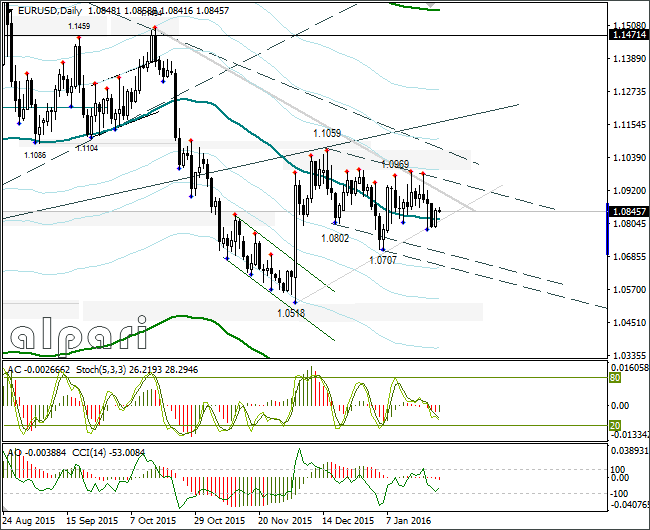

Daily

The euro/dollar has broken away from the trend line due to a fall in the stock indices. The fight is ongoing near the balance line. The AO is in the neutral zone. The stochastic and the CCI are in euro buy zones. Any news could provoke a powerful movement in the pair. Although, it’s unclear what news will be the driver for real fluctuations.

Weekly

No comment.