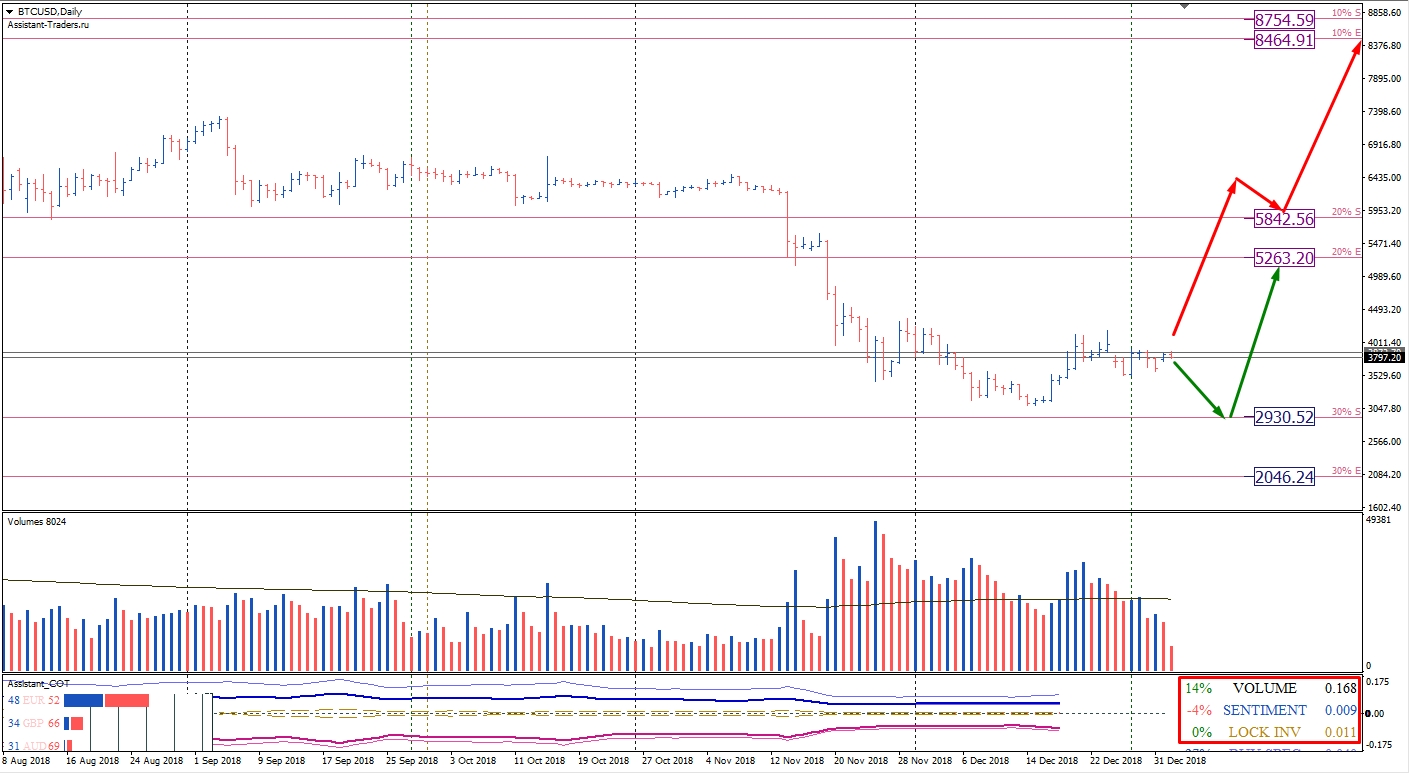

Cash investments among the major participants of the CME Group (NASDAQ:CME) on futures trading on Bitcoin increased by 14%. The total capitalization of investments in dollars amounted to $168 million.

The prevalence of bulls in the previous week decreased by 4%. In monetary terms, the overriding customer sentiment was $ 9 million.

The number of locked positions of investors decreased by less than 1%. In monetary terms, the number of locked positions of investors amounted to $ 11 million.

