Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

A combination of risk aversion and a weaker German economy pressured the March euro on Tuesday. Traders flocked to the U.S. Dollar for protection in anticipation of a possible stalemate in the debt ceiling hike negotiations. Despite stimulus, bailouts and austerity measures, the German economy finally showed signs of weakening. Euro traders feel that this is a sign the euro zone is poised for a double-dip recession.

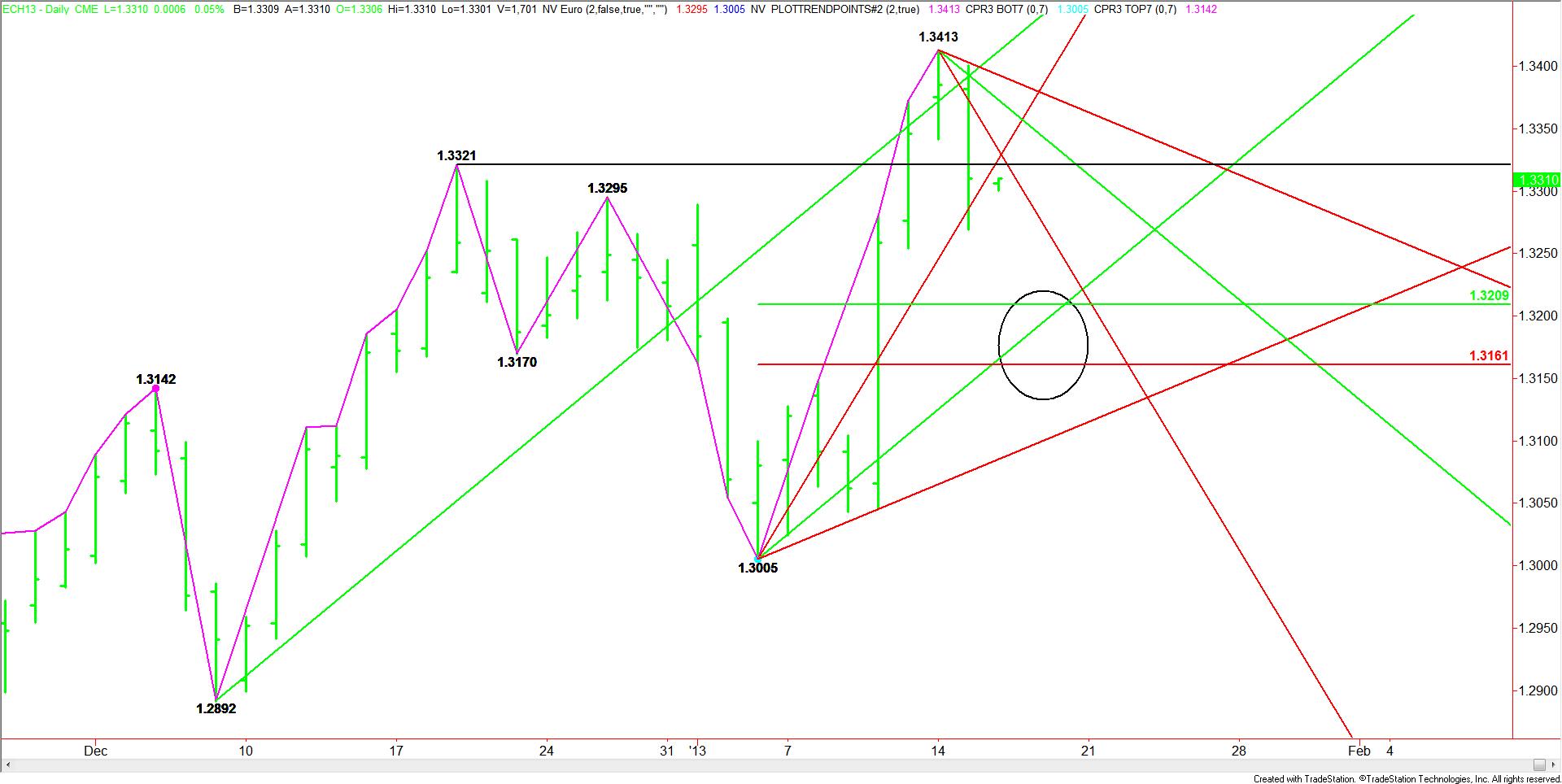

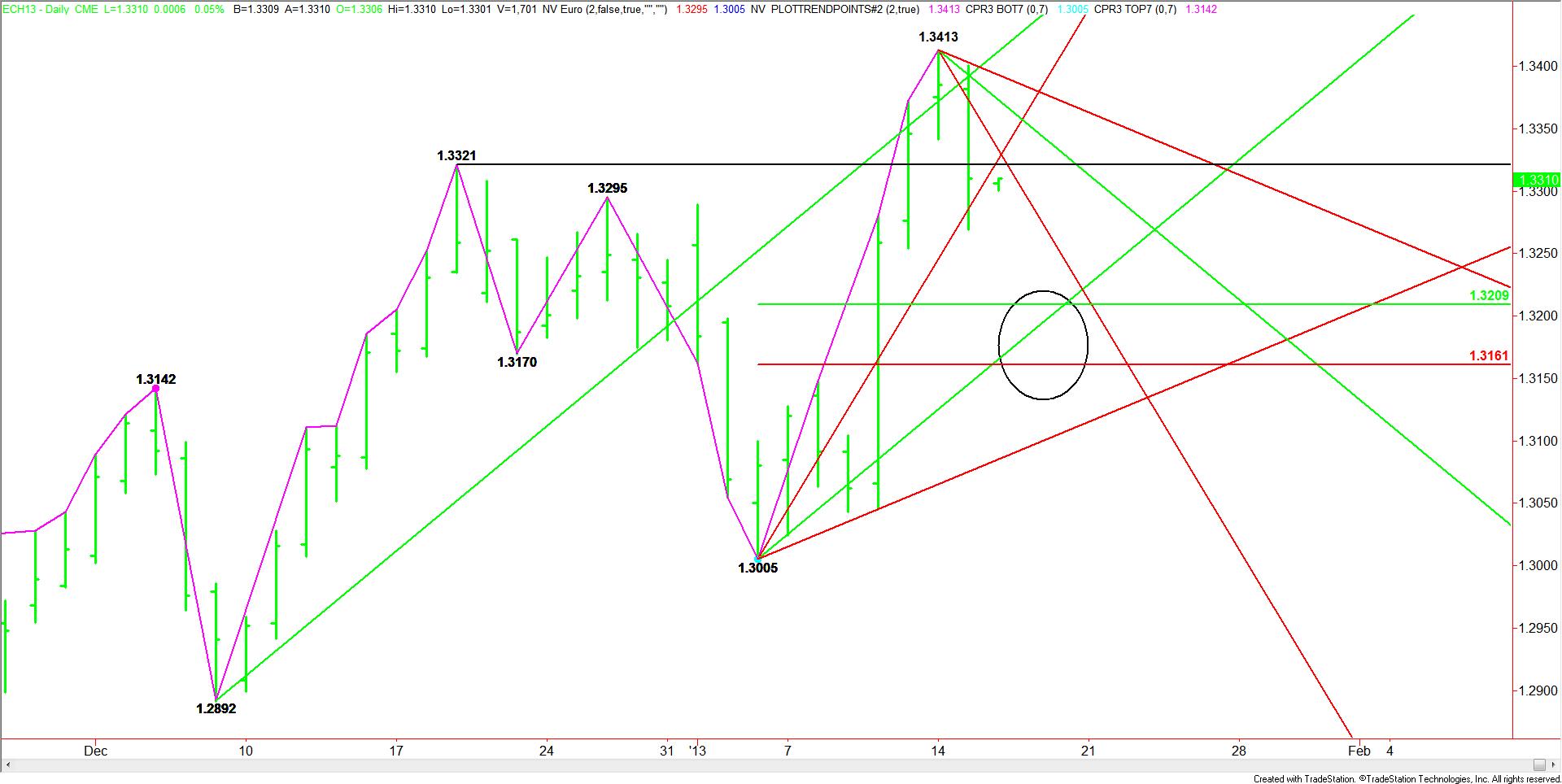

The March euro traded sharply lower after reaching a near-term high on Monday at 1.3413. The move triggered a quick move beyond the previous top from December 19 at 1.3321. This was a sign that the last rally was likely short-covering rather than new buying.

The market stopped and reversed late in the session after testing a Gann angle at 1.3285. The actual low was 1.3270. This angle moves up to 1.3325 on Wednesday. Overnight, the market opened under this angle, putting in a weak position from the start. This sets up a potential move to another uptrending Gann angle at 1.3165.

Downtrending resistance should be tested early at 1.3333. This price actually forms a resistance cluster with the uptrending Gann angle at 1.3325. A failure in this 1.3333 to 1.3325 zone could trigger another sharp sell-off since there is not clear support until the retracement zone at 1.3209 to 1.3161. If the Euro manages to rally through 1.3333 then look for a possible test of 1.3373.

Although the main trend is up, there is a slight bias developing to the downside. Further weakness could be triggered by headlines regarding the U.S. debt ceiling issue or additional weak economic news out of Europe.

The March euro traded sharply lower after reaching a near-term high on Monday at 1.3413. The move triggered a quick move beyond the previous top from December 19 at 1.3321. This was a sign that the last rally was likely short-covering rather than new buying.

The market stopped and reversed late in the session after testing a Gann angle at 1.3285. The actual low was 1.3270. This angle moves up to 1.3325 on Wednesday. Overnight, the market opened under this angle, putting in a weak position from the start. This sets up a potential move to another uptrending Gann angle at 1.3165.

Downtrending resistance should be tested early at 1.3333. This price actually forms a resistance cluster with the uptrending Gann angle at 1.3325. A failure in this 1.3333 to 1.3325 zone could trigger another sharp sell-off since there is not clear support until the retracement zone at 1.3209 to 1.3161. If the Euro manages to rally through 1.3333 then look for a possible test of 1.3373.

Although the main trend is up, there is a slight bias developing to the downside. Further weakness could be triggered by headlines regarding the U.S. debt ceiling issue or additional weak economic news out of Europe.