(Update: After posting this article my friend Doug Short emailed me asking about the data. Upon returning to the NYSE site for verification, the data I originally extracted from the site had been removed. I will update this post, if necessary, when the NYSE republishes their data.)

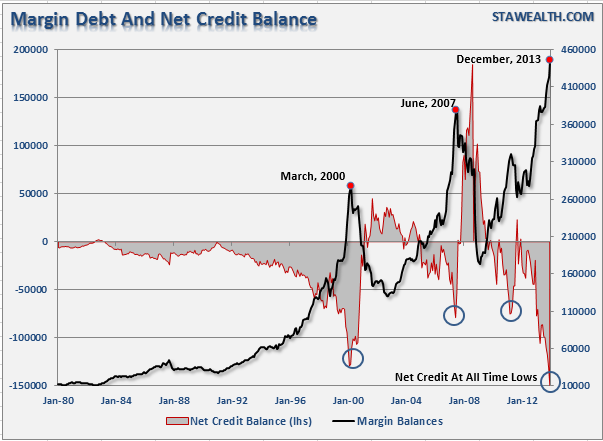

In the month of December margin debt on the NYSE surged by over $20 Billion dollars hitting a new all-time high of $444.931 billion. The rise in leverage also sent investors net worth to a negative $149.358 billion which is also a record. This is shown in the chart below.

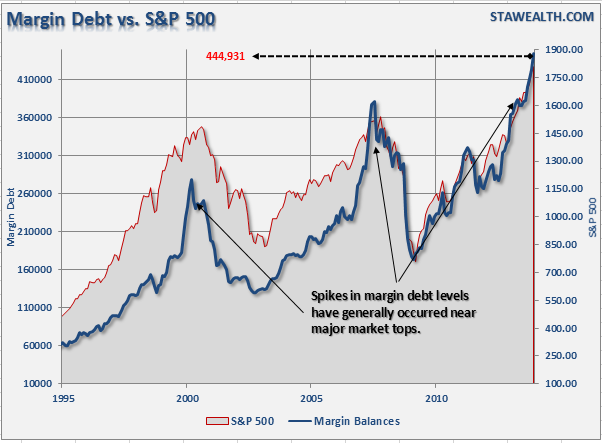

It is important to note that it is not the rise in margin debt that is the problem for the markets - it is the fall. When the ultimate reversal begins, and investors are forced to liquidate to meet margin calls, the market begins to feed upon itself. This forced liquidation quickly accelerates downside reversions in equity markets leaving investors little opportunity to react. The last two peaks in margin debts have had nasty outcomes for this very reason.

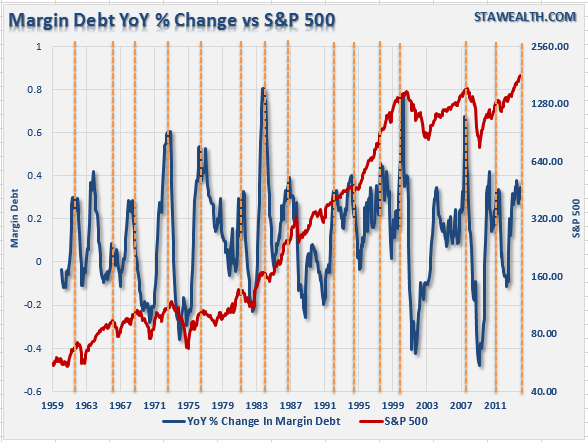

Lastly, spikes in margin date on an annualized basis (brought to my attention by my colleague Eric Hull) has typically marked either short term peaks are larger market corrections. This chart below is a log chart of the S&P 500. While this makes the chart easier to read it also smooths some of the more relevant market reversion like Long Term Capital Management or the Asian Contagion in the late 90's.

The surge in margin debt, along with the current levels of leverage overall, are certainly worth noting. However, what we need to be vigilantly aware of is when the levels of margin debt begin a reversal. Despite many claims to contrary - this will likely not end without a good deal of investor pain.