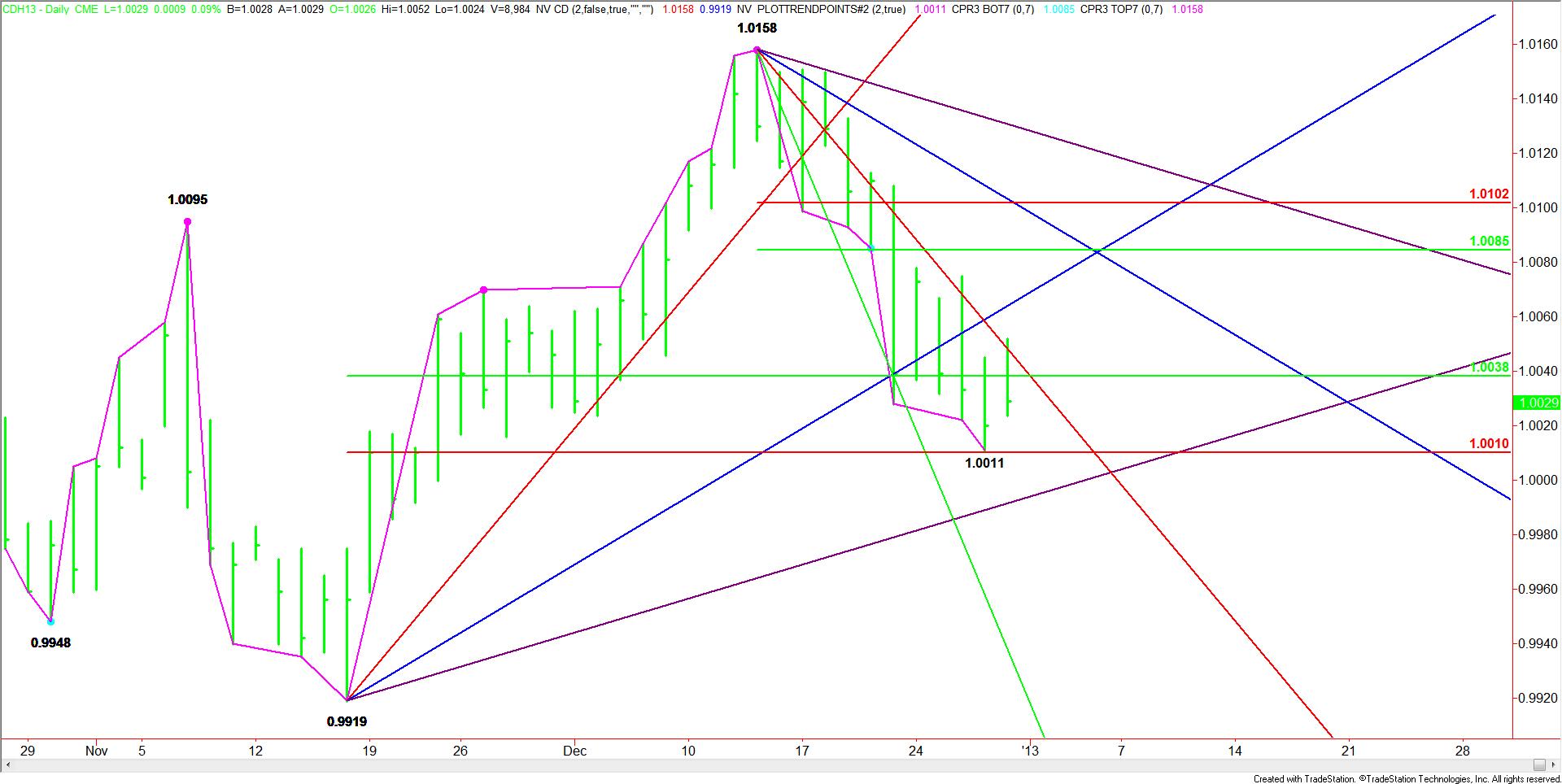

The March Canadian Dollar is giving back earlier gains after a surprise pop to the upside. On Friday, the contract survived a test of a Fibonacci level at 1.0010 by posting a low at 1.0011. The weak close, however, suggested that further downside movement could be expected.

The market gapped Friday’s close overnight, taking out a 50% level in the process at 1.0038. The subsequent follow-through rally stalled, however, at a downtrending Gann angle at 1.0048.

Thin holiday trading volume could produce a volatile trade today especially if there is news about the U.S. fiscal cliff. The lack of any substantive news, however, may mean a trade between 1.0038 and 1.0010 throughout the session.

With the main trend up on the daily chart, the retracement zone that is currently being tested could become a significant support area. Of course, there is going to have to be catalyst to drive the market higher from here. The most likely trigger will be positive news regarding the fiscal cliff. Based on the short-term range of 1.0158 to 1.0011, the first likely upside target would be 1.0085 to 1.0102.

On the downside, the downtrending Gann angle at 1.0048 is controlling the short-term direction of the market. This angle combined with the 50% level at 1.0038 creates a good resistance cluster today. Breaking through the minor support cluster at 1.0011 – 1.0010 could trigger an acceleration to the downside which should take the Canadian Dollar into an uptrending Gann angle at .9992.

