Have you been eager to see how Marathon Petroleum (NYSE:MPC) – a leading downstream operator – performed in Q3 in comparison with the market expectations? Let’s quickly scan through the key facts from this Findlay, OH-based company’s earnings release this morning:

About Marathon Petroleum: Marathon Petroleum is a leading independent refiner, transporter and marketer of petroleum products. The company operates in three segments: Refining and Marketing, Speedway (Retail), and Midstream.

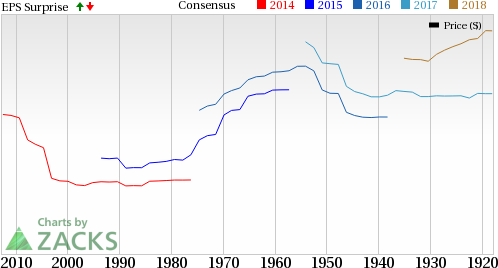

Zacks Rank & Surprise History: Currently, Marathon Petroleum has a Zacks Rank #3 (Hold) but that could change following its third quarter 2017 earnings report which has just released. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Coming to earnings surprise history, the company has a mixed record: it’s gone past estimates in two of the last four quarters resulting in an average positive surprise of 186.35%.

We have highlighted some of the key details from the just-released announcement below:

Earnings Beat Estimate: Earnings per share came in at $1.77, ahead of the Zacks Consensus Estimate of $1.45. Higher margins led to the outperformance.

Revenue Came in Higher than Expected: Marathon Petroleum posted revenues of $19,386 million, beating the Zacks Consensus Estimate of $17,808 million.

Total Costs:Total costs and expenses came in at $17,810 million, up 11.1% year-over-year.

Key Stats: Operating income from the Refining & Marketing segment – which is the main contributor to Marathon Petroleum earnings – was $1,097 million compared with $252 million in the year-ago quarter. The jump reflects wider gross margin.

Total refined product sales volumes were 2,357 thousand barrels per day (mbpd), up from the 2,316 mbpd in the year-ago quarter. Moreover, throughput improved from 1,926 mbpd in the year-ago quarter to 2,017 mbpd.

Income from the Speedway retail stations totaled $209 million, same as the year-ago period. Contributions from a new joint agreement with Pilot Flying J and lower operating costs were offset by lower volumes, decrease in light product margin and fall in merchandise profitability.

Finally, Midstream segment profitability was $355 million, up from $310 million in the third quarter of 2016. Earnings were buoyed by strength in volumes gathered, processed and fractionated.

Share Performance: Shares of Marathon Petroleum have gained 8% during the third quarter, underperforming the industry’s 11.5% increase.

Check back later for our full write up on this Marathon Petroleum earnings report later!

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Marathon Petroleum Corporation (MPC): Free Stock Analysis Report

Original post