Investing.com’s stocks of the week

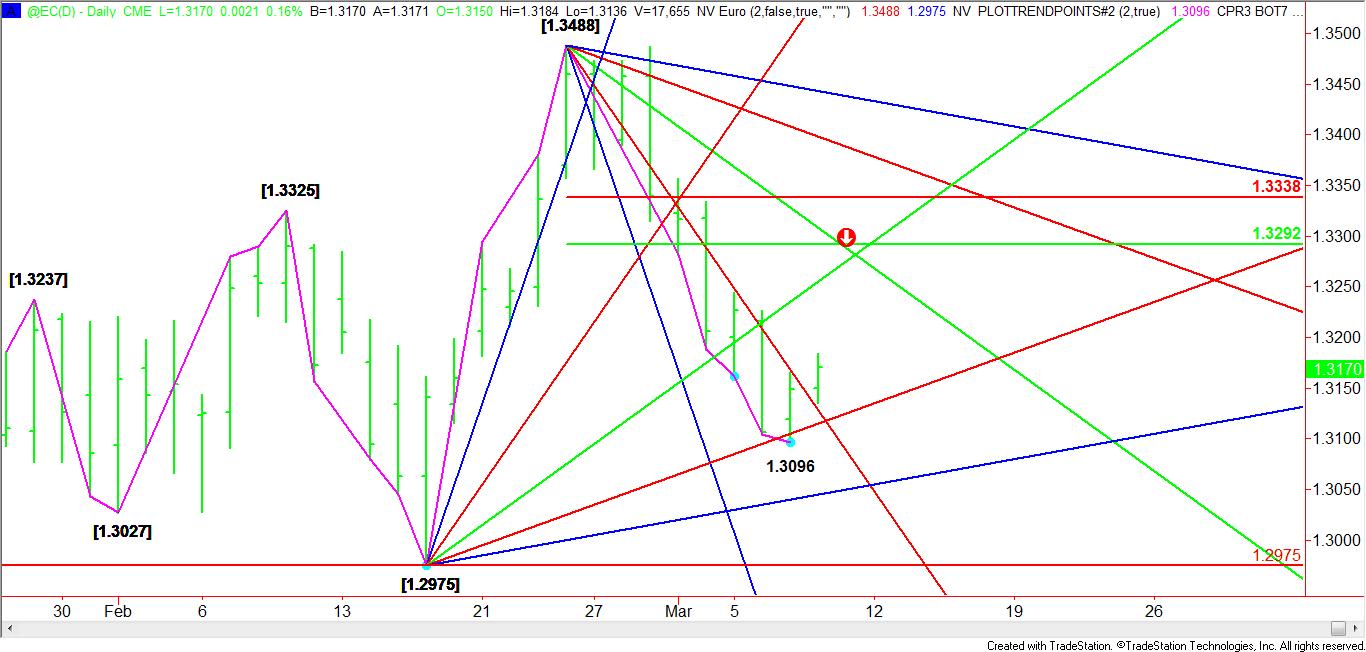

Overnight the March Euro confirmed Wednesday’s closing price reversal bottom when it broke thorough yesterday’s high at 1.3165. Based on the break from 1.3488 to 1.3096, expectations are for the Euro to mount a 2 to 3 day rally to at least the 50 percent level of this range to 1.3292.

For several days the Euro had been walking down a Gann angle at 1.3128, but overnight this angle was gapped putting the market in a slightly bullish position. Now that the Euro is trading on the bullish side of this downtrending Gann angle, the market may make an attempt to reach another downtrending angle at 1.3308 today.

Although a rally to this angle seems remote, there is room to the upside. This same angle drops to 1.3288 on Friday, March 9, forming a potential resistance cluster with the 50 percent level at 1.3292. (See Arrow)

On the downside, the March Euro stopped near an uptrending Gann angle on Wednesday. The angle came in at 1.3105, the actual low was 1.3096. Either short-covering or bottom-pickers came in at that point to form the closing price reversal bottom. On Thursday this angle moves up to 1.3115 and is still considered to be key support. A break through the closing price reversal bottom will negate the chart pattern and likely trigger an acceleration to the downside.

Fundamentally, the Euro rallied against the Dollar on Wednesday as confidence grew that the private-sector would participate in the Greek bond-swap deal. As mentioned in the technical comments, it was either profit-taking from the Euro’s long slide or some light bottom-picking that helped turn the market around.

Given the uncertainty of the Greek bond-swap deal, the European Central Bank meeting on Thursday and Friday’s U.S. Non-Farm Payrolls report, it doesn’t look like institutions are participating in the markets in a major way this week. This is one of the reasons why the Euro ping-ponged between a pair of retracement zones.