Despite the looming U.S. tax hikes and spending cuts if a compromise isn’t reached regarding the fiscal cliff issue, traders seem to be respecting the technical chart points. This could change dramatically if no compromise is reached and panic conditions set in.

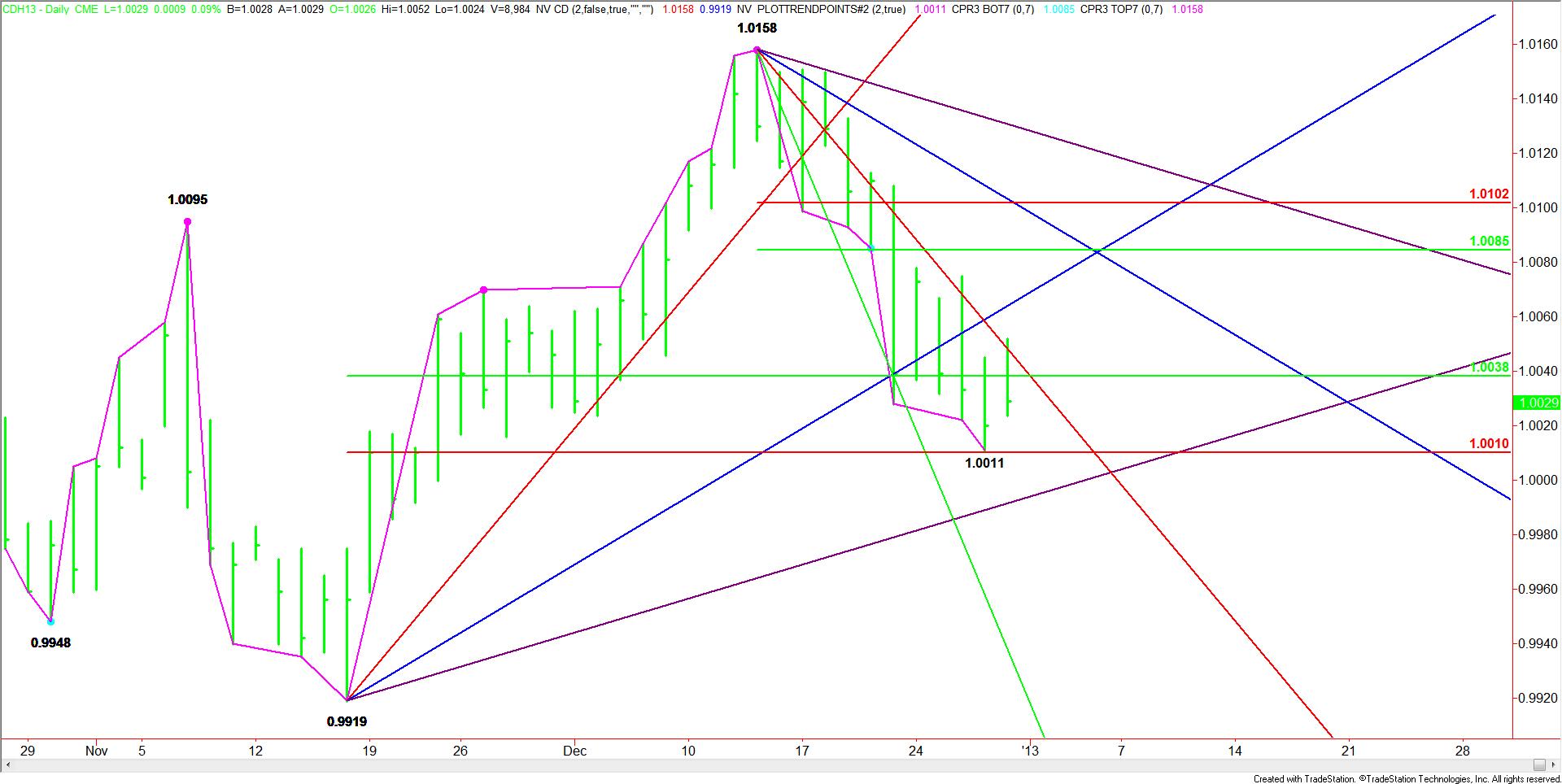

The market gapped Friday’s close overnight, taking out a 50% level in the process at 1.0038. The subsequent follow-through rally stalled, however, at a downtrending Gann angle at 1.0048.

Thin holiday trading volume could produce a volatile trade today especially if there is news about the U.S. fiscal cliff. The lack of any substantive news, however, may mean a trade between 1.0038 and 1.0010 throughout the session.

With the main trend up on the daily chart, the retracement zone that is currently being tested could become a significant support area. Of course, there is going to have to be catalyst to drive the market higher from here. The most likely trigger will be positive news regarding the fiscal cliff. Based on the short-term range of 1.0158 to 1.0011, the first likely upside target would be 1.0085 to 1.0102.

On the downside, the downtrending Gann angle at 1.0048 is controlling the short-term direction of the market. This angle combined with the 50% level at 1.0038 creates a good resistance cluster today. Breaking through the minor support cluster at 1.0011 – 1.0010 could trigger an acceleration to the downside which should take the Canadian Dollar into an uptrending Gann angle at .9992.

Despite the looming U.S. tax hikes and spending cuts if a compromise isn’t reached regarding the fiscal cliff issue, traders seem to be respecting the technical chart points. This could change dramatically if no compromise is reached and panic conditions set in.