Thank goodness it’s Friday in the Wall Street Daily Nation!

Today we abandon longwinded analysis and let some carefully selected graphics do the talking for us.

So that means less writing for me… and less reading for you. But don’t let our brevity fool you. Most subscribers tell us this is the most insightful and useful column we write each week.

Yes, picture books can be educational for adults, too! And here’s the latest proof.

Déjà Vu Anyone?

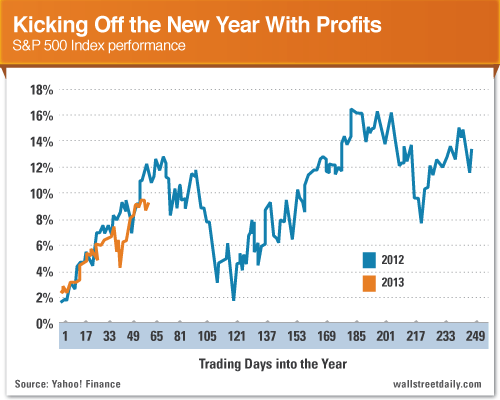

After a 10-day streak of consecutive gains, you might be tempted to think that the stock market has shot up too far, too fast.

Think again!

At just over 50 trading days into the New Year, the S&P 500 Index is up 9.29%. But at this point last year, the S&P 500 was actually up 11.76%.

So the next time someone even tries to convince you that stocks have risen too far, too fast, I want you to whip out this chart and say, “What you talkin’ bout, Willis?”

Myth Busting Runaway Gas Prices

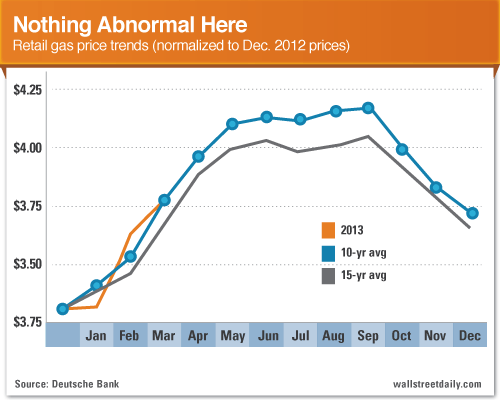

Another common misperception is that gas prices have risen unreasonably fast.

They’re up about 16% since mid-December, so it’s easy to understand why people would think that. But, as always, perception seldom matches reality.

Per Deutsche Bank’s Carl Riccadonna, “Gas prices have a distinct seasonal pattern: Typically, they rise in the first half of the year, plateau during the peak summer driving season and retrace most of the earlier gains in the back half of the year.”

And if we normalize gas prices to December 2012 levels, guess what? This year’s price increases match up perfectly with the seasonal pattern.

So stay calm and carry on. There’s nothing out of the ordinary (yet) going on with gas prices.

Unfortunately, we can’t say the same about some countries’ banking systems…

Too Big to Bail Out?

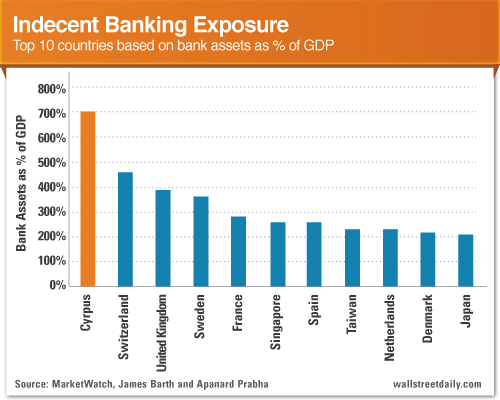

As we all know, the latest financial crisis in the eurozone comes courtesy of itty-bitty Cyprus.

It boasts a population of just 800,000 Cypriots (no comment) and a $17 billion economy. To put its size into perspective, consider that Apple (AAPL) generates more than three times Cyprus’ entire GDP in sales… every quarter!

So how did Cyprus get in so much trouble?

Iceland knows. It found its way into the same pickle back in 2008. Specifically, its banking industry grew so big that it dwarfed the size of the entire country’s economy. And it’s kind of hard for a country to bail out its banks when that happens.

In Cyrpus’ case, its banking assets ballooned to 702% of GPD. Yikes!

If you’re curious about which other countries face similar circumstances, wonder no more…

The United States is noticeably absent from the top 10. But that’s because of the infinite wisdom of our country’s generally accepted accounting principles (GAAP). They don’t take into account derivatives held by U.S. banks, which reach into the trillions.

If they did, we’d sadly make the list. But we’ll save that frightening little fact for discussion at a later date.

Bracketology 2013

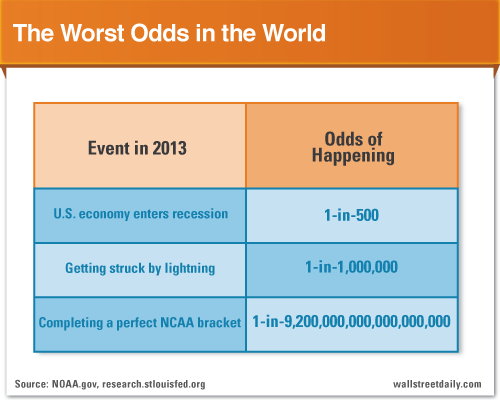

In honor of all the lost productivity about to hit corporate America thanks to the biggest unregulated gambling event in the world, I figured I’d drop some depressing statistical knowledge on you, too.

While you might have visions of completing a perfect NCAA bracket and walking away with fistfuls of your co-workers’ cash – the chances of that happening are, well… less than good.

In fact, they’re 1-in-9.2 quintillion.

If they didn’t teach you how to count that high in public school, don’t worry. They didn’t teach me in private school, either.

As you can see, you’d be better off spending your entry fee to bet a co-worker that you’ll get struck by lightning in the next few weeks. Or that the U.S. economy is going to enter into a recession in 2013. That is, if you have any interest in actually stacking the odds in your favor.

Good luck!

That’s it for today. Before you sign off, though, do us a favor. Let us know what you think about this weekly column – or any of our recent work at Wall Street Daily – by sending an email to feedback@wallstreetdaily.com or leaving a comment on our website.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

March Madness, Stock Mania And The Truth About Gas Prices

Published 03/22/2013, 02:58 AM

Updated 05/14/2017, 06:45 AM

March Madness, Stock Mania And The Truth About Gas Prices

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.