The first long-term goal of raising on the daily timeframe is the 20% zone (5263.20-5842.56). The next growth target is the zone of 10% (8464.91-875459). The nearest area of support on the daily timeframe is the 30% zone (2930.52-2046.24).

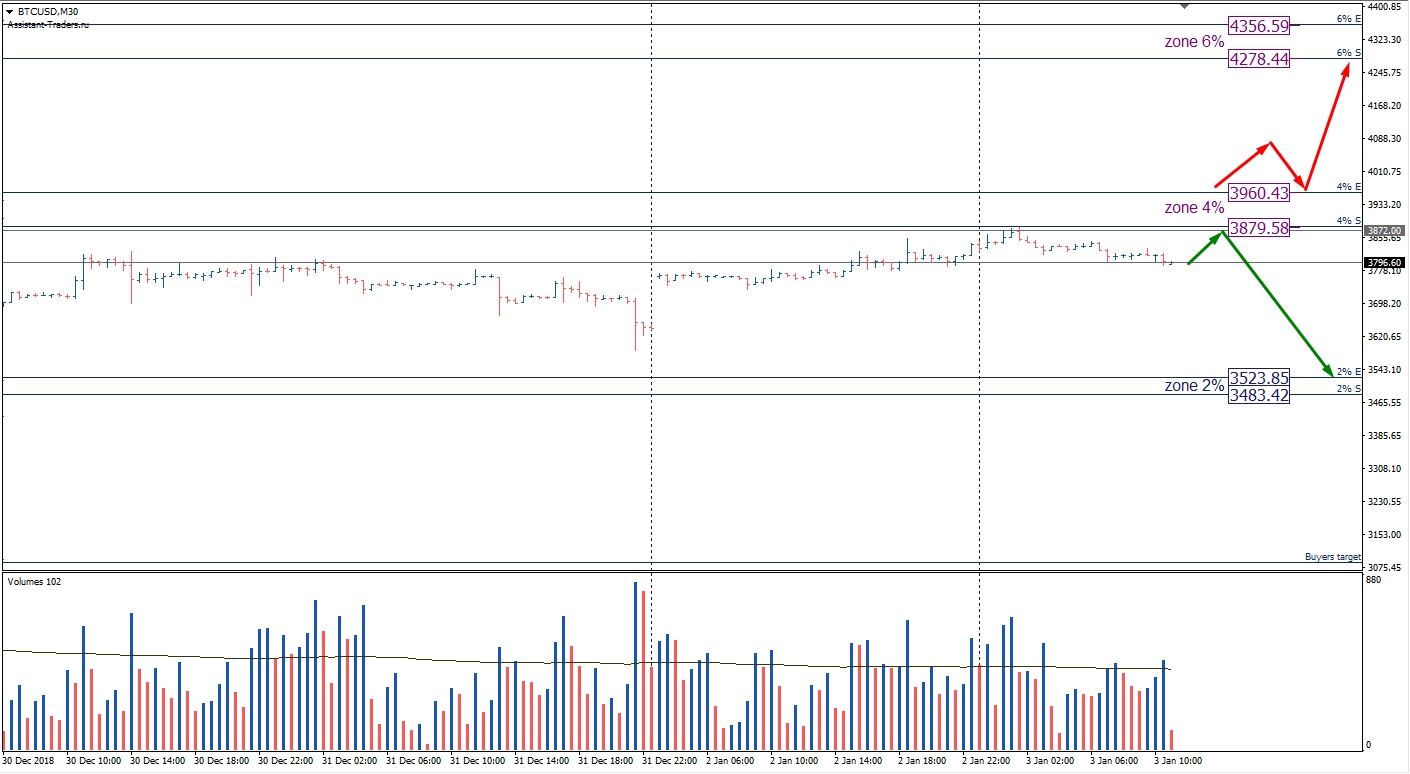

The nearest support for the current working day is a 2% zone. The nearest resistance is 4%. Subsequent resistance is a zone of 6%. The main scenario is the retest zone 4% and the subsequent decrease to the zone 2%. An alternative scenario is the breakdown of the zone of 4% and growth to the zone of 6%.